Charles Edwards, founder and CEO of Capriole Investments, has issued his starkest warning but on quantum computing, arguing that Bitcoin should migrate to post-quantum signatures on an accelerated timeline or face existential danger later this decade. “We have to improve Bitcoin to be Quantum proof subsequent yr. 2026. In any other case we’re fucked,” Edwards wrote on X early Monday, escalating a sequence of posts through which he contends “Q-Day is that this decade.”

Might Bitcoin Crash To $0?

Edwards’ thesis hinges on the fast compression of useful resource estimates required to run Shor’s algorithm towards Bitcoin’s elliptic-curve digital signatures (ECDSA/Schnorr on secp256k1). Pushing again at skeptics who “handwave Quantum as being 20+ years away,” he argued that solely “~2,000 logical qubits” could also be adequate to interrupt ECC-256 inside a sensible time window, putting a reputable assault in “2–6 years.” In a separate trade he framed the stakes bluntly: “Would you like $1M Bitcoin in 5 years, or $0?”

Associated Studying

Edwards’ timeline intently tracks a contemporary line of analysis and business messaging from Pierre-Luc Dallaire-Démers, founding father of Pauli Group, a startup targeted on quantum-resistant cash. In an August analysis preprint and public thread, Dallaire-Démers and co-authors launched graded ECDLP challenges on Bitcoin’s curve and, after translating logical circuits to bodily prices throughout a number of error-corrected architectures, positioned “cryptanalytically related” ECC-256 assaults in a “roughly 2027–2033” window—emphasizing broad error bars and sensitivity to {hardware} assumptions.

Pauli Group summarized the upshot plainly: “The primary assault on 256-bit ECC will plausibly occur between 2027–2033.” The agency additionally provocatively acknowledged through X: “PQC BTC will go to $1M+ by 2030. ECC BTC gained’t.”

The core danger vector is well-established: as soon as a Bitcoin handle reveals its public key on-chain—by spending from it or by utilizing legacy codecs that expose the important thing outright—a sufficiently highly effective quantum pc working Shor’s algorithm might, in precept, derive the non-public key shortly sufficient to steal funds.

Safety researchers and business groups be aware that cash in already-exposed keys are the primary in line, whereas cash nonetheless sitting behind hashed (unrevealed) public keys are safer till they transfer. A number of analyses estimate {that a} non-trivial share of excellent BTC resides in exposed-key outputs, together with early “pay-to-pubkey” period cash usually related to Satoshi. Edwards leaned into that tail danger, claiming “Satoshi’s cash can be market dumped” absent a migration.

Associated Studying

Not everybody agrees on the clock velocity. Some conservative estimates nonetheless level to hundreds of thousands of error-corrected qubits for sensible, quick ECDSA breaks, and requirements our bodies have revealed transition steerage that implicitly assumes an extended runway.

In late 2024, materials circulated within the NIST/PQ ecosystem sketched migrations away from susceptible algorithms by roughly 2035—a horizon many safety engineers view as sensible for broad IT programs, even when area of interest breakthroughs arrive sooner. The unfold between the “1000’s” versus “hundreds of thousands” of logical qubits camps displays fast-evolving algorithmic optimizations, differing error-correction fashions, and various assumptions about gate speeds and code distances.

Notably, Edwards is taking the message to TOKEN2049 this week, the place he’s slated to current “DOUBLE THREAT: Quantum & the Treasury Bubble” on Wednesday, October 1 at 10:45 a.m. native time—positioning quantum compromise and a rising “Bitcoin Treasury Bubble” as the 2 dominant draw back dangers for BTC over the following cycle.

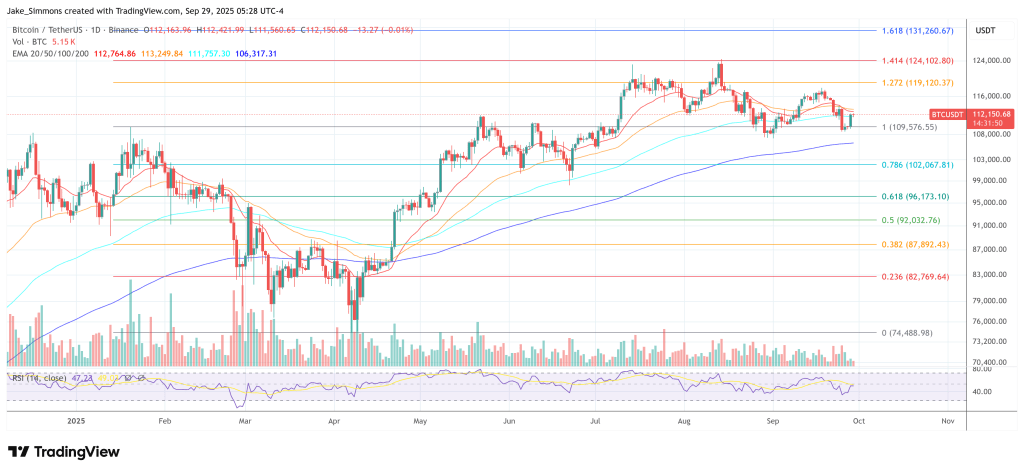

At press time, BTC traded at $112,150.

Featured picture created with DALL.E, chart from TradingView.com