Eric Trump and Donald Trump Jr. used a CNBC interview this week to resume their public assist for Bitcoin, calling it the defining asset class for a brand new era and predicting a serious value growth forward.

Talking throughout a wide-ranging dialogue that touched on stablecoins and broader cryptocurrency adoption in the course of the World Liberty Discussion board, Eric Trump mentioned he stays “an enormous proponent of Bitcoin” and argued the asset may finally attain $1 million.

He pointed to Bitcoin’s long-term efficiency, bearing on its restoration from lows close to $16,000 two years in the past and claiming it has delivered sturdy common annual features over the previous decade.

Trump framed volatility as a pure characteristic of an rising asset with vital upside, contrasting BTC with lower-yielding conventional investments akin to municipal bonds or U.S. Treasuries.

“I’ve by no means been extra bullish on bitcoin in my life,” Trump mentioned.

The Trump sons additionally highlighted what they see as accelerating institutional acceptance. Eric Trump cited main monetary companies together with Constancy, Charles Schwab, JPMorgan, BlackRock, and Goldman Sachs as examples of Wall Road’s rising engagement with digital belongings.

He claimed personal wealth purchasers are being allotted greater percentages of crypto publicity than in previous years, positioning Bitcoin as an funding theme for folks underneath 50.

Goldman Sachs CEO owns bitcoin

The feedback got here as conventional finance leaders signaled a cautious shift in tone. Goldman Sachs Chief Govt Officer David Solomon disclosed that he now holds a small quantity of BTC, talking on the World Liberty Discussion board held at Mar-a-Lago in Florida.

Solomon described his holdings as “very, very restricted” and mentioned he’s not a “nice Bitcoin prognosticator,” casting himself as extra of an observer than an advocate.

His remarks mirror the rising proximity between established monetary establishments and the crypto sector after years of regulatory constraints that stored companies like Goldman largely on the sidelines.

Solomon has beforehand expressed skepticism about BTC’s sensible position. In a 2024 CNBC interview, he characterised the asset as speculative and questioned its real-world use case, whereas acknowledging its volatility and investor curiosity.

Coinbase Chief Govt Officer Brian Armstrong additionally addressed Bitcoin’s current value weak point throughout his look on the discussion board. Armstrong mentioned the most recent decline seems pushed extra by market psychology than by underlying fundamentals.

He dismissed hypothesis that macro political components had been behind the transfer and argued that volatility stays a part of crypto’s regular cycle.

Armstrong maintained that BTC stays one of many best-performing belongings of the previous decade and mentioned Coinbase doesn’t take a short-term view of value swings.

Armstrong additionally pointed to the coverage atmosphere in Washington, suggesting crypto laws may advance underneath President Donald Trump’s administration.

He described a possible “win-win-win” consequence for the business, banks, and shoppers if regulatory readability is achieved, including that proposed measures may attain Trump’s desk inside months.

Yesterday, Armstrong mentioned the corporate expects a market construction invoice to go and argued that statutory readability would offer long-term certainty past shifting management at businesses just like the SEC.

If laws stalls, he mentioned Coinbase would proceed working underneath current guidelines whereas in search of readability by way of regulators or the courts.

“I believe the invoice will get executed,” Armstrong mentioned. “It’s in everybody’s curiosity at this level.”

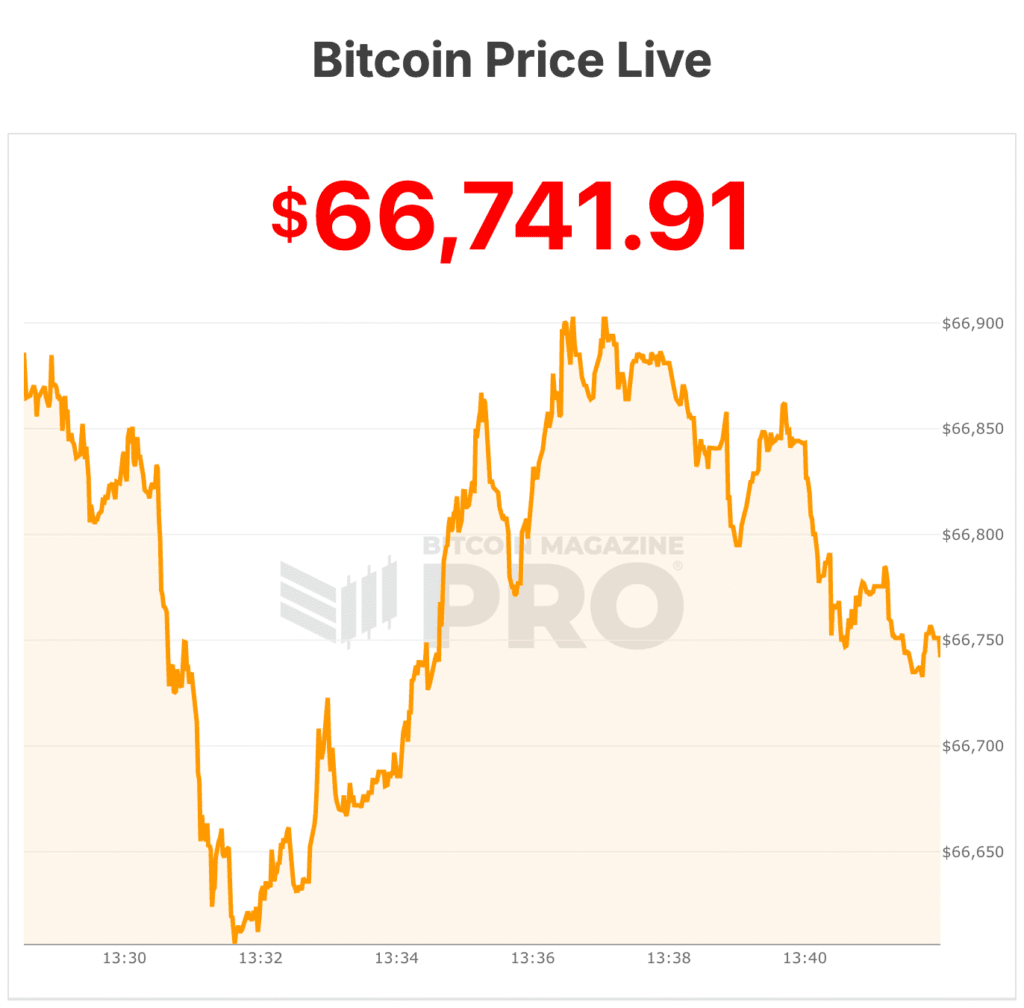

BTC is buying and selling at $66,800 in the present day, with $33 billion in 24-hour quantity. The asset is down 1% over the previous day as value motion stays tight inside its weekly vary.

BTC is sitting about 2% beneath its 7-day excessive of $68,328 and primarily flat from its 7-day low of $66,834, signaling continued consolidation fairly than a decisive breakout.

Bitcoin’s circulating provide stands at 19,991,396 BTC, towards a hard and fast most of 21 million. The full market capitalization is now roughly $1.34 trillion, down 1% from the day past.