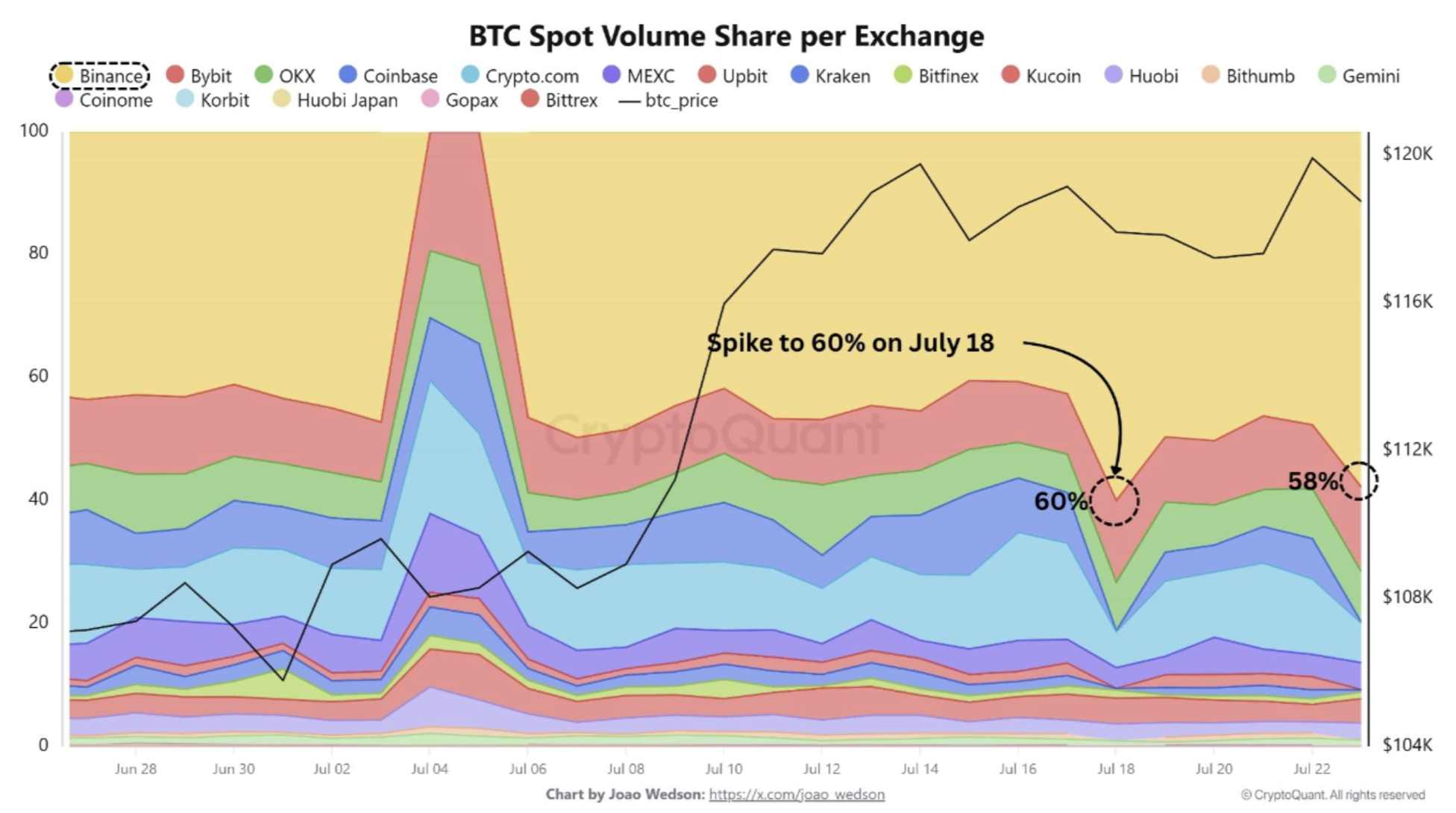

Bitcoin (BTC) could also be on the cusp of one other rally, as main cryptocurrency alternate Binance noticed its spot quantity rise from round 40% on July 15 to as excessive as 60% on July 18. Historic knowledge means that surges in Binance’s spot market share have regularly preceded upward actions in BTC’s worth.

Bitcoin Rally Imminent? Binance Knowledge Suggests So

In line with a CryptoQuant Quicktake submit by contributor Amr Taha, Binance’s spot quantity market share surging to 58% on July 23, has additional strengthened the premier cryptocurrency’s $117,000 help.

Associated Studying

This marks the second notable spike in Binance’s spot market dominance this month. On July 18, Binance’s share surged to 60%, coinciding with Bitcoin holding above the vital $117,000 mark on the every day chart.

Since then, the $117,000 degree has served as a dependable help zone, probably buoyed by Binance’s deep liquidity and excessive execution reliability. Worth stability at this degree has been noticed a number of instances for the reason that preliminary breakout.

Along with this, Bitcoin’s worth has proven robust resilience across the Realized Worth of the 1-day to 1-week Unspent Transaction Output (UTXO) Age Band, which is at the moment close to $118,300.

