XRP is quietly leaving Binance at a tempo that’s starting to register in CryptoQuant’s alternate provide metrics, a sample one CryptoQuant contributor Darkfost (X: @Darkfost_Coc)says is in step with renewed accumulation after a pointy year-to-date drawdown.

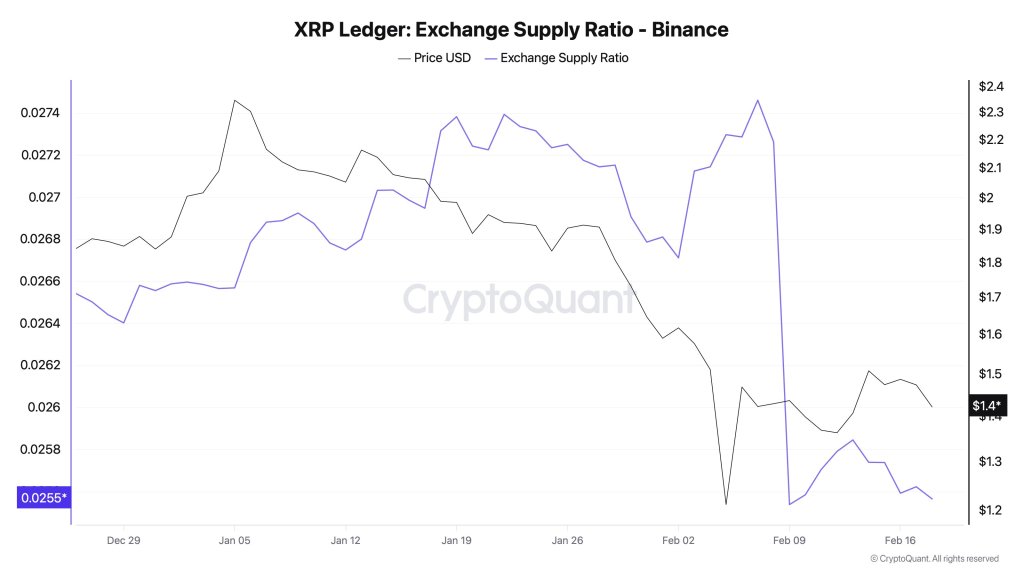

In a word printed on CryptoQuant, Darkfost pointed to a gradual decline in Binance’s XRP “provide ratio”, a measure of how a lot of the asset’s complete provide sits on a given alternate as a sign that some holders are choosing custody over liquidity.

Binance Ratio Slides As XRP Strikes Off-Platform

CryptoQuant’s framing is simple: rising alternate reserves usually monitor elevated readiness to promote, whereas falling reserves are inclined to mirror withdrawals into non-public wallets and longer time horizons. Darkfost described the present setup in plain phrases: “A decline in reserves held on buying and selling platforms suggests traders are withdrawing. Funds are moved into non-public custody options. That is the pattern on Binance.”

Associated Studying

The info level on the heart of the word is the Binance XRP provide ratio over the past ten days. “Over the previous ten days, Binance’s XRP provide ratio fell from 0.027 to 0.025. About 200 million XRP left the platform,” Darkfost wrote, characterizing the transfer as “notable” within the context of short-dated flows.

Alternate-specific ratios matter to merchants as a result of they’re a proxy for near-term sell-side availability (and Binance probably the most liquid alternate). When balances drift decrease, it sometimes means fewer cash are sitting one click on away from the order ebook, not a assure of upper costs, however a measurable shift in positioning.

CryptoQuant additionally flagged a well-recognized caveat: not each giant switch is “natural.” Exchanges reshuffle wallets, rotate custody addresses, or consolidate funds for operational causes, which might muddy any simplistic learn of inflows and outflows.

Associated Studying

Darkfost argued the Binance dataset remains to be interpretable as a result of public custody infrastructure gives some visibility. “Some actions could also be inner reallocations. Binance publishes custody addresses, making it potential to tell apart natural consumer flows from operational changes,” the word stated, suggesting the noticed decline possible displays not less than some user-driven withdrawals reasonably than pure inner accounting.

Why This Issues After A 40% Drawdown

The word ties the withdrawal pattern to cost context with out leaning on forecasts. Darkfost stated XRP has “undergone a correction of round 40% for the reason that starting of the yr,” and that the decrease ranges could also be drawing curiosity from traders positioning with an extended horizon.

That mixture: a cloth year-to-date correction alongside a measurable discount of exchange-held provide is usually what analysts search for once they’re making an attempt to determine accumulation phases. The logic is easy: cash moved off exchanges are, by definition, much less instantly liquid, and that tends to be extra in step with holding than with imminent promoting.

At press time, XRP traded at $1.4161.

Featured picture created with DALL.E, chart from TradingView.com