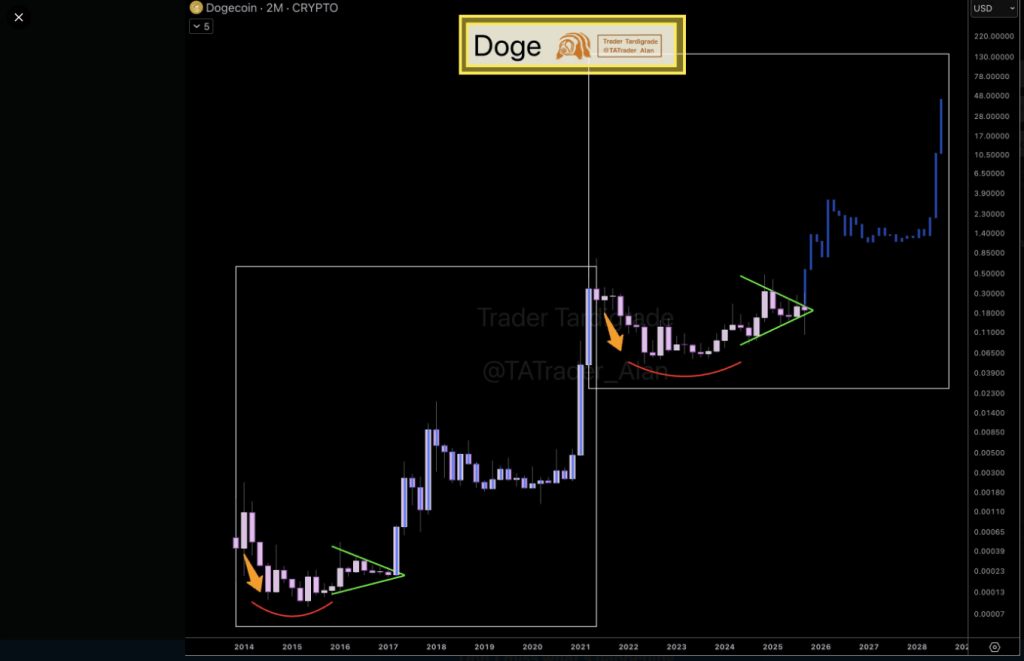

In response to analyst Dealer Tadrigrade, Dogecoin has been shifting inside a long-running symmetrical triangle that echoes a setup seen in 2016–2017. Based mostly on stories, the analyst used a two-month chart to check present value motion with the buildup that preceded a breakout in March 2017.

Again then, DOGE climbed from about $0.0003 to $0.0194 by January 2018, a rally of seven%. Merchants pointing to that episode say the present narrowing vary seems to be acquainted and will set the stage for a notable transfer.

Market Strikes This Month

DOGE is buying and selling at round $0.18 on the time of writing after a 20% drop up to now this October. That decline contrasts with latest Octobers: a 40% rise in October 2024, a ten% acquire in October 2023, and a 100% bounce in October 2022.

Costs have been compressing contained in the triangle since late 2024, and the tighter vary has elevated speak amongst chart watchers {that a} breakout could also be close to.

$DOGE/2-month#Dogecoin is following its first cycle pic.twitter.com/FNFJo3C59I

— Dealer Tardigrade (@TATrader_Alan) October 30, 2025

Targets After A Breakout

Analysts who favor the sample level to a primary goal close to $3.90, which might symbolize a few 2,000% acquire from present ranges if reached. Different, a lot bolder projections are additionally being shared.

One chart proven by bulls extends towards $48 — a 26,500% rise — which, if circulating provide stayed close to 151 billion tokens, would suggest a market worth close to $7 trillion. That quantity would dwarf most world asset lessons and is broadly seen as extremely unlikely.

Reviews have additionally referenced an $18 forecast final month, a degree that may make many holders rich if it materialized, but it surely stays an extended shot.

Technical Patterns Versus Broader Forces

Sample recognition can provide a transparent rule for merchants, however charts don’t seize all the things that drives value. Liquidity ranges, investor curiosity, strikes in Bitcoin, and shifts in social consideration all have an effect on how far any rally can run.

For a multi-thousand p.c surge to occur, sustained shopping for and prolonged public consideration could be required. At current, the view rests totally on a visible similarity between previous and current setups reasonably than on impartial indicators {that a} main rally is assured.

Featured picture from Pexels, chart from TradingView