Bitcoin is combating to reclaim the $90,000 degree after a pointy drop earlier at present, including gas to rising fears of a deeper downtrend. Market sentiment has weakened noticeably, with promoting strain intensifying throughout spot and derivatives markets.

Merchants stay cautious as liquidity thins and volatility will increase, creating an setting the place even minor inflows can set off outsized worth reactions. The latest rejection under $90K highlights the fragility of the present construction and raises questions on whether or not Bitcoin is getting into a extra extended corrective part.

Associated Studying

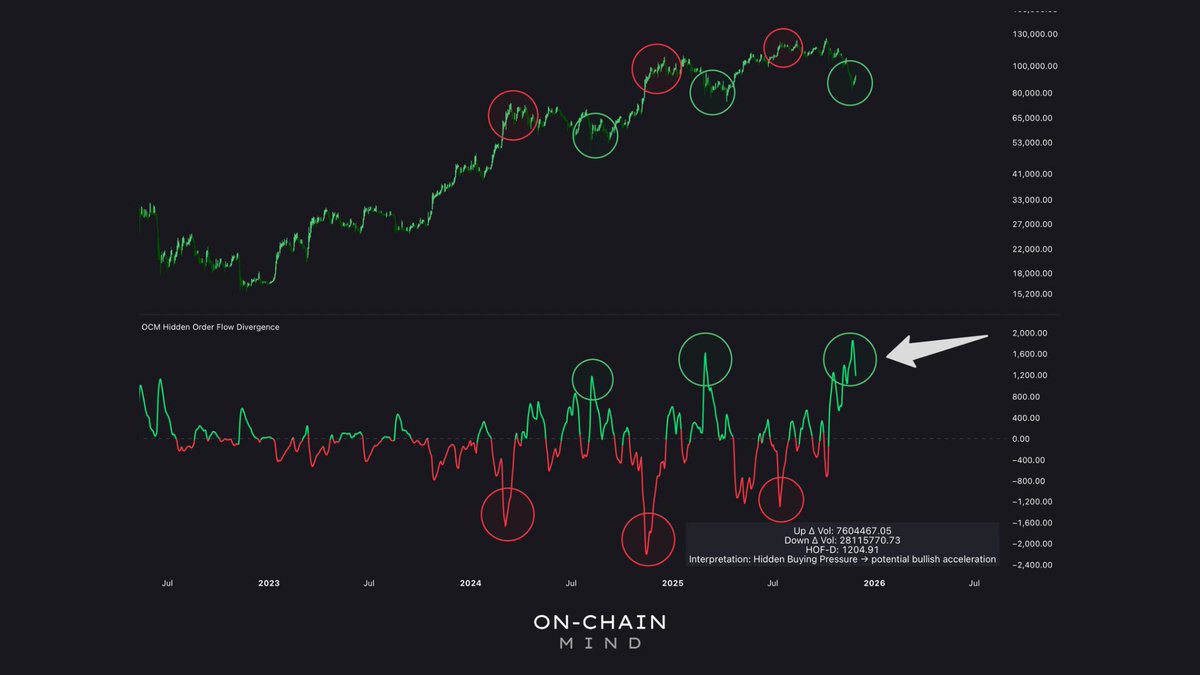

Nevertheless, beneath the floor, on-chain information reveals a placing counter-signal. In accordance with On-Chain Thoughts, Bitcoin is presently printing the biggest hidden-buying spike of your complete cycle. Order stream evaluation tracks the connection between precise purchase/promote strain and the corresponding worth motion. When the 2 don’t align, hidden divergences emerge: optimistic divergences point out aggressive shopping for regardless of muted worth motion, whereas detrimental ones mirror stealth promoting.

The dimensions of this hidden-buying spike suggests a significant imbalance in favor of consumers—an early signal that giant gamers could also be quietly accumulating whereas the broader market focuses on the decline. Whether or not this hidden demand can offset the prevailing promote strain will decide Bitcoin’s subsequent decisive transfer.

Hidden Shopping for Helps Reversal Narrative Regardless of Macro Worry

In accordance with On-Chain Thoughts, the persistent hidden-buying spike stays one of many strongest indicators favoring a future upside reversal. Even after Bitcoin’s most up-to-date drop, the imbalance between actual shopping for strain and worth motion suggests that giant gamers are nonetheless absorbing provide.

Whereas such a sign doesn’t assure a right away rebound—and will take a number of weeks to completely materialize—it signifies that consumers haven’t exhausted their assets. Traditionally, such divergences seem close to cyclical inflection factors, when sentiment is weakest, however accumulation quietly strengthens beneath the floor.

This constructive sign emerges at a time when worry out there is amplified by exterior narratives. Renewed headlines a couple of China Bitcoin ban, regardless of being recycled and missing substantive coverage updates, have resurfaced throughout social media, contributing to confusion and short-term panic. Equally, recent waves of Tether FUD—targeted on reserve transparency and regulatory scrutiny—have pressured liquidity situations and fueled risk-off habits.

Collectively, these storylines have exaggerated bearish sentiment, overshadowing the extra nuanced on-chain developments. Whereas retail reacts to alarming headlines, order stream information means that refined traders are taking the other stance. If hidden accumulation continues, this correction could finally resolve with a stronger restoration than present sentiment implies.

Associated Studying: Bitcoin STH Loss Transfers Fall 80% From Peak – What Comes Subsequent?

Bitcoin Makes an attempt to Stabilize After Sharp Breakdown, however Pattern Stays Fragile

Bitcoin’s 1-day chart displays a market nonetheless beneath heavy corrective strain following the steep decline from the $110,000 area. The breakdown sliced via the 50 SMA and 100 SMA with little resistance, signaling a decisive shift in momentum. Value is now hovering under each shifting averages, which have begun to curve downward—an early signal that the medium-term pattern has weakened. The 200 SMA across the $109,000 zone sits far above the present worth, underscoring how aggressive the correction has been.

After reaching a neighborhood low close to $83,000, BTC has tried to rebound, however the response stays modest. The most recent bounce did not reclaim $90,000 convincingly, forming a decrease excessive that aligns with bearish continuation.

Associated Studying

Quantity spikes throughout sell-offs reinforce the dominance of sellers, whereas shopping for exercise stays comparatively muted. Till BTC can flip the 50 and 100 SMAs again into help—now clustered round $101,000–$108,000—bulls will wrestle to regain management.

The chart additionally reveals rising distance between worth and the 200 SMA, a situation that usually precedes non permanent aid rallies. Nevertheless, except Bitcoin closes again above the $95,000–$98,000 area, draw back dangers persist. For now, BTC is making an attempt to stabilize, however the broader pattern continues to favor warning.

Featured picture from ChatGPT, chart from TradingView.com