Bitcoin is buying and selling for $59,545, a slight improve of 0.5% prior to now 24 hours. Though little, this surge in its worth is sort of noteworthy because it comes towards the backdrop of Bitcoin’s worth plunging as little as $57,812 earlier immediately.

No matter this modest restoration, a latest evaluation by a CryptoQuant creator on the CryptoQuant QuickTake platform has revealed that Bitcoin may now be approaching a precarious place.

Bears At The Gates? Analyzing BTC’s Weak Stance

In line with the CryptoQuant analyst Grizzly, Bitcoin’s Internet Unrealized Revenue/Loss (NUPL) metric—a software used to gauge the market’s revenue or loss standing by evaluating unrealized revenue and loss—hovers close to a pivotal threshold—0.4 stage.

Grizzly disclosed that this stage traditionally acts as an important juncture, both as help that reinforces the market’s spirits or as a resistance that spells a downturn.

Will the bears seize management of the market?

“The NUPL metric is at the moment positioned close to a crucial stage. Traditionally, the 0.4 stage has served as a major level of help and resistance.” – By @GrizzlyBTClover

Learn extra https://t.co/Q0Nuwu6Xz8 pic.twitter.com/sePvAvWg44

— CryptoQuant.com (@cryptoquant_com) August 15, 2024

Present information means that Bitcoin is teetering near this stage, and a dip beneath might firmly hand the reins over to the bears, doubtlessly dragging the market right into a bearish section.

In line with Grizzly, the implications of such a transfer might see Bitcoin’s worth retract to as little as $40,000, a serious decline from its present market costs. The analyst notably famous:

Knowledge exhibits {that a} breach beneath this [0.4] stage typically marks the onset of a considerable downward pattern. If the index continues its downward motion, it’s affordable to anticipate that the bears might take full management of the market. In such a state of affairs, the worth might drop to round $40,000.

In the meantime, regardless of these ominous indicators, it’s value approaching the revealed information with a balanced perspective. Grizzly identified that the present decline in Bitcoin’s worth whereas regarding, has not but escalated to a stage that conclusively indicators the tip of its bullish trajectory.

Historic information helps cautious optimism, as earlier situations have proven that Bitcoin can rebound from related positions, defying bearish expectations and sustaining its upward pattern.

Bullish Take On Bitcoin

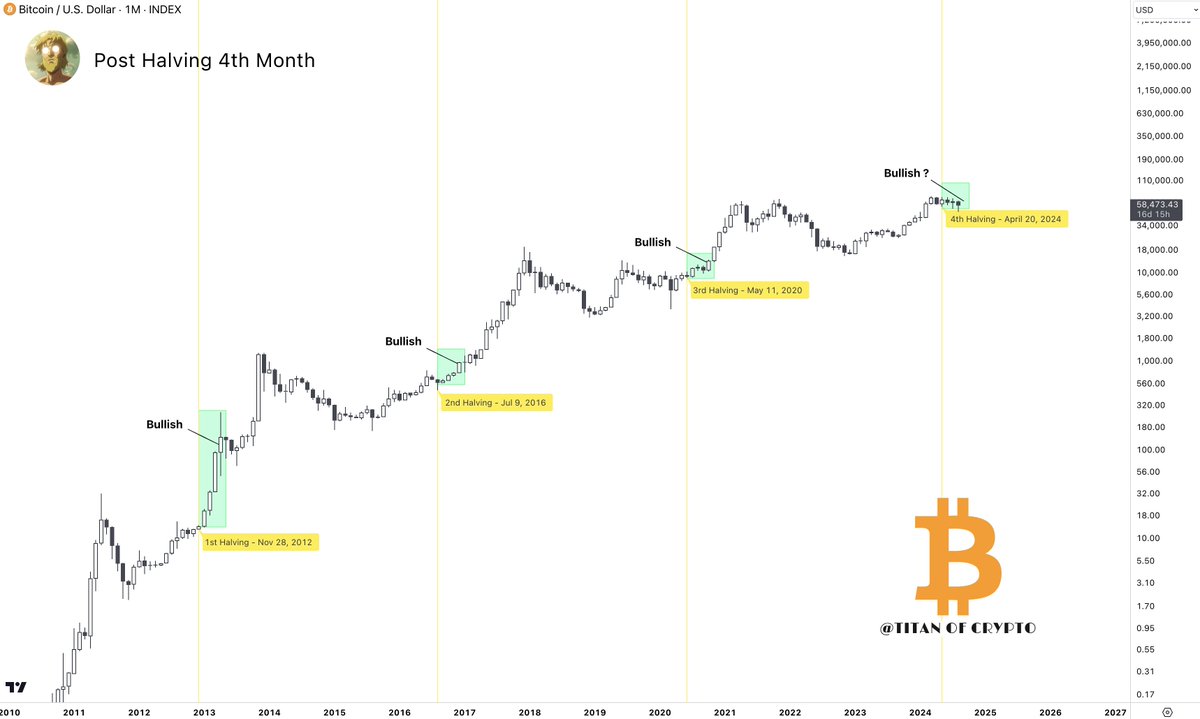

On the flip aspect, historic information may additionally recommend a potential rebound for Bitcoin. Earlier immediately, a famend analyst within the crypto area often called Titan of Crypto on X disclosed an attention-grabbing recurring pattern in Bitcoin.

In line with Titan of Crypto, “traditionally, the 4th month after the halving has at all times been bullish for BTC, closing above the halving worth.” The analyst added: “If this sample repeats, September may very well be a bullish month above $66,000.”

Featured picture created with DALL-E, Chart from TradingView