Fast Take

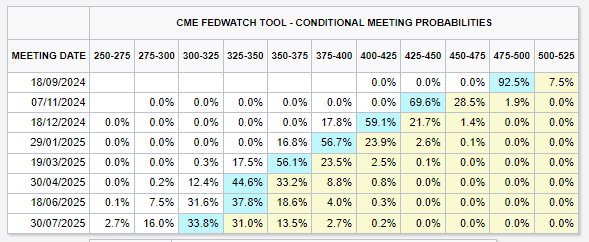

The Federal Reserve lately maintained the federal funds charges at 5.25-5.50%. Nonetheless, a continuation of poor US information, together with weak US jobs information, has triggered the Sahm Rule, signaling a possible recession. Consequently, the market anticipates roughly 50 foundation factors (bps) of charge cuts within the upcoming September assembly, which is 44 days away.

Polymarket signifies a 57% chance of an emergency charge reduce in 2024.

In Asia, the Nikkei skilled its most vital two-day drop in historical past following Japan’s choice to boost rates of interest to 0.25%. This transfer strengthened the Japanese yen in opposition to the US greenback, hitting 142, contributing to the unwinding of the yen carry commerce. This commerce concerned borrowing yen at near-zero rates of interest to put money into higher-yielding international property like US equities and treasuries. With the Financial institution of Japan (BoJ) growing charges, merchants face increased curiosity funds and vital foreign exchange losses, unwinding their commerce positions and prompting a large sell-off in US shares to cowl their positions. It’s speculated that the yen carry commerce might be value trillions of {dollars}, along with Japan being the most important holder of US treasuries.

Amid these developments, US equities are down a number of share factors in pre-market buying and selling, whereas European indices, together with the FTSE and DAX, are additionally declining. Analysts will intently monitor the US yield curve (US 10Y-2Y), normalizing a historic predictor of recessions over the previous 50 years.

Bitcoin is down roughly 10% on Aug. 5, buying and selling under $52,000.