The European Central Financial institution (ECB) is laying the groundwork for the possible launch of its wholesale and retail central financial institution digital foreign money (CBDC), the Digital Euro. Christine Lagarde, President of the ECB, shared this replace at their newest press convention. “President Lagarde burdened that the digital euro is ‘extra related than ever,’” the ECB tweeted.

Lagarde emphasised that the Digital Euro, the EU’s CBDC resolution, is ready to launch in October 2025—supplied it passes the legislative section involving key stakeholders, together with the European Fee, Parliament, and Council. Notably absent from this course of is the European public, regardless of the numerous affect this initiative can have on their day by day lives.

Why Is the Digital Euro Extra Related Than Ever?

May it’s linked to Ursula von der Leyen’s latest “ReArm Europe” announcement, which proposes the creation of an EU military? This initiative requires an estimated €800 billion in funding—cash the EU doesn’t have. The choices? Extracting it from EU member states and their residents or printing contemporary funds by way of the ECB. Both means, it’s time to heat up the ECB’s cash printers!

Moreover, The EU has launched the “Financial savings and Investments Union”, aiming to redirect €10 trillion in “unused financial savings” from residents to finance army progress and bolster Europe’s protection business. “We’ll flip personal financial savings into much-needed funding,” tweeted von der Leyen. If this hasn’t shocked you already, I’ll attempt to make clear: This can be a clear violation of personal property rights, and an implicit confiscation of Europeans’ wealth, whereas bluntly utilizing their funds because the EU sees match, together with funding of a army industrial advanced, with out even asking them.

If the EU is accelerating towards totalitarian collectivism, as this assertion suggests, then a CBDC could be a strong device—enabling tighter management over Europeans’ cash with options like an “on/off” change and programming skills.

Christine Lagarde lately campaigned on the European Parliament, arguing that the Digital Euro is important to cut back the EU’s dependence on international fee options. European banks should innovate fee strategies, however the EU’s major concern isn’t simply reliance on tech giants like Google Pay or Apple Pay—it’s the potential for widespread adoption of decentralized international protocols like Bitcoin.

The ECB is observing geopolitical tendencies, noting that the U.S. is embracing crypto, Bitcoin, and stablecoins—applied sciences that pose a danger to centralized management. Unsurprisingly, they’re selecting a special path. In accordance with Reuters, “Eurozone banks want a digital euro to reply to U.S. President Donald Trump’s push to advertise stablecoins” as a part of a broader crypto technique. ECB board member Piero Cipollone strengthened this stance, stating, “This resolution additional disintermediates banks as they lose charges, they lose shoppers… That’s why we want a digital euro.”

Backside line, Lagarde’s and Von der Leyen’s latest agendas are aimed to drive extra centralised management whereas strengthening the EU hierarchy, governance and incentive construction – that has all the time been their position.

