Fast Take

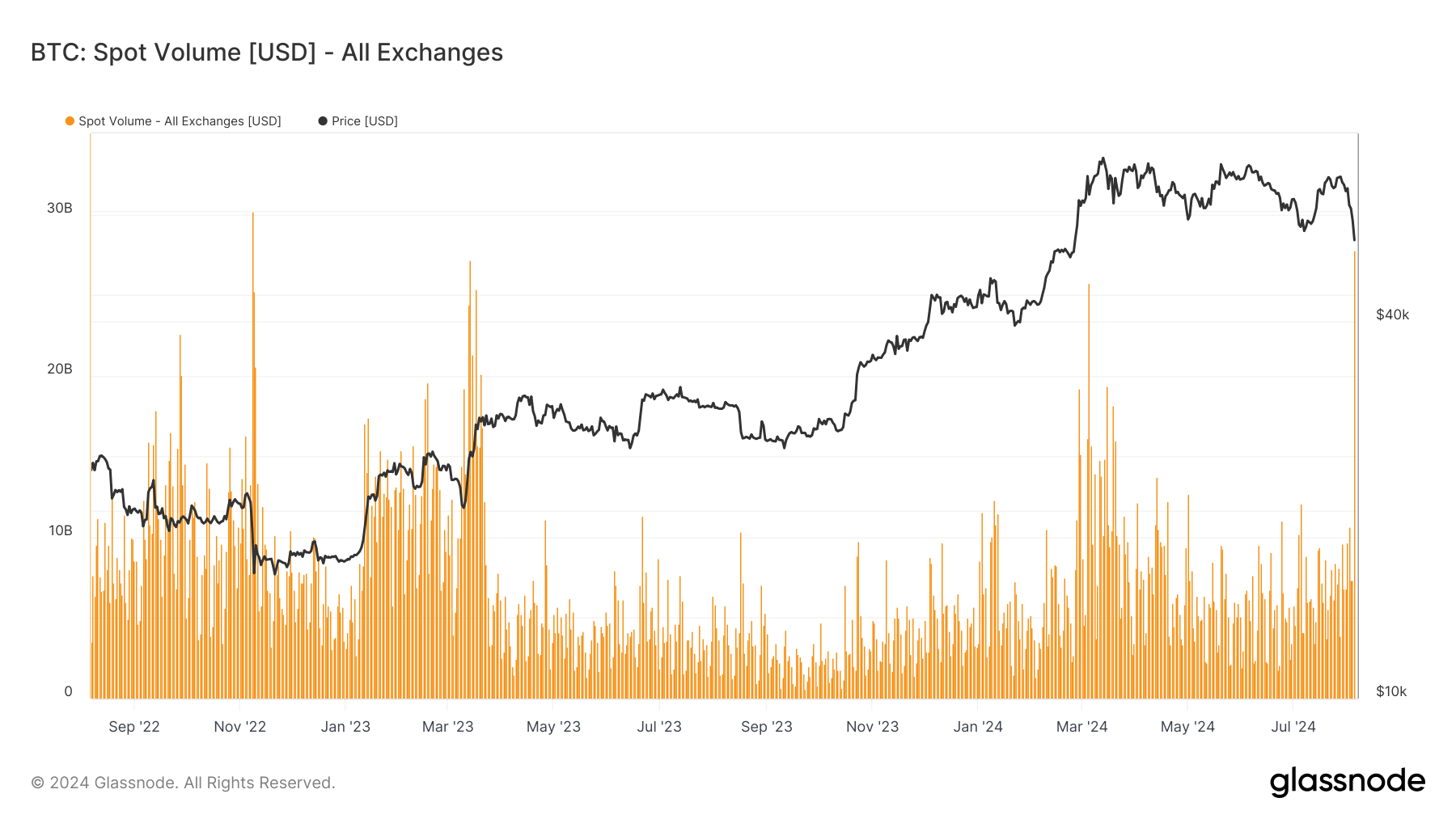

Aug. 5 was marked by vital international volatility, with the VIX hovering above 60 and Bitcoin experiencing dramatic value swings, dropping to $49,000 earlier than rebounding to $55,000. By the top of the day, Bitcoin recorded $28 billion in spot quantity, the very best for the reason that FTX collapse in November 2022. Bybit led the exchanges with a staggering $7 billion in spot quantity, adopted by Coinbase, which noticed its highest quantity since Bitcoin’s all-time excessive in March 2024, based on Glassnode information.

