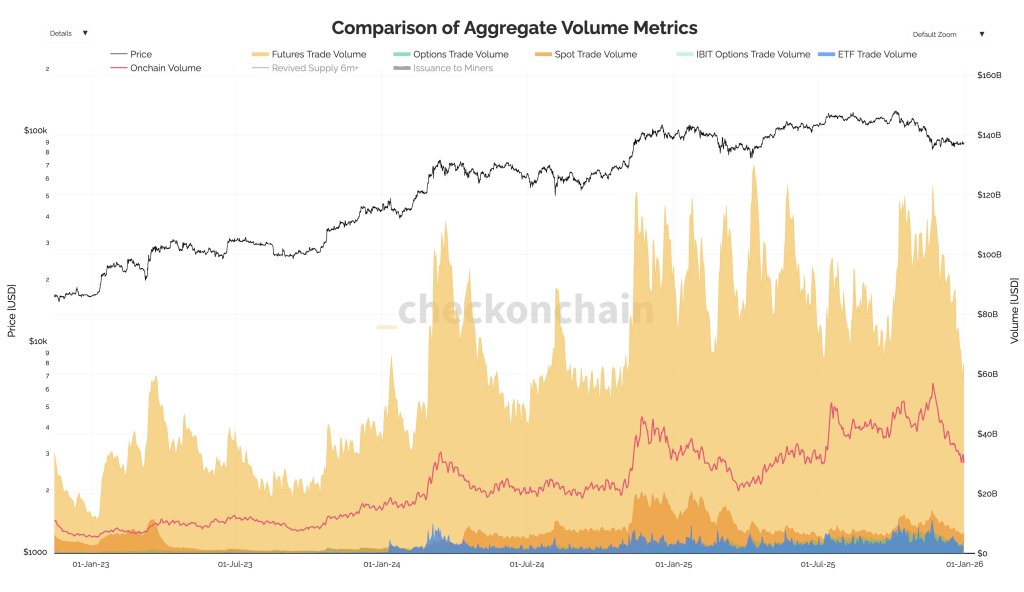

Bitcoin’s current incapability to flee a good buying and selling vary might have much less to do with spot Bitcoin ETF flows than many headlines recommend, and extra to do with the derivatives complicated nonetheless doing many of the heavy lifting, at the same time as futures exercise cools.

That’s the core argument from CryptoQuant analyst Darkfost (@Darkfost_Coc), who stated Bitcoin futures volumes have been “lower in half since November 22,” dropping from $123 billion in every day quantity to $63 billion.

Futures, Not ETFs, Are Holding Bitcoin In Place

The slowdown, he added, “partly explains the low volatility noticed on BTC in current weeks.” However the greater level is relative scale: at $63 billion per day, futures nonetheless symbolize “practically 20 instances the quantity of spot Bitcoin ETFs ($3.4B) and about 10 instances spot market volumes ($6B),” in line with the analyst.

In different phrases, even when ETF outflows are actual and visual, they will not be the dominant marginal power setting the tone. “Many proceed to level to ETFs, which have skilled important outflows in current weeks,” Darkfost wrote. “Whereas these outflows do contribute to promoting stress, futures markets clearly stay the dominant power in total volumes.”