New Digital Euro CBDC Survey

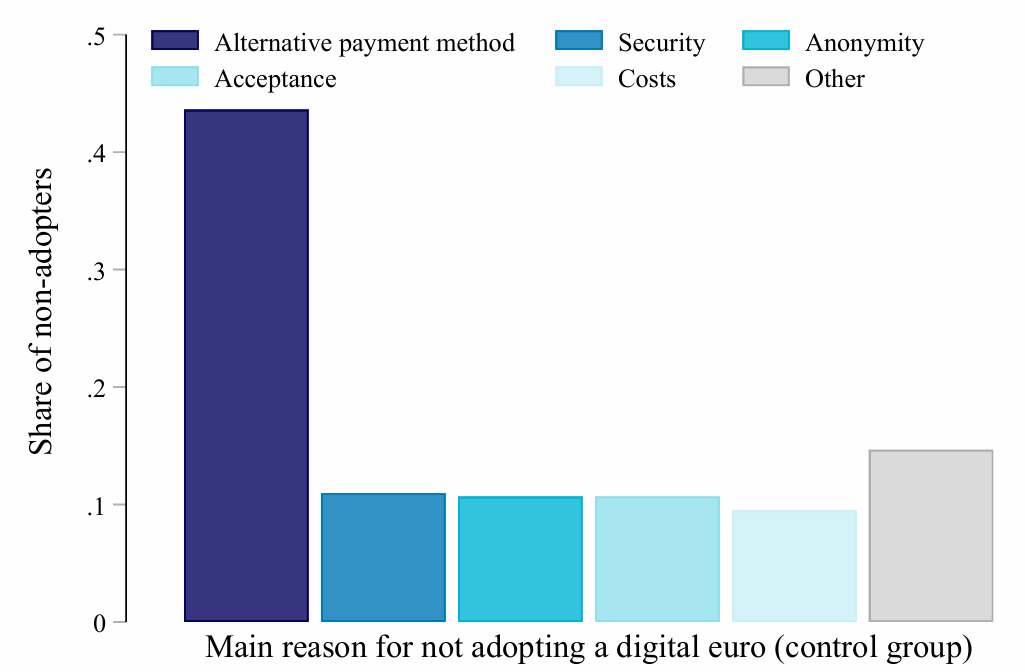

The ECB lately revealed findings from a survey on shopper attitudes towards retail CBDC, carried out amongst 19,000 Europeans throughout 11 Eurozone international locations. Key takeaways embrace:

1) Lack of Curiosity – Most Europeans aren’t within the Digital Euro, as current fee strategies already serve their wants nicely.

2) Europeans are Open to Propaganda – Whereas public curiosity is low, the survey discovered that Europeans are receptive to video-based training and coaching. The ECB’s examine means that CBDC-related movies might drive widespread adoption by reshaping shopper beliefs. The report states: “Shoppers who’re proven a brief video offering concise and clear communication about the important thing options of the digital euro are considerably extra prone to replace their beliefs… which will increase their fast chance of adopting it.” No marvel the ECB has ramped up its digital euro video content material since late 2024. For instance:

3) Choice for Present Fee Strategies – “Europeans have a robust desire for current fee strategies and see no actual profit in a brand new kind of fee system”. Whereas this discovering seems like a optimistic pushback, it may possibly function a precursor to a tactic of technological integrations. “In case you can’t beat them, be part of them” tactic – equally to the Chinese language e-CNY retail CBDC.

A latest Euromoney article highlighted e-CNY’s integration with China’s hottest apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay), a transfer that facilitated its widespread adoption. Regardless of early struggles, e-CNY now boasts 180 million private pockets customers and a cumulative transaction worth of $1 trillion. I lately explored this matter in depth with Roger Huang lately on my podcast.

Not Simply Retail—Wholesale Too

On the wholesale CBDC entrance, the EU is experimenting with distributed ledger expertise (DLT) to interconnect monetary establishments throughout Europe and past. This follows exploratory work carried out by the Eurosystem between Could and November 2024. Their trials concerned 64 members—together with central banks, monetary market gamers, and DLT platform operators—conducting over 50 experiments.

“Digital Money“

Lagarde insists that the Digital Euro is a type of money, gaslighting and deceptive uninformed Europeans in regards to the dangers of CBDCs. Permission-based CBDCs such because the Digital Euro are susceptible to micro ranges of management by expiry dates, geofencing and programmability. If Europeans don’t acknowledge these risks, they gained’t resist the Digital Euro. By framing it as “digital money,” the ECB ensures smoother public acceptance with little to no public fuss.

To be clear, money itself is fiat foreign money—centrally managed, simply debased, and susceptible to inflation. Each time the issuer expands the cash provide, residents undergo from declining buying energy, basically being robbed by the state.

“Guidelines for Thee, However Not for Me”

Whereas bizarre residents are sure by the rule of legislation, elites usually evade penalties. A chief instance is Christine Lagarde, who was discovered responsible of negligence for approving an enormous taxpayer-funded payout to controversial French businessman Bernard Tapie. Nevertheless, she prevented a jail sentence. The Guardian reported in 2016: “A French court docket convicted the top of the Worldwide Financial Fund and former authorities minister, who had confronted a €15,000 positive and as much as a 12 months in jail. Nevertheless it determined she shouldn’t be punished, and that the conviction wouldn’t represent a prison report. … The IMF gave her its full assist.”

My Prediction for the EU’s CBDC

Regardless of public disinterest, the ECB (and different central banks) will push ahead with their CBDCs. To take care of the phantasm of public involvement, they’ll conduct surveys and create engagement instruments. However in the end, the Digital Euro might be built-in into current fee strategies and shopper apps—simply as China did with e-CNY. This technique will drive adoption even with out direct public enthusiasm.

We’re, in any case, taking part in the sport of “democracy,” proper?

Geopolitical analyst Alex Krainer lately tweeted in response to Lagarde and von der Leyen’s acceleration of CBDC efforts: “This is good news; Christine Lagarde and Ursula von der Leyen by no means took on one thing they didn’t utterly mess up. I hope they’ll proceed with their glorious efficiency. Godspeed.”

Keep tuned as I proceed to trace central banks’ strikes towards CBDC implementation.

This can be a visitor submit by Efrat Fenigson. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.