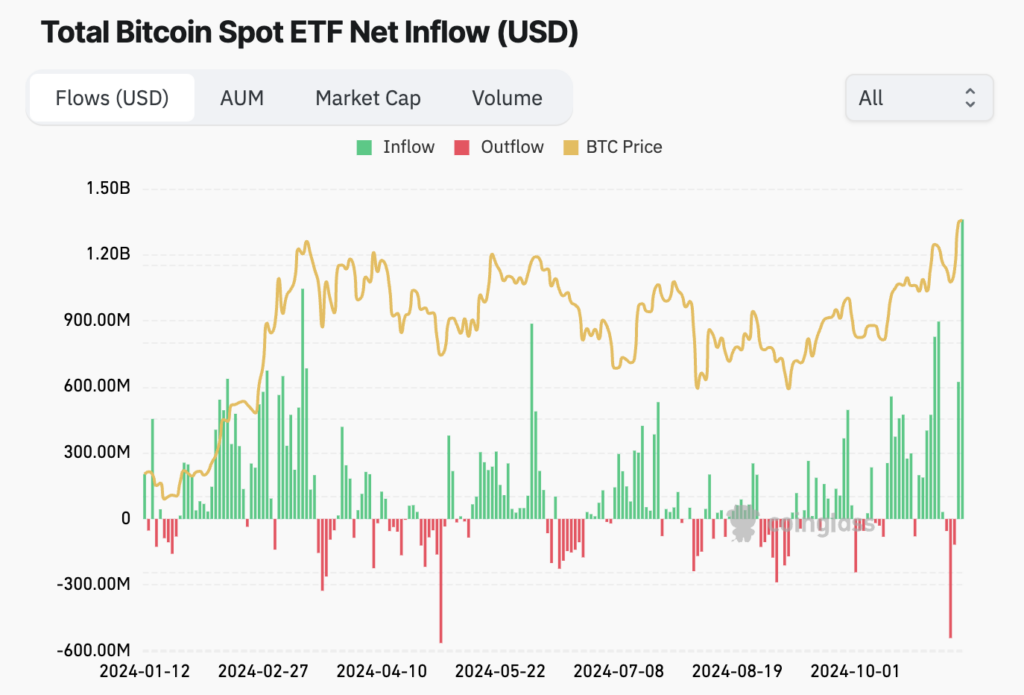

BlackRock’s IBIT recorded a historic influx of $1.12 billion on Nov. 7, surpassing earlier mixed totals for all spot Bitcoin exchange-traded funds. This important capital motion marks the most important single-day influx within the historical past of spot Bitcoin ETFs.

Different main asset managers additionally reported notable inflows. Constancy’s FBTC acquired $190.9 million, whereas Bitwise’s BITB elevated by $13.4 million. Ark’s ARKB gained $17.6 million on the identical day, based on information compiled on Nov. 7. The mixed influx hit $1.37 billion, marking the very best day in spot Bitcoin ETF historical past since they launched in January.

These inflows coincide with Bitcoin breaking the all-time excessive a number of occasions to a peak of $76,900, breaking earlier information twice because the US presidential election on Nov. 5. The surge in Bitcoin’s worth and ETF inflows suggests elevated institutional curiosity following the election outcomes.

The ETF’s unprecedented influx outpaced the earlier mixed complete for all comparable funds, signaling a possible shift in institutional funding methods following Trump’s win.

The submit BlackRock sees historic $1.1 billion influx as spot Bitcoin ETFs have greatest day ever appeared first on CryptoSlate.