Technique (MSTR) is pulling off some type of monetary alchemy: utilizing bitcoin, traditionally a risky asset, to create one thing that appears so much like stability.

That’s the agency’s $2 billion “Stretch” Most popular Inventory (STRC) providing presents a variable 9% dividend and is designed to maintain the share value hovering close to $100.

The providing doesn’t give buyers direct bitcoin publicity, but it's backed by the asset in spirit and construction, in keeping with a latest NYDIG report.

Technique holds $71.7 billion in bitcoin and simply $11 billion in liabilities, giving it room to ship revenue even when crypto costs dip, the report notes.

Traditionally, bitcoin has returned a minimum of 3%–4% yearly over any five-year stretch, whereas common returns have been considerably larger.

Technique is betting it may use this return profile to maintain excessive payouts with out touching its crypto stash, basically turning long-term bitcoin appreciation into month-to-month money stream.

“STRC seems to be to us like a high-yield, bitcoin-backed, money-market-style car, designed to commerce close to $100 par whereas providing a far larger yield than conventional short-term devices, albeit with a special liquidity profile,” NYDIG wrote.

That premise has confirmed standard. Investor curiosity drove Technique to quadruple the providing measurement from $500 million to $2 billion.

STRC could not simply be a yield car, however quite bitcoin, reworked for conventional finance revenue buyers. A form of money-market fund, remixed with crypto underneath the hood.

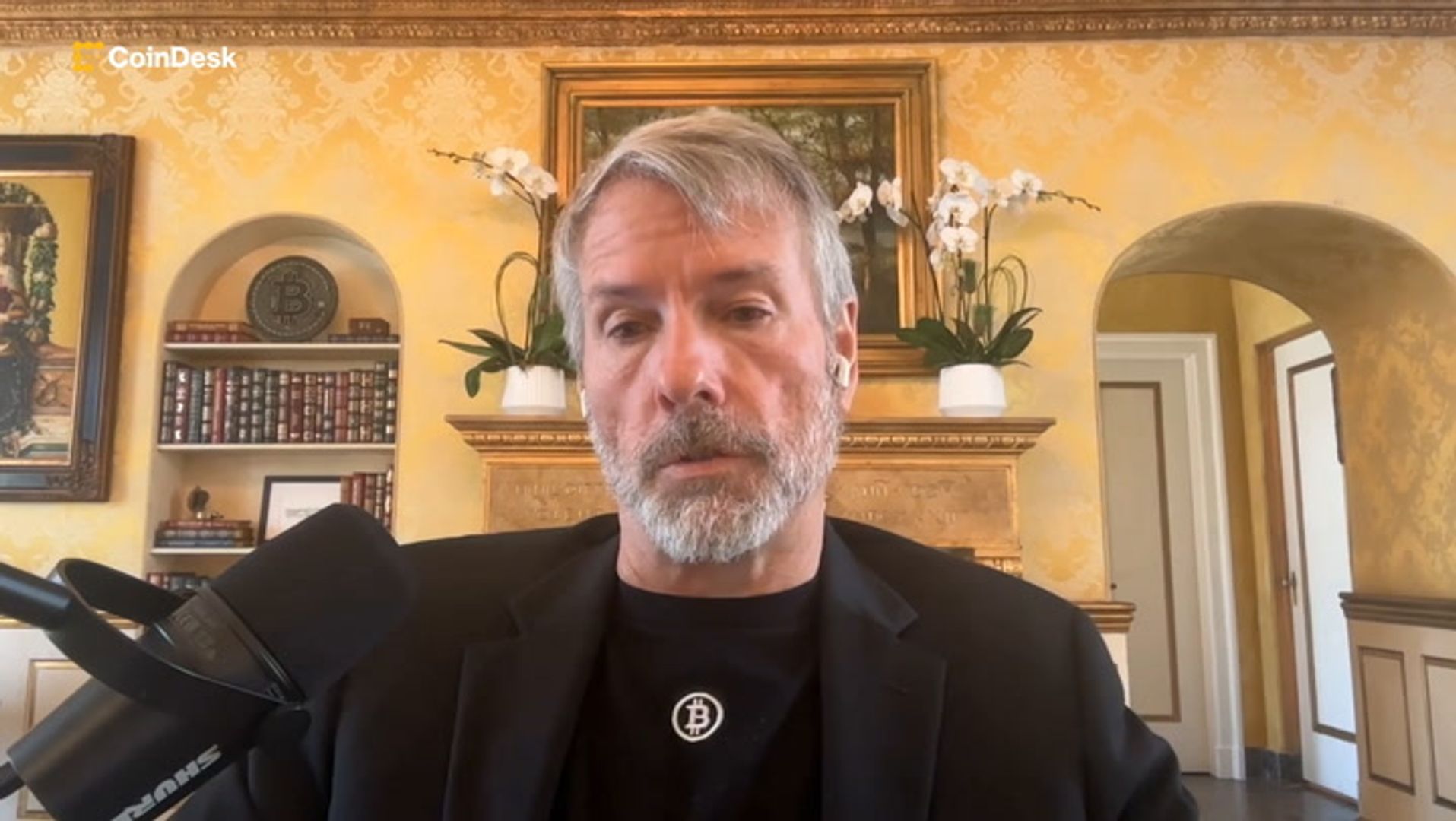

Learn extra: Michael Saylor Builds Out Personal Yield Curve With Upsized Most popular Inventory Sale