The delta between shopping for and promoting on numerous exchanges supplied a revealing perspective, as Binance exhibited a bearish sentiment dominated by promoting stress. Conversely, Coinbase confirmed a slight inclination in the direction of shopping for quantity, based on Glassnode information.

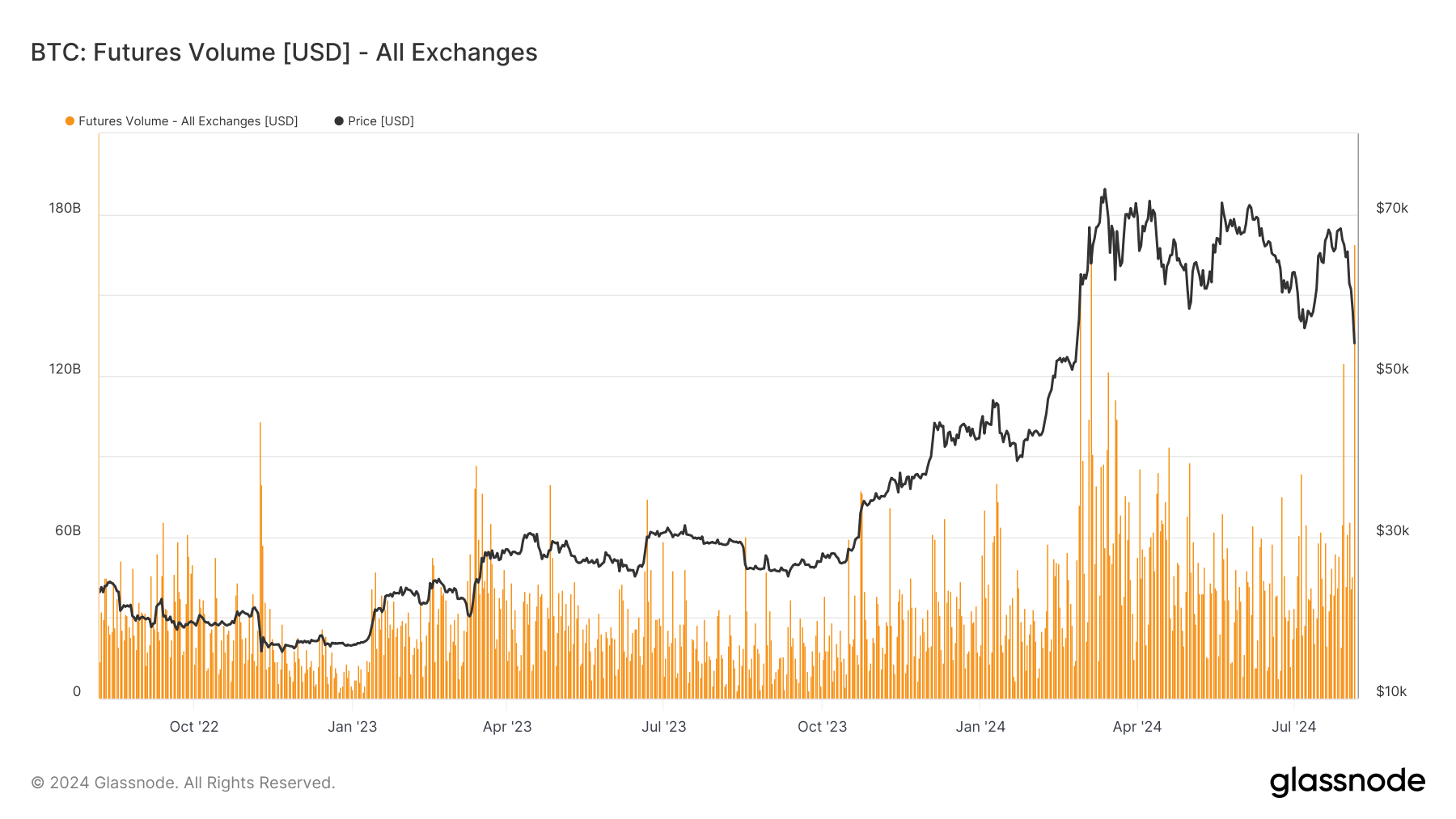

The amount reached $170 billion within the futures market, mirroring the degrees seen throughout Bitcoin’s ascent to its all-time excessive in March 2024.

