The US Securities and Trade Fee just lately authorised itemizing choices on BlackRock’s iShares Bitcoin Belief (IBIT) spot ETF. This growth supplies buyers further instruments for hedging or speculating on Bitcoin worth actions. In response to a latest report by CryptoQuant, the approval might enhance liquidity and investor participation within the Bitcoin market, marking an additional step towards broader institutional adoption.

CryptoQuant knowledge exhibits that Bitcoin choices on the Chicago Mercantile Trade (CME) recorded a contemporary excessive open curiosity of almost $500 million on March 12, rising virtually five-fold from their most degree in 2023. Choices might appeal to longer-term buyers into Bitcoin, as possibility merchants on the CME seem to have a longer-term investing horizon in comparison with futures merchants. Whereas most open positions in CME Bitcoin futures have an expiration date of 1 to a few months, choices persistently have many contracts with expirations of 4 or extra months.

In response to CryptoQuant’s report, choices on the IBIT ETF could possibly be a brand new instrument for buyers to generate yield from holding Bitcoin by promoting coated calls. Buyers holding spot Bitcoin can promote name choices and gather premiums, acquiring yield from their holdings in a regulated method. Yields on CME Bitcoin futures at present stand at round 5% annualized for contracts with expirations over six months.

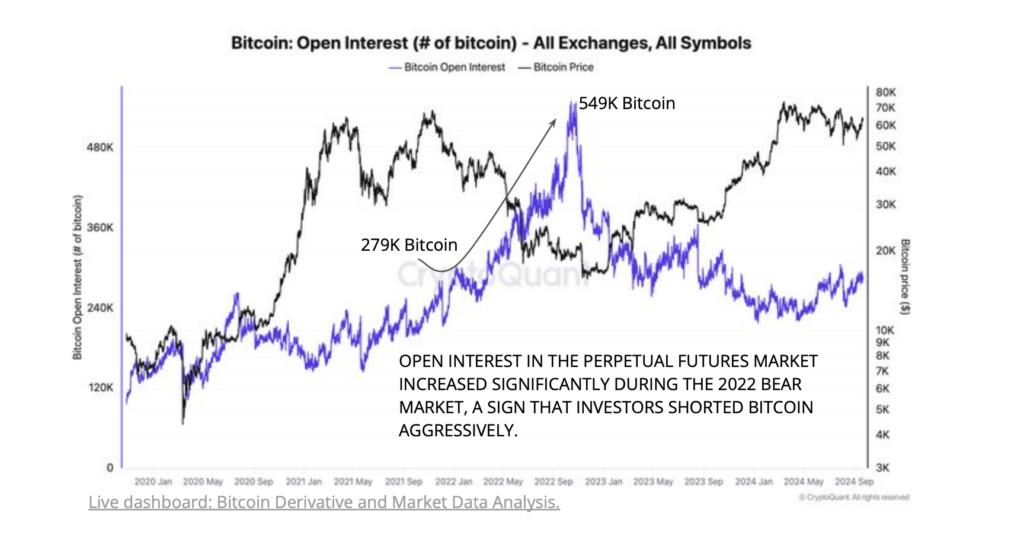

Nonetheless, CryptoQuant states that introducing choices might additionally enhance the “paper” provide of Bitcoin, as buyers can achieve publicity with out transacting within the spot market. This situation has occurred within the perpetual futures market, the place buyers brief Bitcoin throughout bear markets.

It’s value noting that the product nonetheless requires the assist of the Choices Clearing Company (OCC) and the Commodity Futures Buying and selling Fee (CFTC), which haven’t any official approval timeline.