President Donald Trump’s marketing campaign to chop Democrats out of U.S. regulatory work has arrange an uncommon state of affairs on the two companies that can have essentially the most say over how the federal authorities handles crypto: A handful of Republican crypto advocates are fully in control of each.

The U.S. Securities and Trade Fee simply mentioned farewell to its solely Democratic commissioner, Caroline Crenshaw, final week, eradicating routine opposition to its present coverage drives. Crenshaw had usually cautioned the company about its shift towards a digital asset embrace, together with opposing bitcoin exchange-traded funds (ETF) as a hazard to buyers. She took a consumer-protection stance that commonly prolonged to those that put money into crypto.

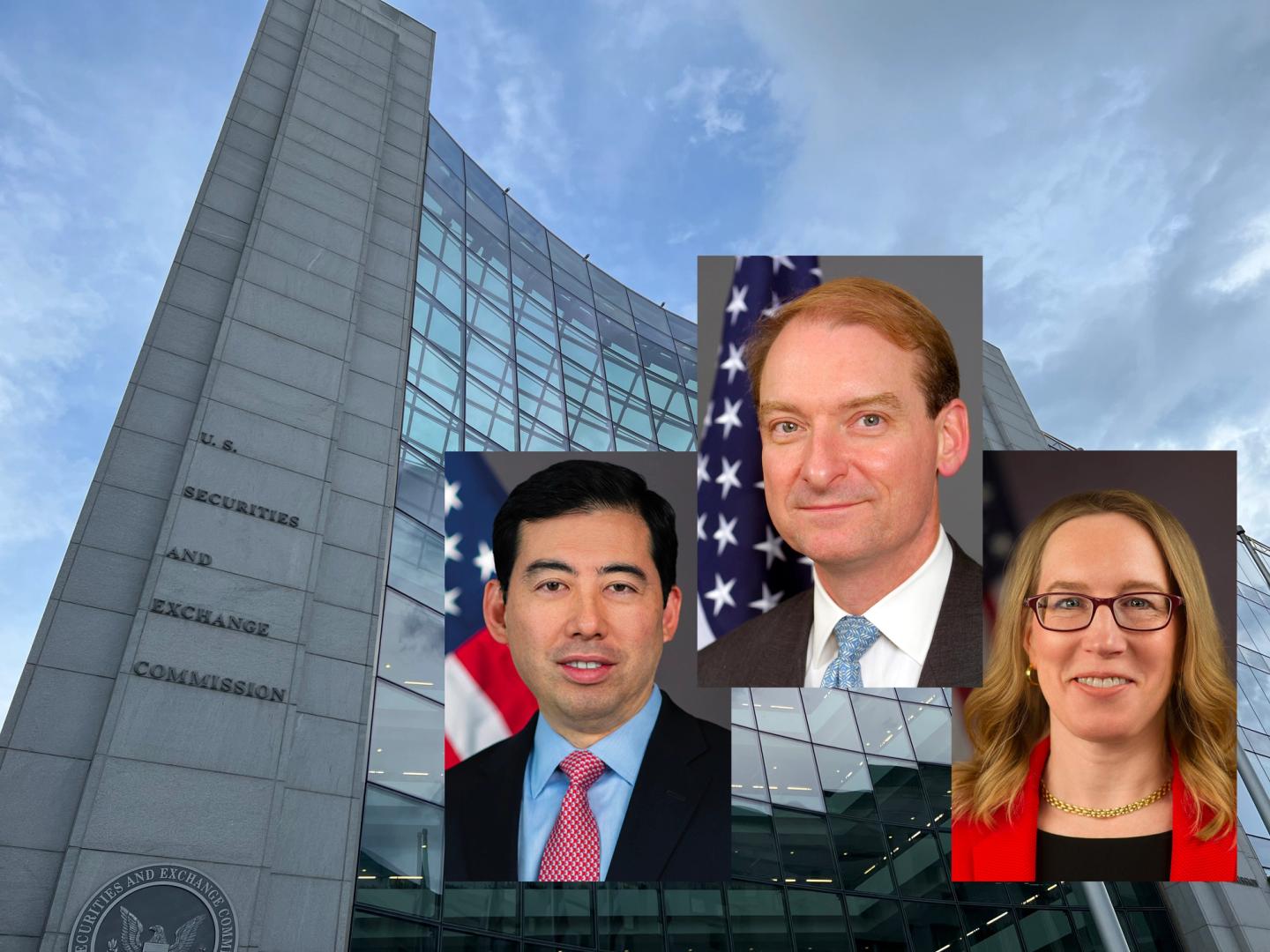

“I feel it’s protected to say they’re speculating, reacting to hysteria from promoters, feeding a need to gamble, wash buying and selling to push up costs, or as one Nobel laureate has posited — betting on the recognition of the politicians who help, or stand to profit personally from, the success of crypto,” Crenshaw had mentioned in a speech final month. Whether or not or not such vocal opposition contained in the company has an impact on the regulatory course of the SEC, it is over now, and the regulator is run by Trump nominee Chairman Paul Atkins and two commissioners who’d superior crypto pursuits, Hester Peirce and Mark Uyeda.

At its sister company, the Commodity Futures Buying and selling Fee, the brand new 12 months begins with a brand new chief, as Trump nominee Mike Selig received the affirmation late final month to be sworn in as chairman on Dec. 22. Appearing Chairman Caroline Pham took the chance to exit for an {industry} job at MoonPay, leaving Selig alone within the five-member fee.

Whereas that could be a superb state of affairs for crypto-friendly coverage, as Selig advances into his not-yet-outlined agenda with no need enter or debate from fellow commissioners, the absence of a bipartisan slate of commissioners on the CFTC and SEC has change into a sticking level for crypto laws within the U.S. Senate.

