Este artículo también está disponible en español.

Ethereum adoption is hovering, with the community simply passing a vital milestone that has analysts forecasting a value restoration.

Associated Studying

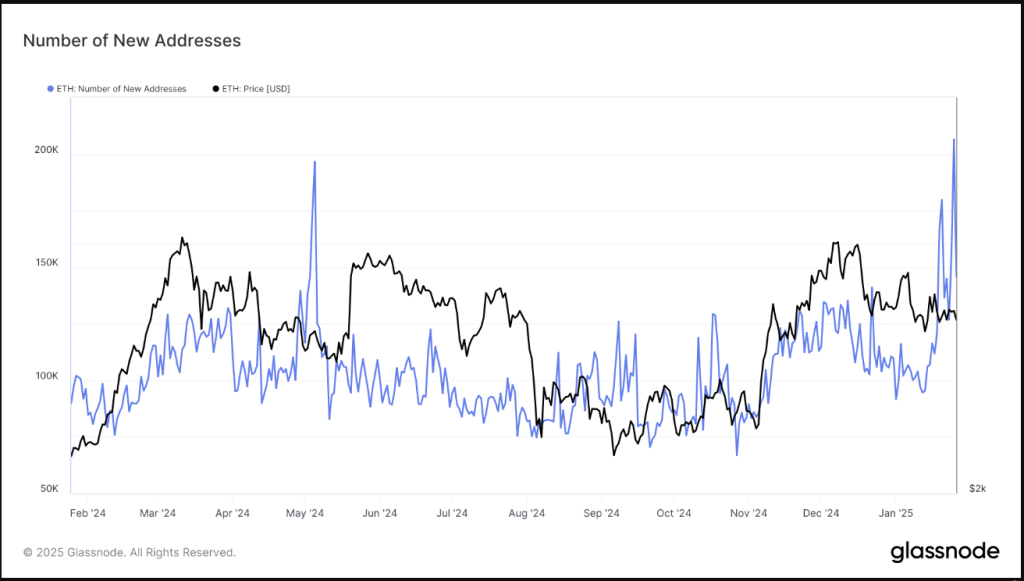

On January twenty fourth and twenty fifth, Ethereum skilled an increase in every day lively addresses, exceeding 200,000—a quantity not seen since October 2022. This large enhance displays the community’s elevated engagement and significance in decentralized finance (DeFi) and non-fungible tokens (NFT), Glassnode knowledge reveals.

Ethereum Community Exercise And Person Engagement

The rise in every day lively addresses is among the most vital measures of Ethereum adoption because it demonstrates that extra customers are interacting with decentralized apps (dApps) and conducting DeFi transactions.

The latest enhance in new Ethereum addresses reveals that extra persons are coming into the market. This can be as a result of value modifications are drawing in newcomers, regardless that costs have fallen just lately. The rise in addresses reveals previous patterns seen throughout instances of market instability and value modifications, when fluctuations often result in extra exercise on the community.

Ethereum addresses with a non-zero stability have likewise steadily grown; in January 2025 they are going to have topped 136 million. This constant rise—even within the face of declining costs—showcases Ethereum’s resilience and means that community acceptance is transcending easy speculative buying and selling, subsequently exhibiting substantial, long-term demand within the platform.

Value Restoration And Market Volatility

Now, the query is whether or not this sample will result in a value restoration for Ethereum, whilst its use is rising. Ethereum’s value has had problem breaking previous important resistance ranges, even when the community’s person base is increasing.

The value of ETH continues to be under its peak in January 2025, even with sturdy adoption indicators. ETH was down 4.0% and 1.0% on the every day and weekly charts at $3,203 on the time of writing.

Analysts are retaining an in depth eye on the value motion, and a few predict that as extra institutional traders and particular person merchants look to revenue from the rising demand for ETH-powered providers, Ethereum’s value will rise.

On Macroeconomic Circumstances & Bitcoin Value Efficiency

In the meantime, macroeconomic situations, particularly Bitcoin efficiency and broader market temper, proceed to have a big influence on Ethereum’s value swings. The cryptocurrency market’s volatility continues to be a problem, with sudden drops and spikes forcing merchants to be hesitant.

Nevertheless, if Ethereum can maintain its current acceptance pattern and proceed to develop its community of lively customers, its value could lastly achieve the upward impetus it has been missing.

Associated Studying

What Triggered The Spike?

The rise in new Ethereum addresses on January 24 and 25 is a results of rising market volatility, which attracts extra customers. This enhance reveals the rising engagement with DeFi and NFTs and suggests a future utilization past speculative buying and selling. The community’s operations present that client curiosity is increasing, no matter value discount.

Featured picture from DALL-E, chart from TradingView