Bitcoin’s value rally has hit turbulence over the previous 48 hours, and this has opened the door for bearish voices to resurface. After reaching a recent excessive of $124,128 simply three days in the past, the main cryptocurrency has since declined by about 4.8%, sliding again to the $117,000 to $118,000 value zone on the time of writing. This pullback has opened up a risk that the much-anticipated macro high might already be in, and additional draw back could also be potential if there’s a lack of bullish momentum.

Associated Studying

Analyst Maps Out Bearish Bitcoin Wave Construction

Bitcoin confirmed indicators of constructing on in early August after bouncing off a low round $112,000. Nevertheless, after its newest excessive at $124,128, sellers rapidly stepped in, pulling the value down. The decline has been accompanied by fading short-term momentum. Though it is perhaps too early to conclude, relative energy index (RSI) readings are beginning to level to a bearish divergence on the 4-hour candlestick timeframe chart.

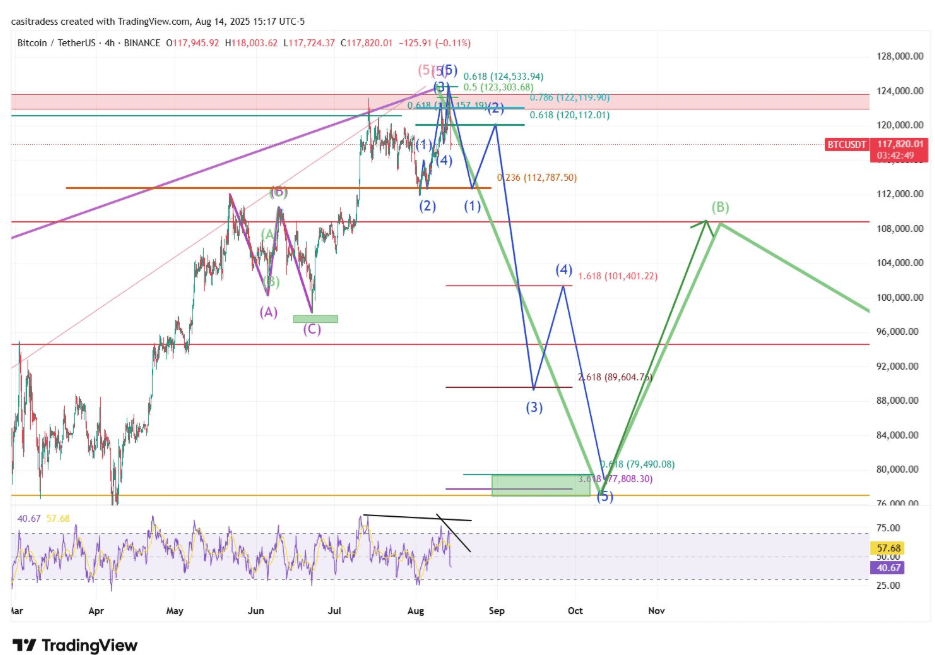

Taking to the social media platform X, crypto analyst CasiTrades outlined what they imagine might be the beginning of a bigger ABC corrective construction for Bitcoin. In response to the projection, Bitcoin could also be getting into Wave A, which consists of a five-wave corrective construction that would ship the value to as little as $77,000 on the macro 0.382 Fibonacci retracement.

The roadmap of this value crash envisions an preliminary Wave 1 drop to $112,000, a short Wave 2 restoration again to $120,000, after which one other Wave 3 decline into the $89,000 vary. After this, the following step is a Wave 4 retest break of $100,000 earlier than reversing into Wave 5, which brings the final word Wave A backside at $77,000.

Chart Picture From X: CasiTrades

The accompanying chart posted by the analyst exhibits the wave counts with subwave precision. Curiously, the analyst additionally identified that the final word macro goal for the tip of this correction is at $60,000, proper on the golden 0.618 Fibonacci retracement. That is on the macro stage and might solely come to fruition if the ABC corrective waves play out to completion.

A Bearish Tone Amidst Bullish Predictions

This evaluation introduces a sobering counterpoint at a time when many forecasts proceed to color Bitcoin as being on observe for $150,000 and past. Although robust institutional inflows and technical milestones, such because the realized value flipping above the 200-day shifting common are bullish indicators, the bearish situation from CasiTrades might nonetheless be legitimate.

If Bitcoin fails to reclaim bullish momentum, the present correction might turn into one thing deeper, making the $124,000 excessive not only a pause however the macro high of this cycle.

Associated Studying

Though many cryptocurrencies have largely adopted Bitcoin’s actions this cycle, CasiTrade’s evaluation isn’t a bearish case for the complete crypto market. In response to the analyst, if this bearish case performs out, it might trigger the long-discussed capital rotation out of Bitcoin and into large-cap altcoins, a few of which can surge to new all-time value highs whilst Bitcoin retraces. On the time of writing, Bitcoin was buying and selling at $118,203.

Featured picture from Unsplash, chart from TradingView