Bitcoin has continued its bearish worth motion as on-chain information exhibits the inflows into the cryptocurrency market have seen a pointy decline lately.

Cryptocurrency Capital Inflows Have Seen A Notable Drop Just lately

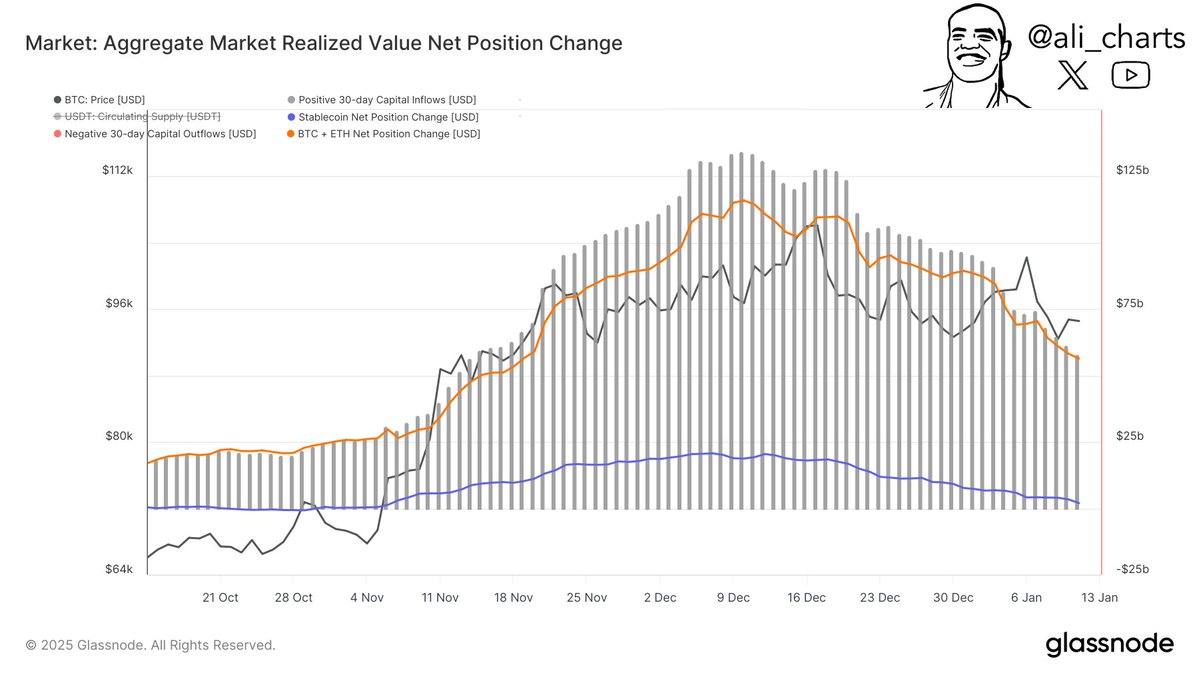

As defined by analyst Ali Martinez in a brand new submit on X, capital inflows for the cryptocurrency sector have slowed down over the previous month. Capital enters (or exits) the digital asset market by primarily three asset lessons: Bitcoin (BTC), Ethereum (ETH), and the stablecoins. It’s solely as soon as that inflows have made it to those cash that they rotate out into the altcoins.

Thus, the flows associated to those belongings could possibly be assumed to characterize the netflows for the cryptocurrency sector as an entire. As for a way the flows might be calculated, the Realized Cap indicator can be utilized within the case of Bitcoin and Ethereum.

The Realized Cap is an on-chain capitalization mannequin that determines the overall worth of any given asset by assuming that the actual worth of any token in circulation is the same as the worth at which it was final transacted on the community.

The final transaction of any coin is prone to be the final level at which it modified palms, so the worth at the moment would denote its present price foundation. Because the Realized Cap sums up this worth for all tokens within the circulating provide, it basically measures the quantity of capital that the traders as an entire have put into the asset.

Bitcoin and Ethereum capital netflows might be equated with the modifications going down on this indicator. For stablecoins, there isn’t any want for this mannequin as their worth is at all times mounted across the $1 mark, so modifications of their mixed market cap function a enough technique for locating capital flows.

Now, right here is the chart shared by the analyst that exhibits the pattern within the 30-day flows associated to the three asset lessons over the previous few months:

As displayed within the above graph, the overall netflows associated to the cryptocurrency sector have been constructive throughout the previous few months, implying {that a} internet quantity of capital has been coming into the assorted belongings.

The 30-day inflows seem to have peaked final month, nevertheless, as they’ve since been following a downward trajectory. On this interval, the metric’s worth has declined from $134 billion to $58 billion, representing a lower of greater than 56%.

“This factors to a big discount in funding exercise,” notes Martinez. The slowdown in capital inflows could possibly be why Bitcoin and different belongings have switched to a bearish trajectory lately.

BTC Value

Bitcoin briefly fell beneath the $91,000 mark earlier within the day, nevertheless it seems the coin has since retraced again above it as its worth is now buying and selling round $91,800.