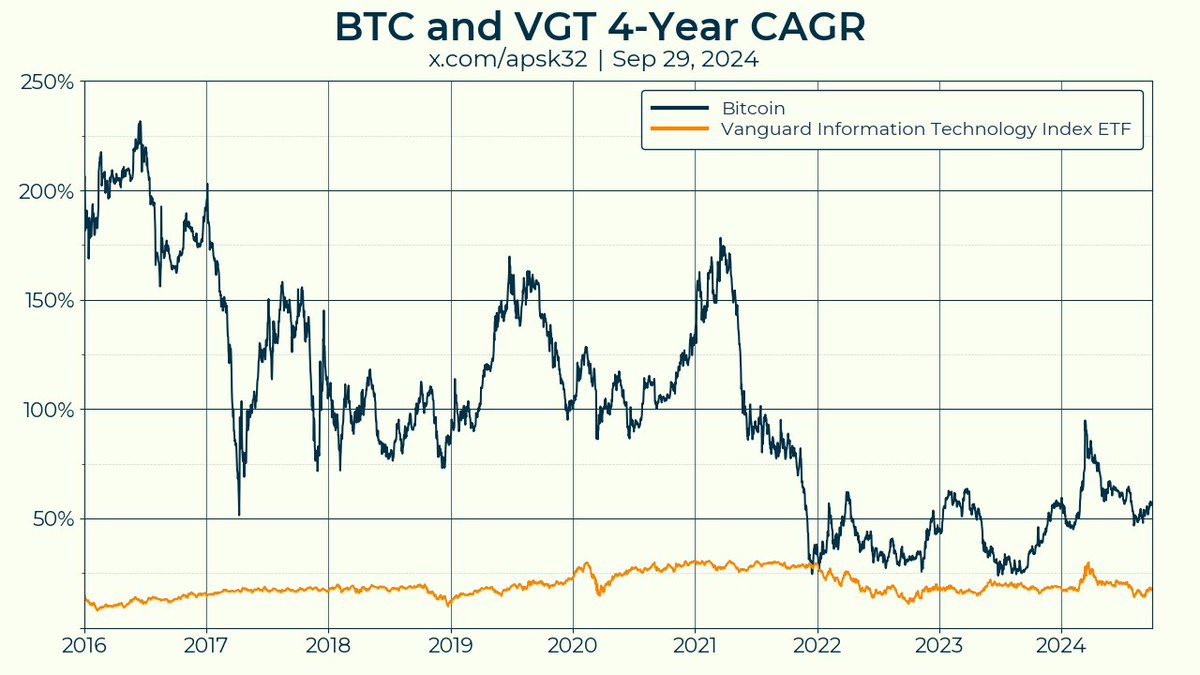

Bitcoin’s 4-year compound annual progress fee (CAGR) stays above 50%, outperforming the Vanguard Data Expertise Index ETF (VGT).

From 2016 by late 2024, Bitcoin’s CAGR has fluctuated however persistently surpassed VGT’s efficiency. In 2016, Bitcoin’s CAGR peaked above 200% earlier than declining to about 50% by early 2017. A resurgence occurred by mid-2017 and climbed above 150% once more in 2019 and late 2021. Regardless of a downward development after 2021, Bitcoin’s CAGR stays sturdy above 50% in 2024, bottoming round 20 – 30% in 2022 and 2023.

Going ahead, if Bitcoin’s value in 2025 just isn’t 50% above its 2021 excessive (which might be roughly $103,500), the CAGR will seemingly drop under 50% once more.

VGT’s CAGR has been comparatively secure, ranging between 0% and 35% throughout the identical interval. Notably, from late 2017 to late 2021, VGT briefly outperformed Bitcoin, indicating that conventional property not often surpass crypto progress.

Bitcoin engineer apsk32 highlighted that the information means that nobody has misplaced cash holding Bitcoin over any 4-year interval. Nevertheless, the lowering development in Bitcoin’s CAGR might sign a diminishing window for top returns. The Bitcoin adoption section presents a singular monetary alternative, however as progress charges decline, future positive aspects could also be much less substantial.