The U.S.-listed spot bitcoin

exchange-traded funds (ETFs) recorded $667.4 million in internet inflows on Might 19, the biggest single-day whole since Might 2, signaling renewed institutional curiosity.

Practically half of those inflows, $306 million, went into iShares Bitcoin Belief (IBIT), now at $45.9 billion in internet inflows, in accordance with information supply Farside Traders.

The renewed demand follows bitcoin’s robust value efficiency, having traded above $100,000 for 11 consecutive days, which has helped restore market confidence.

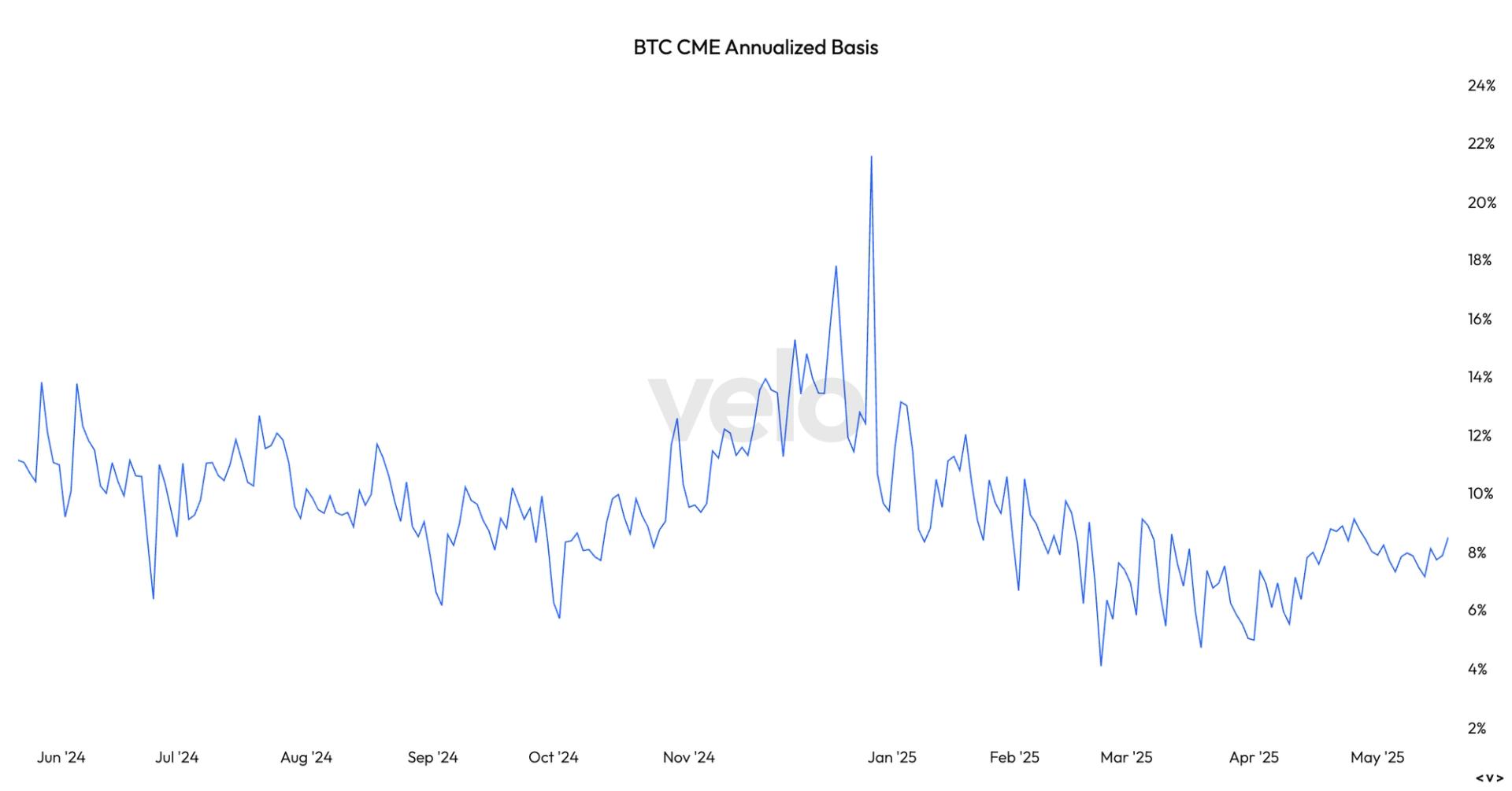

Moreover, the annualized foundation commerce, a technique the place traders go lengthy on the spot ETF and concurrently quick bitcoin futures contracts on the CME, has develop into more and more enticing with yields approaching 9%, nearly double what was seen in April.

In line with Velo information, this has sparked a modest uptick in foundation commerce exercise as evidenced by a rise in buying and selling exercise within the CME futures.

On Monday, CME futures volumes hit $8.4 billion (roughly 80,000 BTC), the very best since April 23. In the meantime, open curiosity stood at 158,000 BTC, up over 30,000 BTC contracts from April’s lows, additional underscoring the rising urge for food for leveraged and arbitrage methods.

That stated, each each futures quantity and open curiosity stay effectively beneath the degrees seen when bitcoin attain an all-time excessive of $109,000 in January, indicating there’s nonetheless important headroom for additional development.

The upswing within the foundation suggests the expansion could also be already taking place, bringing again gamers that left the market early this 12 months when the premise dropped to underneath 5%.

Latest 13F filings revealed that the Wisconsin State Pension Board exited its ETF place within the first quarter, doubtless in response to a then-less favorable foundation commerce setting. Nonetheless, provided that 13F information lags by 1 / 4 and the premise unfold has since widened from 5% to just about 10%, it’s believable that it reentered the market within the second quarter to capitalize on the improved arbitrage alternative.