One of many remaining factors of debate over the invoice that might set up a U.S. crypto regulatory regime is the Democrats’ demand that their social gathering’s vacancies be stuffed on the two companies. It is unclear how a lot Republicans are ready to offer on that. For his half, Trump has been lower than illuminating.

When requested just lately whether or not he’d be keen to make Democratic nominations, he answered with a query, “Do you assume they’d be appointing Republicans if it had been as much as them?”

The historic reply is that presidents of each events have routinely made nominations from each, usually in package deal offers negotiated in Congress that end in a number of confirmations without delay.

“There are specific areas we do take a look at, and sure areas that we do share energy, and I’m open to that,” Trump concluded, leaving the matter in unsure waters.

Each company chiefs have been cautious to not rhetorically run afoul of Trump’s desire to not enable new Democrats into regulatory roles, with new CFTC chief Selig saying in his affirmation testimony that he’d welcome bipartisan enter on the company however that it is out of his palms.

Atkins famous at Crenshaw’s departure that she had “listened fastidiously, engaged substantively and approached on daily basis with the aim of safeguarding buyers and strengthening our markets.”

For now, each the SEC and CFTC have been racing ahead on crypto coverage. Within the last weeks of Pham’s interim chairmanship, she pushed a number of insurance policies, set in movement the buying and selling of leveraged spot crypto at CFTC-registered platform Bitnomial and established a panel of CEO advisers. And Atkins has referred to as digital property the highest coverage precedence at his company, which has deserted crypto enforcement actions and issued a collection of coverage statements to make clear its pro-industry digital property stance in such numerous areas as mining, memecoins, staking and custody.

Each Republican-led companies have made it clear that they intend to pursue crypto guidelines with or with out enter from the legislation that Congress is engaged on.

If Congress does handle to cross the crypto market construction invoice and the brand new legislation directs the companies towards an inventory of latest guidelines and duties, writing these everlasting laws would presently be within the palms of solely Republican commissioners.

Learn Extra: Most Influential: Paul Atkins