Talking at Technique World 2025 immediately, Chris Kuiper, Vice President of Analysis at Constancy Digital Belongings, challenged companies to reexamine how they give thought to danger, capital allocation, and long-term monetary well being. “Bitcoin has outperformed each main asset class over the past ten years,” Kuiper mentioned. “For those who’re an organization sitting on money or low-yield bonds, you’re falling behind.”

With over a decade of knowledge, Kuiper made the case that Bitcoin isn’t only a speculative asset—it’s a superior strategic reserve. The numbers have been entrance and middle: Bitcoin has delivered a 79% compound annual progress fee (CAGR) over the past decade and 65% over the previous 5 years. In distinction, Kuiper confirmed that investment-grade bonds returned simply 1.3% nominally over the identical interval.

“Firms typically deal with volatility. However volatility isn’t danger—everlasting capital loss is,” Kuiper defined. He cited inflation and forex debasement as the actual threats dealing with stability sheets immediately, exhibiting how even conventional secure havens like U.S. Treasury bonds have suffered damaging actual returns over time.

To deal with issues about Bitcoin’s volatility, Kuiper provided two sensible methods: place sizing and long-term pondering. “Bitcoin doesn’t must be all or nothing,” he mentioned. “It’s not a swap—it’s a dial.” Even a 1–5% allocation, he argued, can considerably enhance an organization’s risk-adjusted return whereas limiting drawdown publicity.

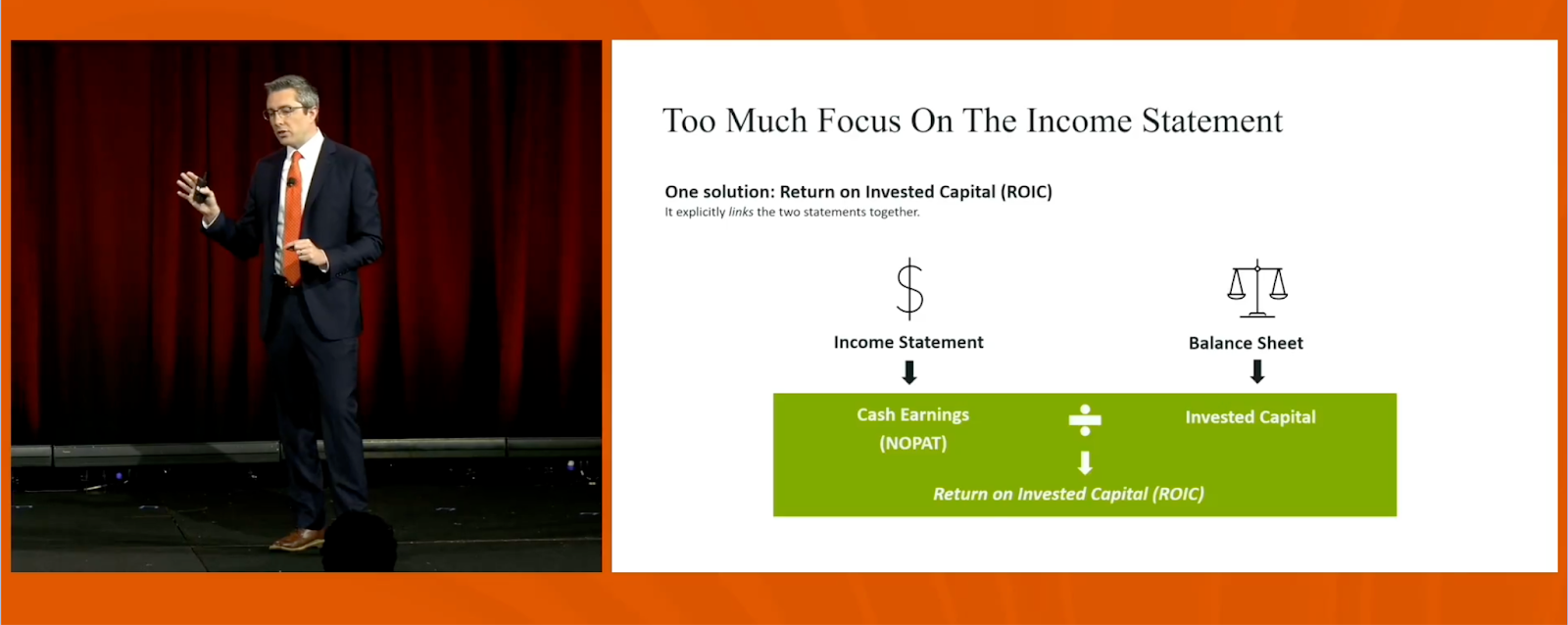

The presentation then turned to company fundamentals. Kuiper emphasised the significance of return on invested capital (ROIC) over headline earnings, calling out the inefficiencies of sitting on money. For instance, he famous that Microsoft’s ROIC drops from 49% to 29% when extra money is included—highlighting the drag idle capital creates.

“Firms are laser-focused on revenue statements, but it surely’s the stability sheet that tells the actual story,” Kuiper mentioned. “Money is a part of that story—and Bitcoin can flip it from useless weight right into a productive asset.”

He closed with a direct query to executives: “What’s your alternative set—and do you consider these alternatives can outperform Bitcoin?”

In Kuiper’s view, the reply is more and more apparent.