Glassnode says XRP is slipping again right into a cost-basis configuration final seen in February 2022, with newer consumers accumulating at ranges that go away a previous cohort “prime” more and more underwater, an on-chain setup that may form promote stress round key worth zones.

In a notice shared Monday by way of X, the analytics agency pointed to a rotation in realized costs by age band. “The present market construction for XRP intently resembles February 2022,” Glassnode wrote. It added that “psychological stress on prime consumers builds over time,” framing the present tape as one the place endurance is being examined somewhat than rewarded.

What This Means For XRP Value

The agency’s core statement is that wallets energetic within the short-term window, roughly the 1-week to 1-month cohort, are accumulating beneath the fee foundation of holders within the 6-month to 12-month band. In observe, which means newer demand is stepping in at costs which can be cheaper than what a significant slice of mid-term holders paid.

Associated Studying

That relationship issues as a result of cohorts are likely to behave in a different way when worth revisits their value foundation. When spot trades beneath a cohort’s realized worth, that cohort is, on common, underwater. If the market rallies again towards that stage, a few of that provide can turn into desirous to de-risk into breakeven, creating overhead liquidity that may cap upside till it’s absorbed.

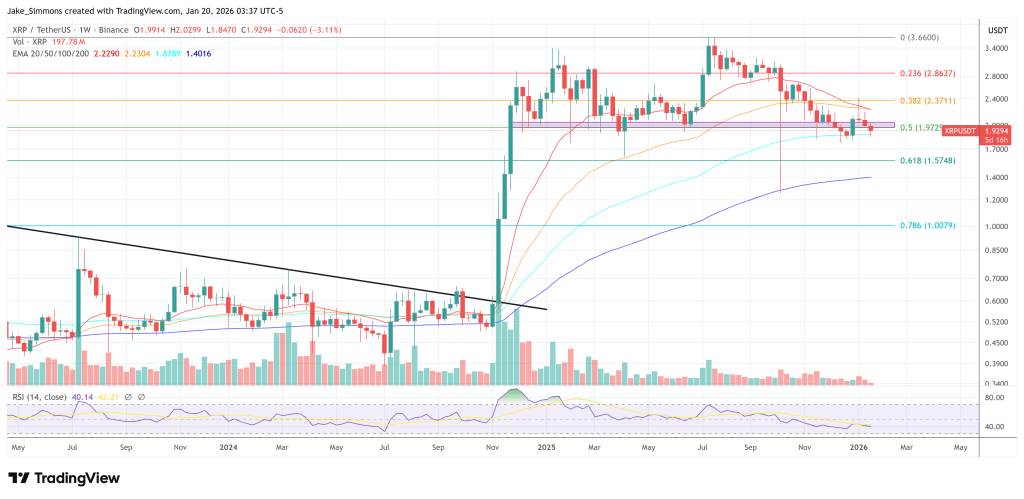

Glassnode’s “Realized Value by Age” chart (7-day transferring common) visualizes this dynamic by plotting cohort realized costs towards spot. The standout function is the hole between shorter-term and 6–12 month value bases throughout the latest consolidation, echoing the agency’s February 2022 comparability.

With XRP worth once more buying and selling barely beneath the $2 mark, a put up by Glassnode from Nov. 24 2025 additionally comes again into focus. Glassnode quoted this previous X put up during which it singled out $2 as the extent the place this cohort stress has been most seen in flows. “The $2.0 stage stays a significant psychological zone for Ripple holders,” the agency stated. “Since early 2025, every retest of $2 noticed $0.5B–$1.2B per week in losses,” a reminder that many holders have been exiting at a loss as worth revisits that deal with.

Associated Studying

These realized loss estimates are a key qualifier: they counsel that $2 is not only a chart stage, however a conduct stage, the place spending selections change and the place capitulation (or pressured de-risking) can cluster.

Notably, in February 2022, XRP put in a pointy round-trip: after slipping to about $0.6034 on Feb. 2, it ripped increased to the month’s peak close to $0.8758 on Feb. 8, then rolled over into the again half of the month as macro threat accelerated. Then, XRP was again round $0.70 by Feb. 23–24 (roughly 20% off the Feb. 8 excessive), earlier than bouncing into month-end close to $0.7856 on Feb. 28.

The late-month downdraft coincided with the Russia–Ukraine escalation and the Feb. 24 invasion, which hit threat property broadly and pushed main crypto decrease intraday, in keeping with the risk-off impulse seen throughout your complete crypto market.

At press time, XRP traded at $1.9294.

Featured picture created with DALL.E, chart from TradingView.com