Investor Paul Barron’s trace at “huge information” has reignited consideration on XRP exchange-traded funds this week, sending the neighborhood into hypothesis over doable upcoming bulletins or launches.

Associated Studying

Merchants and holders reacted quick on social channels, pushing chatter and value focus greater at the same time as specifics stay unclear.

ETF Flows Warmth Up

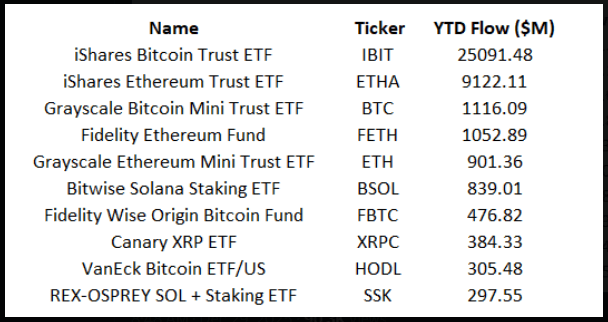

In line with knowledge shared by Nate Geraci, President of NovaDius Wealth, Bitcoin and Ethereum ETFs dominated year-to-date inflows.

BlackRock’s IBIT Bitcoin ETF led with $25 billion in inflows. Grayscale’s Bitcoin Mini Belief ETF adopted at $1.11 billion. Constancy and VanEck posted $477 million and $305 million respectively.

On the Ethereum aspect, BlackRock’s choices recorded about $9.12 billion. A Solana staking ETF from Bitwise pulled in $839 million. These numbers present the place most massive buyers are placing cash proper now.

Anticipate some huge information this week $XRP ETFs https://t.co/3BY5XJosPx

— PaulBarron (@paulbarron) December 29, 2025

Group Response And Hypothesis

Barron’s comment has been learn by many as a touch at one other XRP-related announcement. Some anticipate a brand new ETF launch; others are looking ahead to updates from issuers already available in the market. That discuss has helped push consideration — and inflows — to XRP merchandise that solely debuted late within the yr.

XRP Ledger Tokenization Surge

Based mostly on experiences from rwa.xyz, on-chain knowledge signifies tokenized real-world belongings on the XRP Ledger rose by 2,200% in 2025. The community noticed about 23x progress within the worth of native real-world belongings, together with stablecoins, and crossed the $500 million threshold.

Themes round RWA tokenization had been broadly mentioned this yr by figures similar to BlackRock CEO Larry Fink and former SEC Chair Paul Atkins, and the XRPL seems to be drawing profit from that curiosity.

XRP ETFs Present Early Power

Canary’s XRP ETF (XRPC) registered $384 million in year-to-date inflows after launching in November. Different XRP spot funds have constructed sizable holdings too: 21Shares holds about $250 million, Bitwise roughly $227 million, Grayscale round $244 million, and Franklin about $206 million.

Based mostly on experiences, all of those XRP spot ETFs launched in November and December and now tally roughly $1.24 billion in whole belongings below administration with cumulative inflows close to $1.14 billion.

For a brand new class, that stage of cash shifting in over a brief span is notable; some business voices level out the overall may need been greater if market temper had not cooled lately. Experiences additionally say XRP ETFs pulled in over $1 billion via 21 days of regular inflows.

Pending Merchandise And Rumors

WisdomTree’s XRP ETF is among the many pending choices that market watchers anticipate to reach subsequent. On the similar time, discuss a BlackRock XRP ETF has circulated broadly. There’s at present no public submitting tied to a BlackRock XRP product, and experiences warning that such expectations are untimely with out official filings or approvals.

Associated Studying

Present flows word that XRP’s ETF debut has shifted a part of investor focus from pure crypto bets to identify ETF allocations and tokenization themes. Whether or not Barron’s hinted “huge information” turns into a concrete catalyst will rely upon filings and formal product launches. For now, the combination of stable early inflows and speedy XRPL tokenization progress has put XRP squarely within the dialog amongst ETF-focused buyers and community adopters.

Featured picture from Unsplash, chart from TradingView