For context, UTXO age bands classify Bitcoin held in wallets primarily based on how lengthy it has remained unspent, providing perception into investor conduct. Shorter bands – 1 day to 1 week – usually replicate exercise by newer or speculative holders, whereas longer bands – 6 months to five years – are related to long-term holders with stronger conviction. Taha defined:

Traditionally, this metric acts as a dynamic help degree, indicating that newer holders are usually not capitulating and that the common on-chain price foundation of latest patrons is being revered by the market.

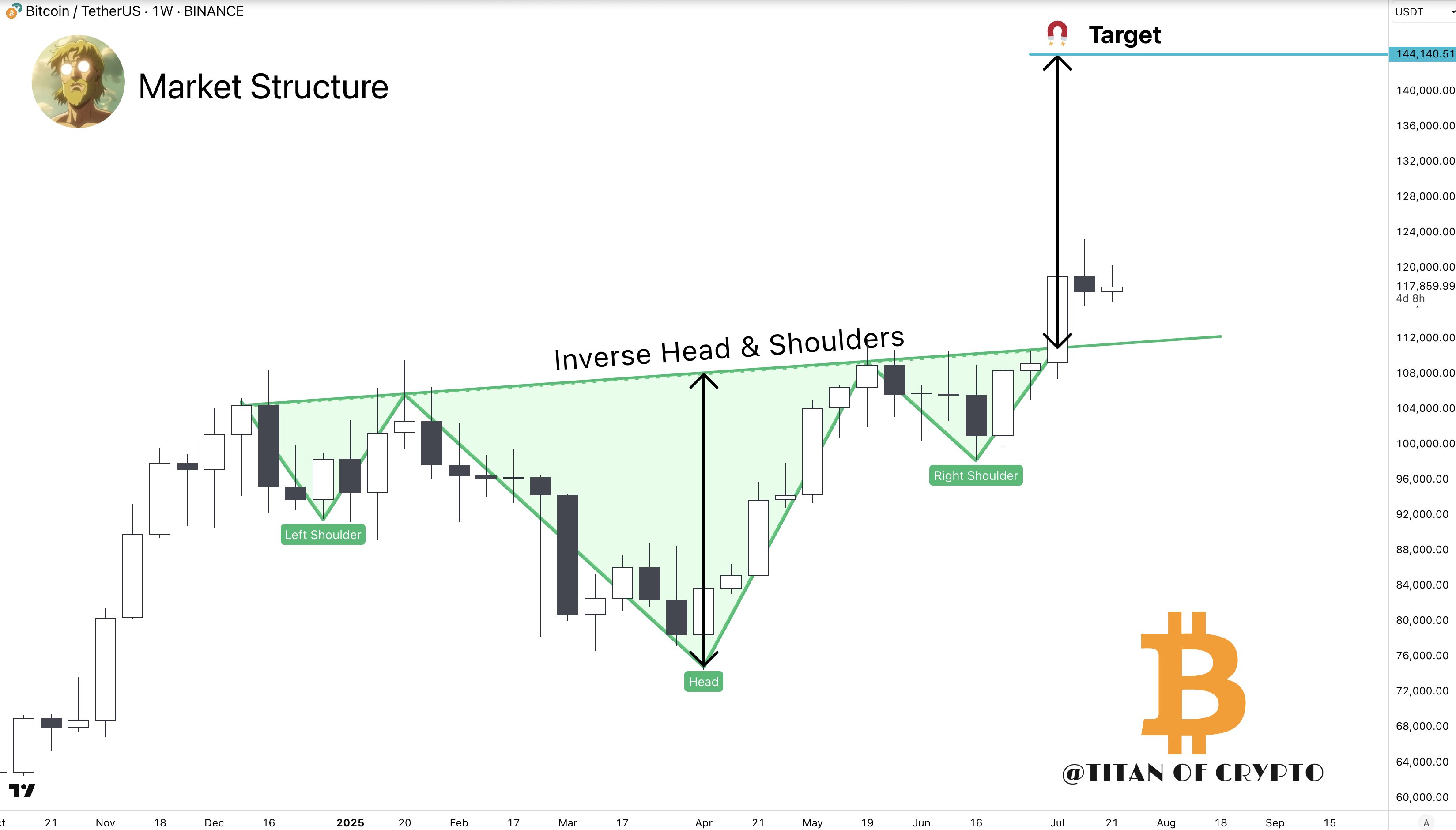

In the meantime, fellow crypto analyst Titan of Crypto took to X to spotlight BTC following the bullish inverse head and shoulders sample. In an X submit, the analyst shared the next weekly chart, including that BTC is on observe to hit a goal of $144,000.

Will BTC Hit $180,000 By 12 months Finish?

Bitcoin’s latest all-time excessive (ATH) of $123,218 has reignited hypothesis round even increased worth targets earlier than 12 months’s finish. In line with CryptoQuant analyst Chairman Lee, BTC stays on observe to achieve $180,000 by the top of 2025.

Associated Studying

Current on-chain metrics help this bullish outlook. Notably, the Bitcoin IFP indicator suggests that main holders proceed to carry BTC regardless of its proximity to file highs – in contrast to in earlier cycles, the place alternate inflows usually preceded important corrections.

Nonetheless, not all indicators level upward. Alternate reserves just lately reached their highest ranges since June 25, elevating considerations about potential promote strain. At press time, BTC is buying and selling at $119,097, up 0.6% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com