Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto market analyst Ali Martinez is warning that XRP’s newest pullback may prolong, citing a cluster of bearish indicators throughout worth, on-chain, and behavioral metrics.

Why XRP May Face A Deeper Correction

In an X thread posted early Wednesday, Martinez opened with: “XRP could also be headed for a deeper correction. Right here’s why!” and pointed to a Tom DeMark Sequential promote sign on the three-day chart “proper on the native high,” which he mentioned “set off[ed] the continuing pullback.” His remarks observe a weekend notice flagging $2.40 because the “subsequent key assist stage to observe” after that three-day TD promote sign.

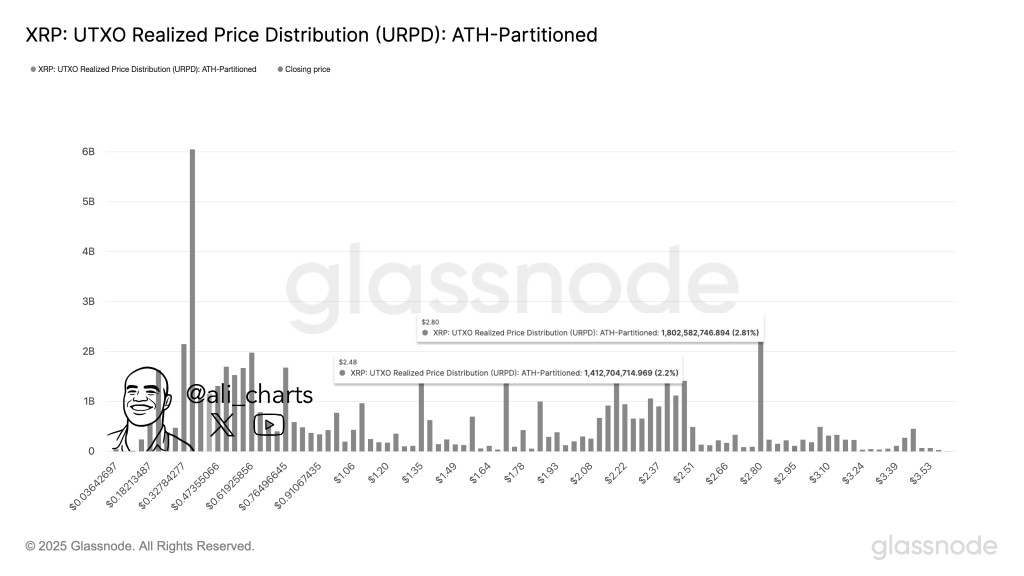

Martinez expanded on market construction, arguing that whereas the $3.00 space has intermittently acted as assist, historic accumulation patterns make $2.80 a short lived buffer, with “actual assist” starting under $2.48—a zone he has mapped utilizing on-chain positioning.

Associated Studying

He reiterated on Aug. 3 that “previous accumulation conduct factors to $2.80 as a short lived buffer for XRP, however actual assist begins under $2.48,” including that essentially the most consequential stage on his dashboard stays $2.40. Impartial protection of his evaluation echoed these thresholds, framing $2.80 as a light-weight cushion with heavier demand pockets sub-$2.50.

Move information has added to the bearish case within the close to time period. Martinez mentioned whales have offloaded over 720 million XRP, intensifying sell-side strain in current classes; earlier, on Aug. 2, he specified that “whales have offered over 710 million $XRP up to now 24 hours!” That spike in large-holder distribution has been picked up by a number of market trackers and recaps over the previous few days.

He additionally flagged the Market Worth to Realized Worth (MVRV) sign turning sharply destructive. “The MVRV ratio simply flashed a dying cross,” Martinez wrote, calling it “one other signal {that a} steeper correction might be underway.” The publish underscores the crossover as a warning of rising draw back threat if short-term holders’ price foundation begins to overhang market worth.

Whereas “dying cross” language is extra generally related to moving-average pairs, Martinez makes use of the time period right here to explain a momentum break in MVRV curves.

Associated Studying

The TD Sequential—a Tom DeMark-designed exhaustion mannequin usually used to anticipate pattern reversals—has been central to Martinez’s view since late July, when he tracked a three-day “promote” print close to the highest of the newest rally leg. He has since framed the trail of least resistance as decrease except the market can set up sustained closes again above the high-volume node close to $3.00–$3.20, whereas on-chain profiles proceed to privilege $2.48–$2.40 as the realm of “actual” demand. As he put it on Aug. 3: “The subsequent key assist stage to observe is $2.40!”

For now, Martinez’s roadmap rests on three pillars: an exhaustion promote on the 3-day TD Sequential, large-holder distribution within the lots of of thousands and thousands of XRP, and a bearish MVRV crossover, all of which he argues increase the chance of a deeper corrective leg towards the high-$2s and, if momentum deteriorates, the mid-$2s. Whether or not bulls can defend the shallower buffers close to $2.80 could decide if XRP’s decline stays a garden-variety pullback or morphs into a bigger reset towards his $2.40 magnet.

At press time, XRP traded at $2.93.

Featured picture created with DALL.E, chart from TradingView.com