Associated Studying

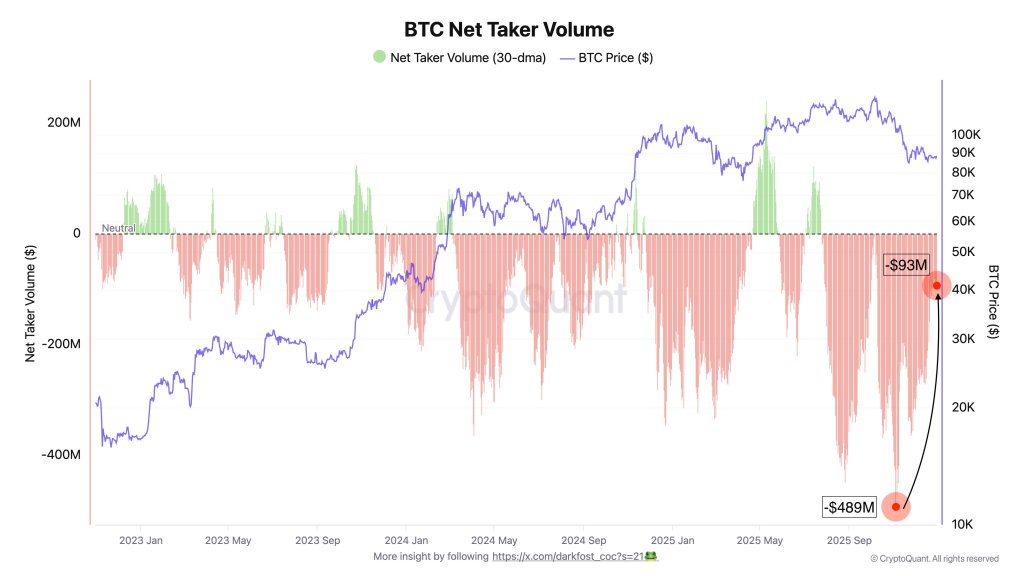

Darkfost pointed to web taker quantity, a derivatives metric used to deduce whether or not aggressive shopping for or promoting is dominating, as a cleaner learn on why value has struggled to pattern. He framed it in conditional phrases primarily based on prior market habits: “Every time web taker quantity has turned unfavourable, Bitcoin has entered a corrective section. When this indicator strikes into unfavourable territory, promoting quantity dominates.”

In his telling, the market has been dwelling with that bias for months. Since July, web taker quantity has “usually remained unfavourable,” he stated, with one notable interruption: “A noticeable slowdown occurred in early October, permitting Bitcoin to set a brand new all time excessive, however promoting stress rapidly regained management. Right this moment, promoting volumes proceed to dominate and have saved Bitcoin trapped in a spread for a couple of month.”

There’s, nevertheless, a tentative enchancment in the identical dataset. Darkfost stated futures-driven promoting stress has declined since early November, with web taker quantity enhancing from round -$489 million to -$93 million. He described that as “a optimistic sign,” however not but sufficient to vary the regime. “Liquidity stays weak,” he wrote, including that ETF and spot volumes are “nonetheless too restricted to permit BTC to interrupt out of its present consolidation section.”

