In an interview with Scott Melker on August 3, veteran macro analyst Jim Bianco leveled a stark critique of Bitcoin’s trajectory, arguing that the asset has been “co-opted” by the very establishments it was created to withstand. In response to Bianco, Wall Avenue’s embrace of Bitcoin by means of automobiles like ETFs and company treasuries has shifted the community’s goal from disruptive innovation to speculative asset chasing.

Has Wall Avenue Co-Opted Bitcoin?

“Bitcoin is superb,” Melker stated, reflecting on his personal controversial tweet that sparked backlash from Bitcoin maximalists. “Nevertheless it’s clearly been co-opted to a point by the very folks that it was created to [hedge] towards. Lots of the most ardent early whales have seen their religion shaken and have been promoting at these costs.” Bianco responded with out hesitation: “Yeah, it does,” aligning himself with the view that Bitcoin’s unique ethos has been undermined.

“I’ve been an enormous fan of those merchandise as a disruptive power for the monetary market,” Bianco stated, referring to early crypto tasks. “The monetary market and the banking system is in determined want of change and disruption. And I noticed these [crypto assets] as automobiles that might try this.” However that imaginative and prescient, he argues, has been eclipsed by FOMO and “quantity go up” tradition pushed by ETFs, institutional endorsements, and speculative hype cycles.

The institutionalization of Bitcoin—through BlackRock’s ETF, company treasuries like MicroStrategy, and the broader TradFi pivot into digital belongings—has created what Bianco calls a “disincentive to innovation.” Fairly than pushing for cost infrastructure reform or monetary sovereignty, the main focus has turn into worth motion. “I’m simply right here for quantity go up,” he stated mockingly, summing up the prevailing mindset. “I’m not right here to know the place this may slot in, how this may make us a greater monetary system.”

Bianco contrasted Bitcoin’s present position with Ethereum’s evolving utility, expressing a choice for platforms that goal to “turn into a brand new model of a monetary system.” Whereas acknowledging that this view might provoke Bitcoin maximalists, Bianco emphasised Ethereum’s potential to allow structural reform—regardless of being closely influenced in latest months by regulatory tailwinds just like the Genius Act and figures reminiscent of Tom Lee.

Nonetheless, his criticism prolonged past Bitcoin. He argued that the broader crypto area is repeating previous errors, particularly in regard to stablecoins. “This entire dialog we’re having about stablecoins sounds rather a lot like the precise dialog we had been having in 2021,” he stated, cautioning that overhyped narratives typically ignore the technological and regulatory challenges nonetheless unresolved.

And Solana?

He expressed explicit concern that stablecoin infrastructure is veering towards centralization, with tasks like JPMorgan Coin and potential Fed-backed devices masquerading as stablecoins. “That’s a CBDC,” Bianco stated bluntly, warning that this development might intestine the decentralized promise of crypto. “There is not going to be an investable alternative there for the common individual.”

In response to Bianco, even Solana—as soon as touted as an institutional-grade blockchain—has strayed from its mission. “It had the promise of being that competitor to JP Morgan and the Federal Reserve,” he stated. “And it sort of bought misplaced on this memecoin mania.” He famous that Solana’s worth motion now seems to be “the metric of memecoins,” and that its identification has been eclipsed by speculative euphoria—an commentary strengthened by the community internet hosting over 10 million memecoins, a lot of which by no means commerce.

Finally, Bianco’s critique centered on the disconnection between crypto’s acknowledged targets and its market habits. “The Maxis’ argument that all the pieces’s going to zero and you need to have your cash in Bitcoin is demonstrably unsuitable as a result of all the pieces’s at an all-time excessive proper now,” he stated. Bitcoin, in his view, now behaves like “a levered threat asset,” transferring in tandem with fairness markets somewhat than serving as a real hedge or various.

For Bianco, the sign of peak complacency is obvious. “That is a few of the finest investing I’ve ever seen—proper up till the second you’re killed,” he stated, likening the market’s present posture to the notorious High Gun quote. In an atmosphere of frothy valuations, political rate-cut stress, and inflationary fiscal dominance, the unique imaginative and prescient of Bitcoin as an antidote to centralized financial abuse, he suggests, could also be slipping farther from attain.

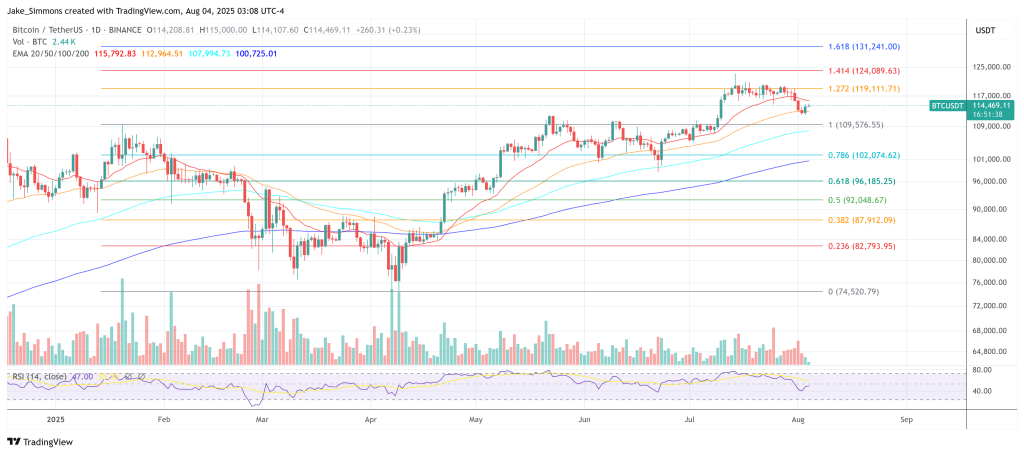

At press time, BTC traded at $114,469.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.