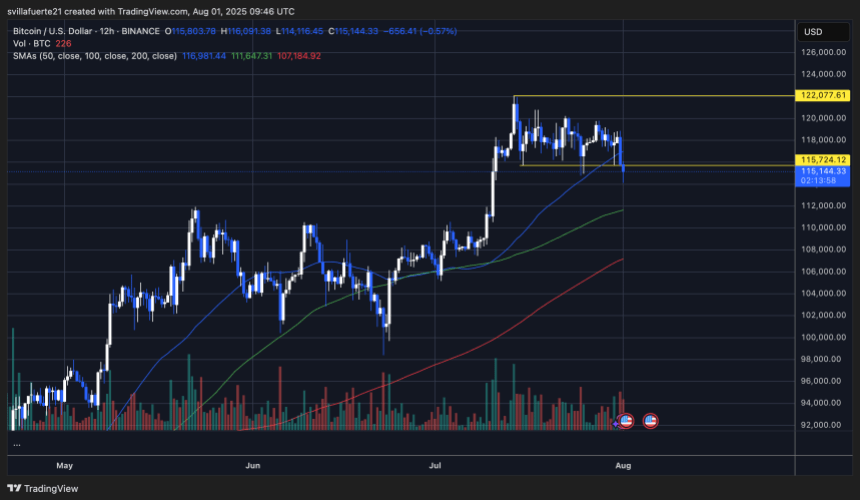

Bitcoin has damaged down from the two-week consolidation vary that held the market between $115,724 and $122,077, reaching a brand new native low close to $114,000. The drop confirms a shift in short-term momentum, placing bulls on the defensive. The $117,000 degree—beforehand a key assist zone—now serves because the instant resistance that should be reclaimed to sign a potential reversal.

Associated Studying

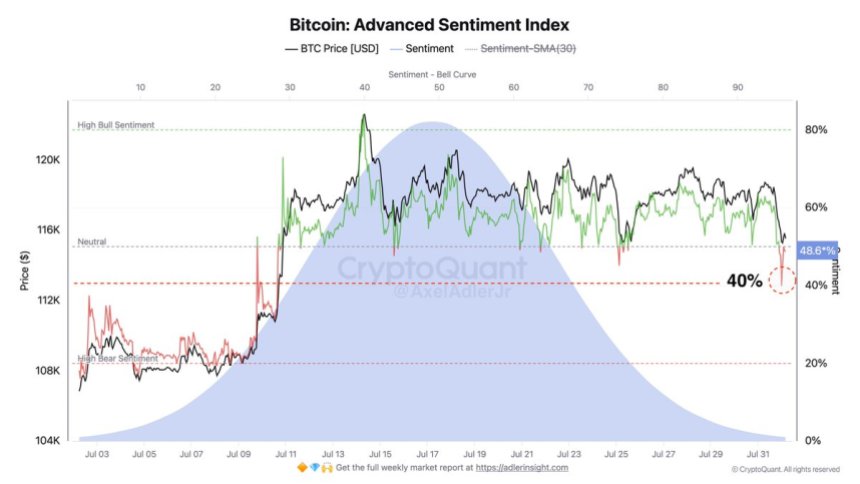

The breakdown comes at a crucial time, as sentiment throughout the market begins to shift. Based on recent information from CryptoQuant, futures sentiment turned bearish immediately, falling sharply earlier than bouncing again barely to 48%. Whereas nonetheless near impartial, any studying under 50% alerts bearish dominance in positioning. This provides strain to an already fragile technical construction and suggests merchants are bracing for extra draw back.

Except bulls can get better $117K shortly and shut with power, Bitcoin dangers getting into a deeper correction part. With long-term assist ranges nonetheless intact, the broader bull development stays in place—however this breakdown marks the primary vital lack of momentum in weeks. The approaching periods will probably be crucial in figuring out whether or not that is only a shakeout or the beginning of a bigger development reversal.

Bitcoin Superior Sentiment Index Alerts Rising Bearish Stress

High analyst Axel Adler has shared new insights into the Bitcoin Superior Sentiment Index, a key metric used to gauge futures market positioning and broader investor temper. Based on Adler, the index lately dropped to 40%—a pointy decline that mirrored rising threat aversion and bearish positioning. Though the metric has since rebounded to 48%, it stays under the crucial 50% threshold, which separates bullish from bearish territory.

This rebound alerts a short lived pause in damaging sentiment, however the broader development reveals a shift from bullish warning to bearish worry. Adler notes that so long as the index stays under 50%, the market lacks the arrogance wanted to maintain upward momentum. Merchants are rising more and more defensive, decreasing lengthy publicity and bracing for additional draw back.

If momentum continues to deteriorate, BTC may take a look at the $112,000 degree—the earlier all-time excessive set in Could. This zone could act as psychological and technical assist, however failure to carry it may set off a deeper correction.

With the Superior Sentiment Index caught in bearish territory and value motion weakening, the market seems to be getting into a riskier part. Whereas this doesn’t but sign a full development reversal, it does mirror rising uncertainty. Till sentiment and value reclaim larger floor, warning is warranted. The following transfer will possible rely upon whether or not bulls can defend $112K—or if bears acquire full management of the development.

Associated Studying

BTC Loses Key Assist After Breakdown

Bitcoin has formally damaged down from its two-week consolidation vary, dropping the crucial $115,724 assist degree highlighted within the chart. The value reached a brand new native low at $114,116 earlier than recovering barely to the $115,100 zone, the place it’s presently searching for footing. This marks a big shift in momentum, as bulls didn’t defend the decrease boundary of the vary, which held agency all through July.

The 12-hour chart reveals rising quantity accompanying this breakdown, including weight to the bearish transfer. BTC now trades under the 50-day SMA ($116,981), confirming weak spot in short-term construction. The following main assist sits round $112,000—the prior all-time excessive set in Could—which may act as a psychological and technical flooring.

Associated Studying

The 100-day and 200-day SMAs stay nicely under present value motion, suggesting that the macro development remains to be intact. Nevertheless, instant momentum has clearly shifted, and bulls should reclaim the $117,000 space shortly to invalidate this breakdown.

Featured picture from Dall-E, chart from TradingView