Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

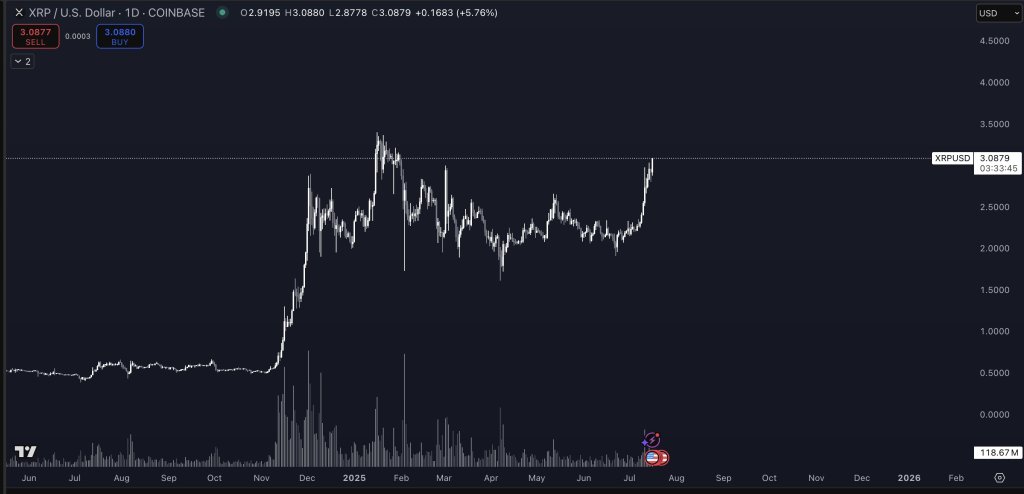

Crypto strategist Pentoshi put the market on discover in a late‑Tuesday publish. “With XRP it held up for the previous 7 months whereas many of the market nuked and saved this construction. It arguably has little resistance from right here as a result of it by no means frolicked buying and selling right here on the verge of worth discovery,” he wrote, including {that a} cluster of regulatory and company tailwinds “is a fairly good setup into respectable tailwinds and up to now has traded very cleanly.”

By Wednesday afternoon XRP was altering arms at $3.08, up roughly 27 p.c on the week and hovering slightly below its highest shut for the reason that 2021 cycle excessive. Every day volumes have topped US $8.5 billion and momentum indicators on main venues present relative‑power indexes again in “purchase” territory, underscoring Pentoshi’s rivalry that overhead provide is skinny.

Upcoming XRP Worth Catalysts

The primary basic catalyst is Washington’s sudden enthusiasm for federal stablecoin guidelines. The Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act sailed via the Senate in June and secured the votes it wants within the Home this week after an eleventh‑hour whip by President Donald Trump. Home Majority Chief Steve Scalise advised reporters, “We’re again on monitor … all three payments can be encompassed within the work we do right this moment,” referring additionally to the CLARITY and Anti‑CBDC acts.

Associated Studying

Ripple, which launched its greenback‑backed RLUSD final December, is already positioning for that atmosphere. On 2 July the corporate filed for a US nationwide financial institution constitution and a Federal Reserve grasp account that might let it custody RLUSD reserves instantly on the Fed. Two weeks later it confirmed plans to safe an EU digital‑cash‑establishment licence below MiCA; an organization spokesperson stated Ripple goals “to turn into MiCA‑compliant” as a result of it sees “important alternative within the European market.”

The second driver is the close to‑decision of Ripple’s grinding courtroom saga. On 26 June, when US District Decide Analisa Torres rebuffed a joint movement by Ripple and the SEC that might have vacated her everlasting injunction and sliced the civil penalty from $125 million to $50 million, ruling the events had “not come shut” to establishing the “distinctive circumstances” required to change a ultimate judgment.

The following day CEO Brad Garlinghouse introduced on X that Ripple will drop its personal cross‑attraction and “shut this chapter as soon as and for all,” including that he expects the SEC to withdraw its attraction as effectively. For now, nevertheless, Torres’s injunction and the total $125 million penalty stay in drive, leaving any definitive decision, nevertheless, the top has by no means been nearer.

Associated Studying

With the litigation roadblock largely cleared, trade‑traded‑fund issuers have accelerated filings. ProShares on 15 July rolled out 2× leveraged futures funds tied to Solana and XRP, noting that spot‑primarily based merchandise stay within the SEC queue. Solely per week earlier, the company issued new disclosure steering meant to streamline crypto‑ETF approvals. Trump Media & Know-how Group has even requested the SEC to log off on a “blue‑chip” basket ETF that might maintain bitcoin, ether, solana and xrp, signalling bipartisan stress to open the ETF spigot additional.

Ripple can also be arming itself for a shopping for spree. “Our M&A persons are very busy,” chief expertise officer David Schwartz advised DL Information in late June, revealing “a number of potential acquisitions in varied completely different levels.” The agency has already paid $1.25 billion for prime dealer Hidden Street this 12 months and is constructing an on‑ledger lending protocol slated for Q3, strikes that might deepen XRP liquidity and justify larger valuations.

Every strand—the GENIUS Act, the financial institution constitution and MiCA licences, the SEC’s retreat, the ETF pipeline, and Ripple’s conflict‑chest for acquisitions—converges on the identical conclusion: regulatory opacity is fading simply as institutional distribution channels open. Whether or not that is sufficient to propel XRP via the earlier all-time excessive at $3.84 from January 2018 stays to be seen, however the technical setup can also be wanting fairly robust, as Pentoshi concludes.

At press time, XRP traded at $3.14.

Featured picture created with DALL.E, chart from TradingView.com