Este artículo también está disponible en español.

Ethereum (ETH) seems to be lastly waking from its slumber, surging practically 37% up to now week following Bitcoin’s (BTC) all-time-high (ATH) rally.

Spot Ethereum ETFs Document Each day Inflows

Ethereum, the second-largest cryptocurrency with a market cap of roughly $404 billion, is now gaining floor on BTC, with the platform’s ETH token leaping greater than 35% over the previous week.

Associated Studying

Whereas the broader digital property market has been buoyed by Donald Trump’s victory within the 2024 US presidential election, further components might also be driving the current business growth, particularly for ETH.

A key information level is the substantial influx of funds into spot ETH ETFs. On November 11, US-based spot ETH ETFs attracted a document $295 million in every day inflows, the very best quantity thus far.

Compared, the earlier peak for every day inflows into spot ETH ETFs was $106 million, recorded on the primary day these ETFs launched in July 2024.

In accordance with information from SoSoValue, the document inflows had been led by Constancy’s FETH ETF, which drew in $115.48 million.

BlackRock’s ETHA adopted with $101.11 million, Grayscale’s ETH with $63.32 million, and Bitwise’s ETHW with $15.57 million.

On the time of writing, the overall worth of internet property held throughout varied spot ETH ETFs stands at $9.72 billion, representing simply over 2.41% of Ethereum’s complete market cap. In the meantime, cumulative internet outflows from all spot ETH ETFs quantity to $41.30 million.

ETH Value Motion And Resurgence In DeFi

Renewed curiosity from institutional buyers in Ethereum ETFs amid document every day inflows seems to be contributing positively to ETH’s value motion.

Associated Studying

All through a lot of 2024, ETH lagged in value efficiency amongst main cryptocurrencies resembling BTC and Solana (SOL). Nevertheless, This autumn 2024 holds potential for a dramatic turnaround in ETH’s momentum.

Evaluation shared by Leon Waidmann, Head of Analysis at Onchain Basis signifies that ETH staking ranges are at an ATH, whereas the token’s reserves on crypto exchanges is heading towards document lows.

This mix of record-high staking ranges and decreased provide on exchanges suggests a possible provide squeeze, which might set off a parabolic rally for ETH.

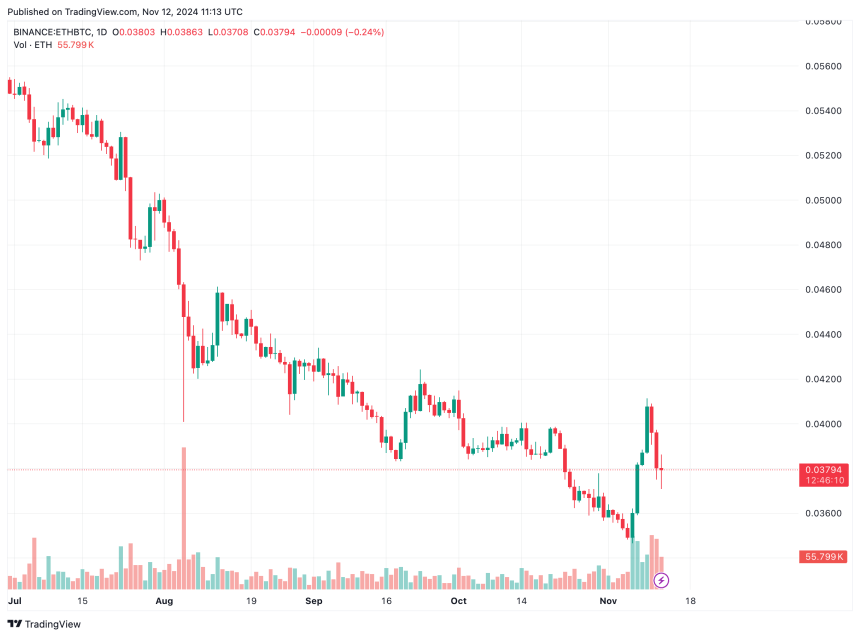

Moreover, the ETH/BTC ratio appears to be recovering after extended losses, with the buying and selling pair rising from 0.034 to 0.040 earlier than dipping to 0.037 on the time of writing.

The subsequent main resistance for this pair lies round 0.040, and a profitable breakout from this stage might result in extra positive aspects for ETH over BTC. At press time, ETH sits about 32% beneath its ATH worth of $4,878 recorded in November 2021.

Additional, Ethereum’s decentralized finance (DeFi) exercise appears to be selecting steam. Knowledge from DefiLlama reveals that the overall worth locked (TVL) throughout Ethereum-based DeFi protocols at the moment sits at $62.36 billion, up from about $24 billion in November 2023.

Over half of this TVL is tied to the ETH staking platform Lido, which holds near $33 billion. Lido is adopted by the DeFi lending protocol Aave with $15.21 billion and EigenLayer with $14.57 billion.

That mentioned, considerations stay concerning ETH’s “ultrasound cash” narrative as a result of token’s excessive issuance charge. At press time, ETH trades at $3,291, up 3.1% up to now 24 hours.

Featured picture from Unsplash, Charts from X.com, DefiLlama.com, and TradingView.com