Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

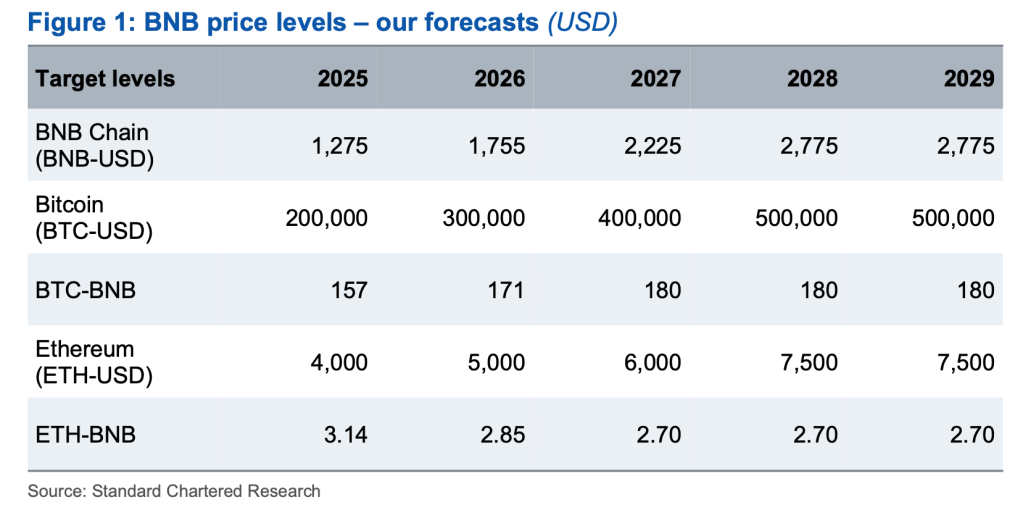

Customary Chartered has initiated formal protection of Binance’s change token, BNB, and set out one of many trade’s most detailed long-term trajectories for the asset. In a analysis word shared with The Block, Geoffrey Kendrick, the financial institution’s international head of digital-asset analysis, argues that the token value might speed up from roughly $600 immediately to $1,275 by 2025 and $2,775 by 2028, earlier than “plateauing” by means of 2029.

BNB May Spike By 360%

The trail implies a achieve of greater than 360% from present ranges and, crucially, situates the token in what Kendrick calls “a benchmark-like position” inside the broader crypto capital construction. “BNB has traded nearly precisely in step with an unweighted basket of Bitcoin and Ethereum since Could 2021 by way of each returns and volatility,” Kendrick wrote. “We count on this relationship to proceed to carry, driving the worth from round $600 presently to $2,775 by end-2028.”

Associated Studying

Customary Chartered’s broader outlook is unabashedly bullish on the majors: Bitcoin is projected to succeed in $200,000 in 2025 and $500,000 in 2028, whereas Ethereum is pencilled in at $4,000 and $7,500 over the identical horizons. When these forecasts are translated into cross-asset ratios, they reveal refined shifts in market share.

The BTC-BNB ratio—what number of BNB one Bitcoin can purchase—is anticipated to tick up from 157 in 2025 to 180 by 2027, then maintain regular, implying that Bitcoin’s greenback appreciation is prone to outrun BNB’s. In contrast, the ETH-BNB ratio is seen slipping from 3.14 in 2025 to 2.70 in 2027, signalling that Ethereum might outperform BNB, however extra gently than Bitcoin will.

Kendrick acknowledges that BNB “might underperform Bitcoin and Ether each in actual phrases and as measured by market cap in circulation,” but he contends that its deflationary tokenomics and deep linkage to the world’s largest centralized change “assist its long-term worth.”

The analysis word scrutinises BNB Chain’s structure. Its “proof-of-staked authority” mannequin rotates simply 45 validators each 24 hours—a pointy distinction to Ethereum’s million-plus validator set. Kendrick describes BNB Chain as “extremely centralised relative to different chains,” including that its developer exercise has “stagnated” for the reason that 2021 DeFi surge and now trails networks corresponding to Avalanche and Ethereum.

Associated Studying

Even so, forthcoming technical milestones are anticipated to develop the ecosystem’s resilience. Kendrick cites the just lately accomplished Pascal exhausting fork and the looming Maxwell improve, due in June, as examples of “incremental however significant” incentives for builders.

On the demand facet, the token’s fortunes stay tethered to Binance’s buying and selling engine. Holders obtain tiered charge reductions calculated on their token stability and 30-day quantity—a mechanically enforced use-case that has to date “helped the BNB Chain retain exercise whilst competitors from different ecosystems like Solana grows,” Kendrick notes. PancakeSwap, the dominant decentralised change on BNB Chain, amplifies that liquidity loop.

In the meantime, common token burns, coupled with the fixed-limit provide, underpin a structural deflation that Customary Chartered says justifies the premium BNB instructions on its market-cap-to-GDP valuation display—presently “wealthy” by the financial institution’s most well-liked metric.

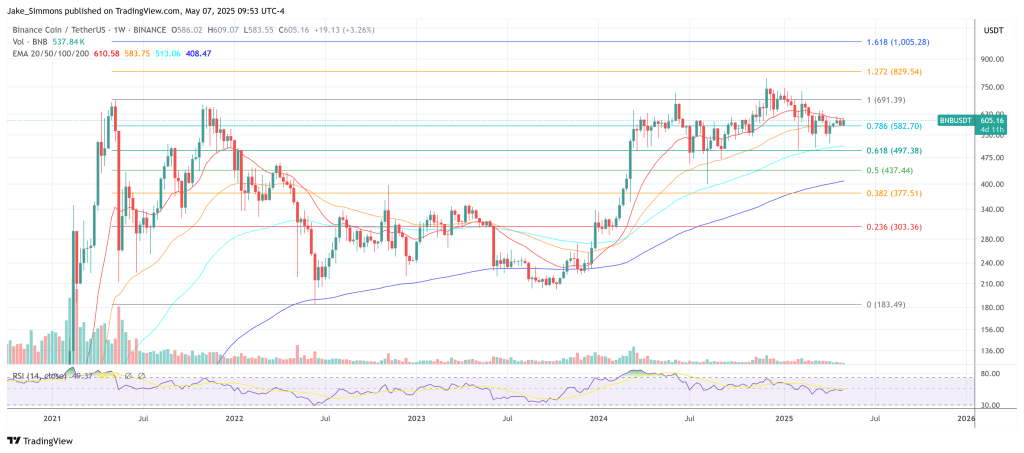

At press time, BNB traded at $605.

Featured picture created with DALL.E, chart from TradingView.com