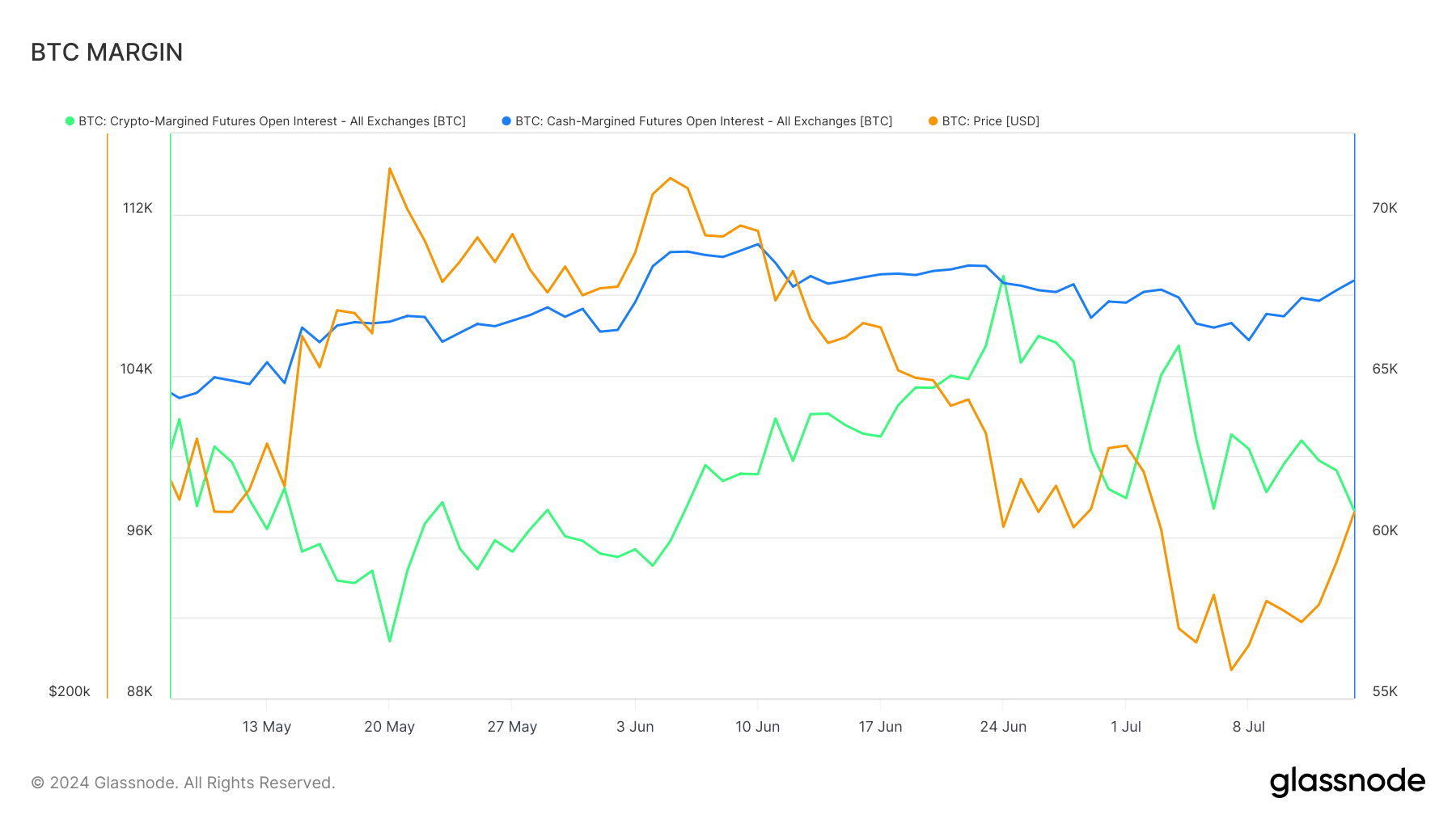

Bitcoin’s latest worth motion has seen a notable divergence in futures market exercise. Information from Glassnode reveals a marked improve in cash-margined futures open curiosity throughout all exchanges, whereas crypto-margined futures open curiosity has declined.

This development coincides with Bitcoin’s worth surging previous $62,000 following bullish momentum on former President Trump’s assassination try on the weekend.

The blue line, representing cash-margined futures, demonstrates a gradual upward trajectory, suggesting elevated curiosity in these devices. Conversely, the inexperienced line, indicating crypto-margined futures, reveals a decline over the identical interval. The orange line monitoring Bitcoin’s worth correlates with the uptick in cash-margined futures.

This shift implies a rising choice for cash-margined futures, significantly on platforms just like the Chicago Mercantile Alternate (CME), as merchants search to hedge positions or achieve publicity with out holding the underlying asset—the divergence between money and crypto-margined futures highlights differing market sentiments and danger administration methods amongst individuals.

This development emphasizes the evolving panorama of Bitcoin derivatives buying and selling, the place institutional engagement by way of cash-settled merchandise seems to be gaining traction.