Demand Is Key

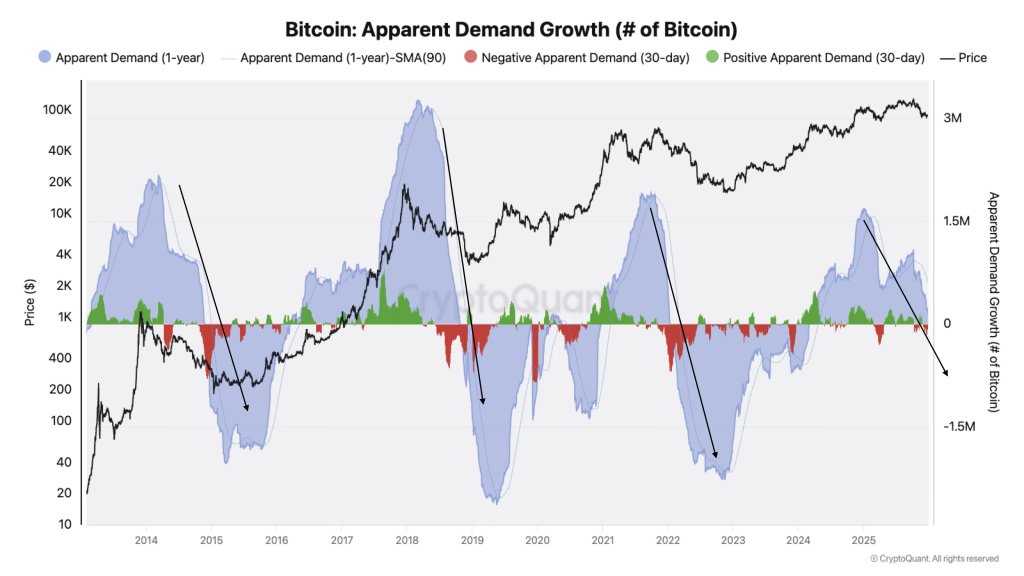

In a separate X submit, CryptoQuant’s Head of Analysis Julio Moreno added a broader framing that shifts consideration away from chart-based cycle narratives and towards demand dynamics. “Most are specializing in value efficiency to outline a cycle, when it’s demand what they need to be trying to,” Moreno wrote. “Bitcoin demand is contracting on month-to-month phrases and slowing down considerably on an annual foundation (and about to get into unfavourable territory).”

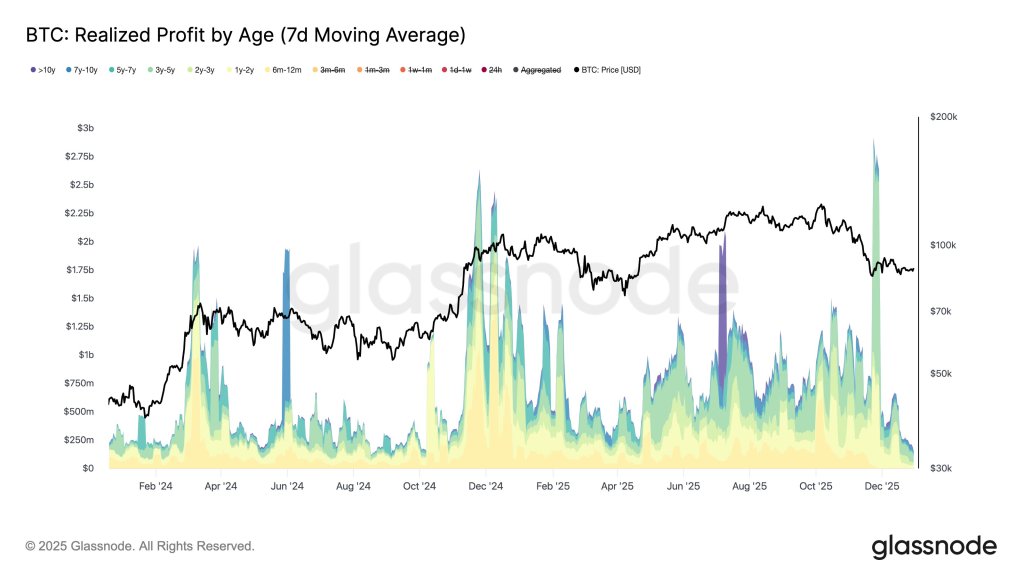

Alongside the futures-driven rationalization for Bitcoin’s stall, the promoting stress from long-term holders (LTHs) emerged in current weeks as the primary driver for Bitcoin lagging efficiency towards the inventory market and gold. As reported yesterday, the long-term holder promoting appeared to have stopped, in line with a number of on-chain commentators, with round 10,700 BTC transitioning into long run held cash.

Associated Studying

In his newest submit, main Glassnode analyst CryptoVizArt argued the change is extra about tempo than path. “LTHs didn’t cease promoting,” the analyst wrote, claiming LTHs “are nonetheless spending ~7.3k BTC/day (7D SMA) and nonetheless realizing <$200M/day in revenue. What modified is the speed, not the habits. It is a cooldown after months of heavy distribution, not a flip to pure accumulation.”

Darkfost didn’t dispute that LTHs might be persistent sellers, however he emphasised a unique lens. “LTHs by no means actually cease promoting in actuality, however once we take a look at provide change, it offers a unique image,” he wrote. “It seems that their distribution has come to an finish for now, which means the quantity of BTC maturing and transitioning into LTH standing equals the BTC being offered by LTHs (STH shopping for).”

At press time, BTC traded at $87,972.

Featured picture created with DALL.E, chart from TradingView.com