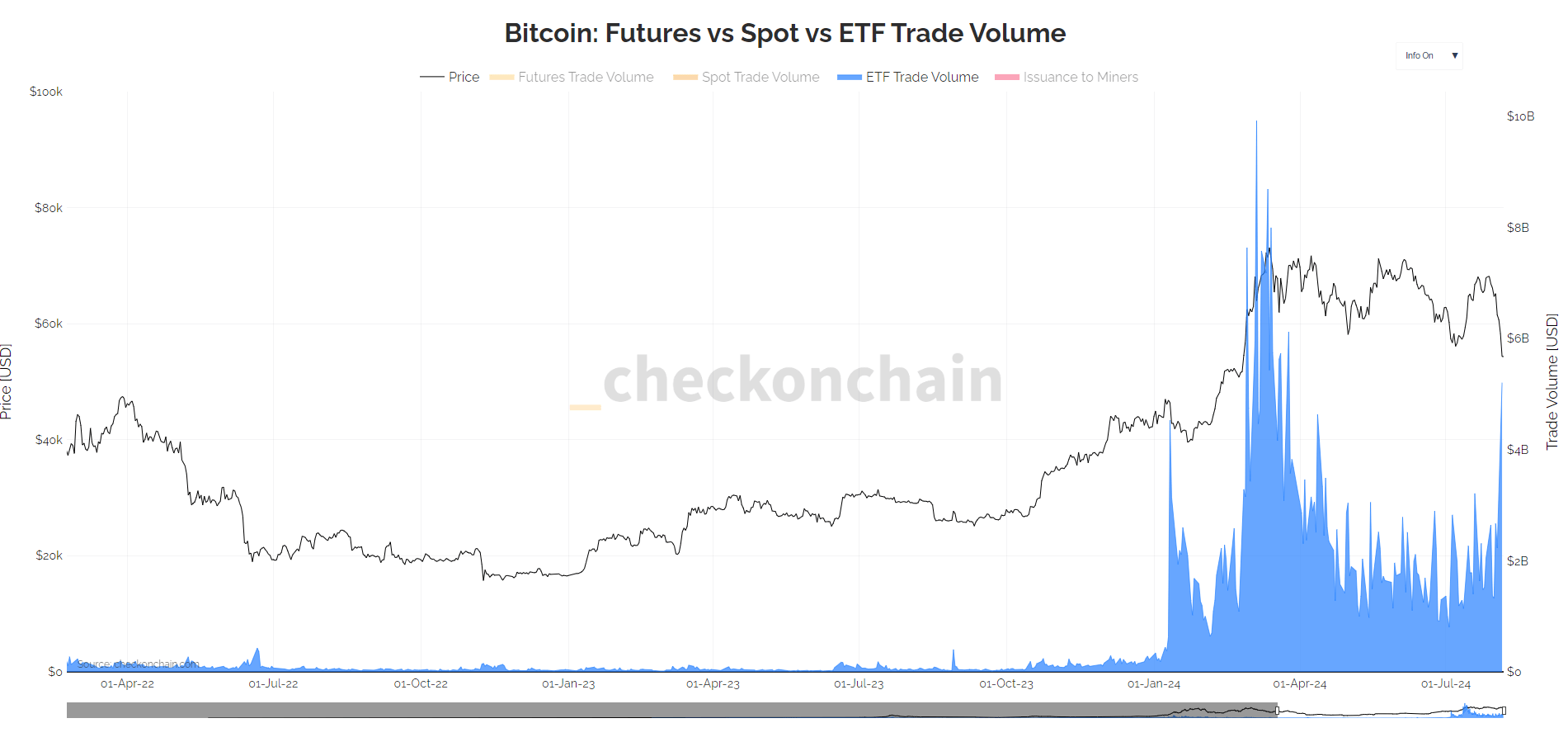

Moreover, Bitcoin US ETF quantity was roughly $5.7 billion, one of many highest since March, as reported by checkonchain.

The submit Risky day for Bitcoin sees document $28 billion spot quantity, highest since FTX collapse appeared first on CryptoSlate.