The Sahm Rule, a key recession indicator, continues to sign an elevated danger of an financial downturn in the US, including to bearish sentiment in crypto markets already grappling with damaging on-chain developments.

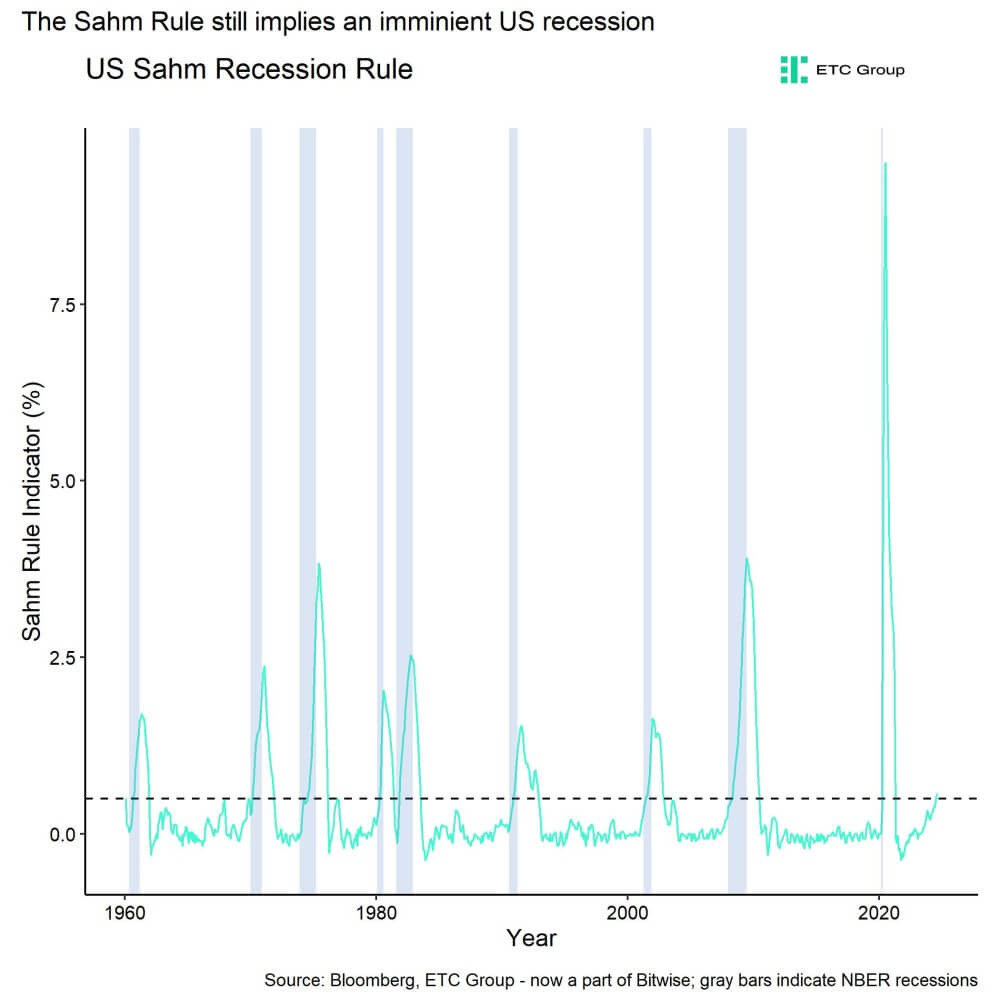

Based on a current evaluation by ETC Group (now part of Bitwise), the Sahm Rule stays triggered, implying an imminent US recession. Created by former Federal Reserve economist Claudia Sahm, this indicator flags the onset of a recession when the three-month shifting common unemployment charge rises 0.50 share factors or extra relative to its low in the course of the earlier 12 months.

The most recent knowledge reveals the Sahm recession indicator stood at 0.53 in July 2024, barely up from the earlier month. This sustained elevation above the required threshold means that recessionary pressures persist regardless of the resilience proven by the US financial system to this point.

The continued recession danger comes as crypto markets face their challenges. ETC Group’s evaluation signifies that main Bitcoin on-chain metrics have continued negatively trending. Web promoting volumes throughout Bitcoin spot exchanges totaled round -$606 million over the previous week, although the promoting tempo has regularly declined all through the beginning of September.

Moreover, Bitcoin whales transferred 9,477 BTC to exchanges on a web foundation final week, contributing to elevated promoting strain. In consequence, Bitcoin trade balances have risen over the previous week.

The bearish on-chain knowledge aligns with broader damaging sentiment in crypto markets. ETC Group’s in-house “Cryptoasset Sentiment Index” continues to sign bearish sentiment, with solely 4 out of 15 indicators above their short-term pattern.

Nonetheless, some analysts see the potential for a shift in market situations. ETC Group means that the mixture of macro and crypto sentiment capitulation in early August could have marked a major tactical backside for Bitcoin, doubtlessly signaling the beginning of a renewed bull run. This view is predicated partly on expectations of looser financial coverage from the Federal Reserve, which may present a good tailwind for cryptocurrencies within the coming months.

Because the market navigates these conflicting alerts, recessionary dangers and bearish on-chain developments persist, and the potential for financial coverage shifts and oversold situations may set the stage for a market reversal.