As Bitcoin (BTC) continues to submit new all-time highs (ATH), reaching as a lot as $118,869 on Binance, market indicators present little signal of overheating. The shortage of retail-driven hype amid BTC’s record-breaking run suggests there should still be room for additional development within the flagship cryptocurrency.

Bitcoin ATH Sees Absence Of Hype

In keeping with a latest CryptoQuant Quicktake submit by contributor burakkemeci, Bitcoin’s present rally is notably characterised by the absence of retail buyers. The contributor argues that this lack of retail participation implies BTC should still have important upside potential.

Associated Studying

The evaluation facilities on the Spot Retail Exercise Via Buying and selling Frequency Surge metric, which tracks the frequency of retail buying and selling exercise within the Bitcoin spot market. The analyst shared the next chart as an instance the development.

When retail buying and selling exercise rises considerably in comparison with the one-year shifting common (MA), the chart varieties bubbles. Inexperienced bubbles point out that there are only a few retail buyers at present out there.

Orange bubbles present that buying and selling exercise amongst retail buyers is choosing up. Equally, crimson bubbles point out warning, hinting that there are too many retail buyers out there and that it might be a great time to think about exit methods.

Because the under chart reveals, retail exercise stays subdued – at the same time as BTC continues to achieve new ATHs. In reality, the metric has stayed throughout the grey zone since March 2024, reflecting an absence of mass retail entry.

Traditionally, retail buying and selling tends to surge as BTC approaches or exceeds ATH ranges. The analyst notes that this absence could point out the cycle high remains to be forward:

The bull market remains to be largely pushed by establishments and exchange-traded funds (ETFs). When retail lastly enters the scene, which may mark the start of the ultimate part.

BTC Witnessing Subdued Promoting Strain

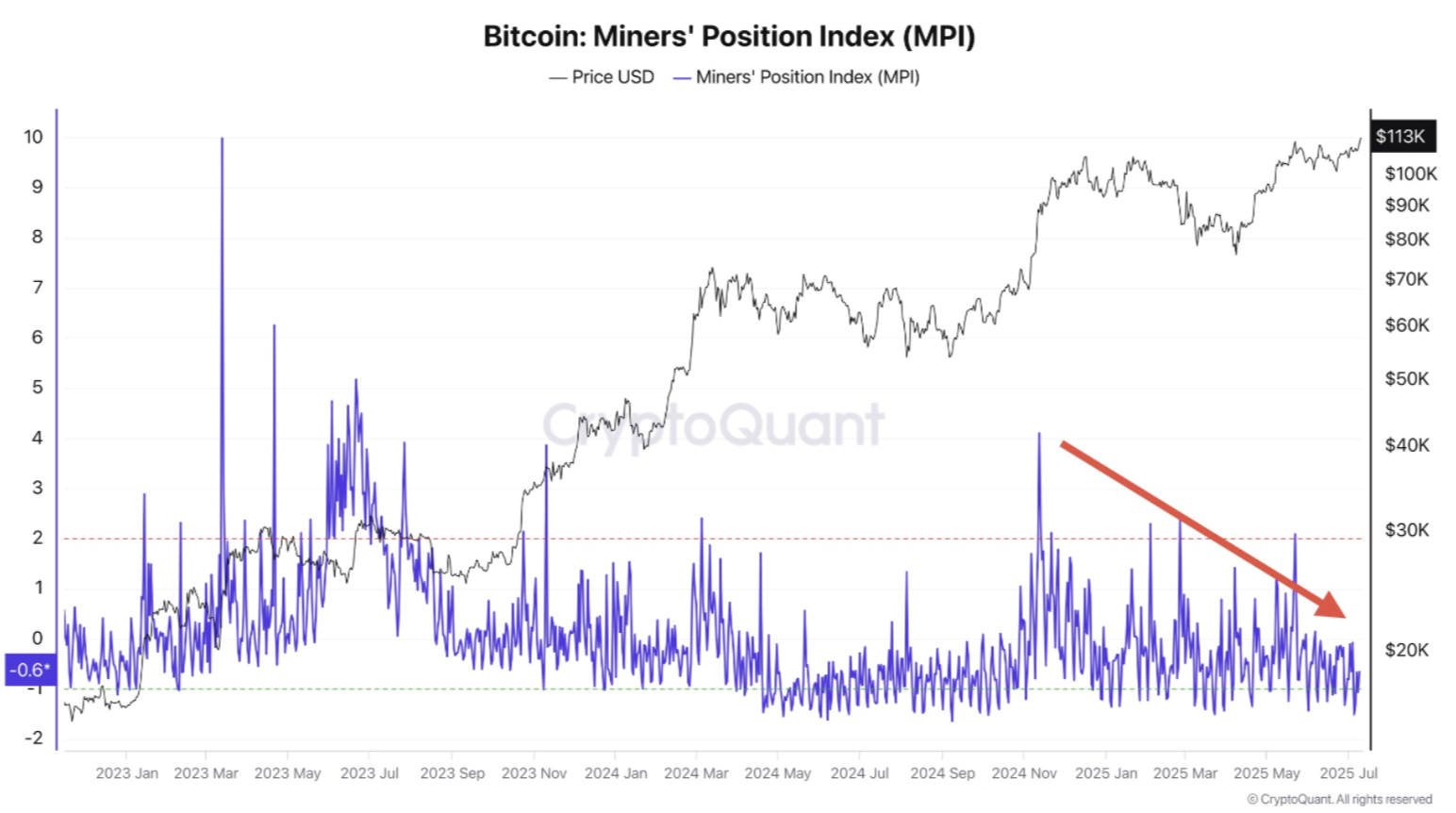

Along with the low retail presence, different on-chain indicators counsel that Bitcoin’s present rally shouldn’t be overheating. For instance, the Miner Place Index has been declining since November 2024, implying lowered promoting strain from miners.

One other key metric, the Market Worth to Realized Worth (MVRV) ratio, is holding regular round 2.2 – under the two.7 ranges noticed throughout ATHs in March and December 2024. Latest evaluation predicts the subsequent important resistance could emerge at round $130,900.

Associated Studying

Regardless of weak promoting strain and restricted retail exercise, some latest trade developments trace at the potential for a short-term pullback. On the time of writing, BTC is buying and selling at $117,746, up a powerful 6% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com