Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ostium Labs argues that Bitcoin’s uptrend stays intact after August’s reversal, however it attracts a vivid purple line at $98,000. In its September 1 Market Outlook, the agency writes: “Closing under $98k on this timeframe would flip weekly construction bearish,” including that “above $98k weekly construction remains to be bullish and due to this fact we should always anticipate the formation of a higher-low.”

At publication time, Ostium referenced BTC round $108,017, with the August month-to-month candle settling “firmly purple” after wicking by way of the report to roughly $124.5k and shutting close to prior resistance-turned-support round $108.2k.

Key Bitcoin Value Ranges To Watch Now

On the month-to-month chart, Ostium sees no proof of a 2021-style cyclical high. The observe acknowledges some momentum divergence on RSI however stresses the absence of affirmation from the Superior Oscillator: “AO has continued to level in direction of constructing momentum all through the uptrend… I don’t suppose that is even remotely much like the 2021 high formation.”

Associated Studying

The bear case strengthens provided that September “closes under the 2025 open at $93.3k and due to this fact under native trendline assist.” For the bullish path, the workforce desires September to search out assist “above the yearly open, however doubtless a lot greater across the July lows at $105k,” and “ideally” end the month inexperienced “above the August open at $115k,” a configuration they are saying would “set us up for enlargement past the highs in October.”

Weekly construction, by Ostium’s learn, “confirmed no exhaustion on the transfer greater” and has now reset towards 50 on RSI, a profile the agency says helps development continuation. Ought to the market carve the next low early in September and reclaim momentum, a weekly shut “again above $112k results in a retest of the August open and probably $117.5k into FOMC with a retest of the highs earlier than month-end.”

The each day timeframe stays the near-term hurdle. Ostium characterizes the pullback as “orderly,” with helps flipped to resistance on the way in which down and “the important thing stage… clearly the $112k prior all-time excessive,” which served as assist in early August after which “reclaimed resistance” on final week’s leg decrease.

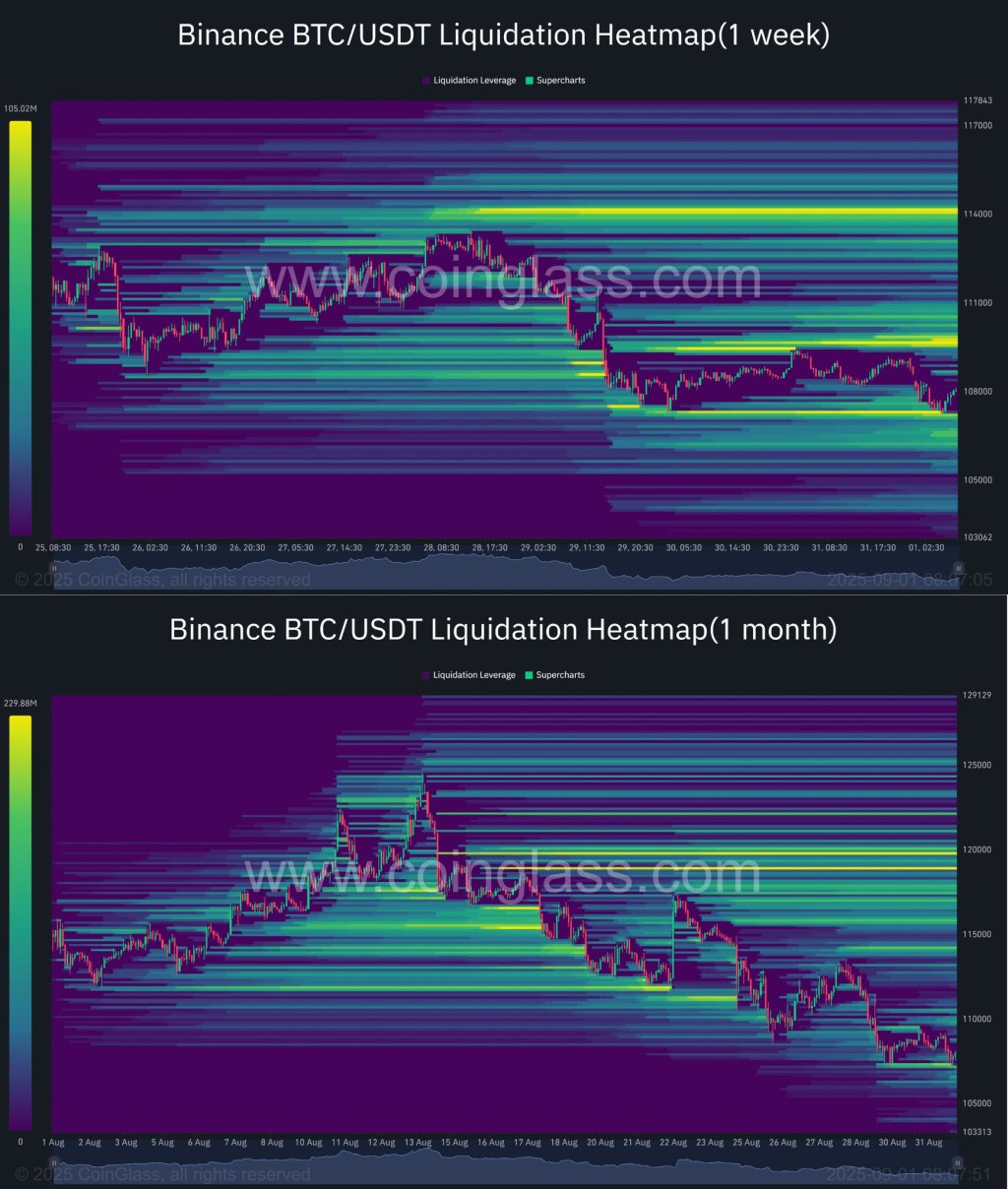

“A breakout and shut above the trendline and again above $112k would seem like the underside is in,” they write. A failed probe—“wick above the trendline into $112k and reject”—would bias value towards “the June open at $104.5k, with the 200dMA under that at $101.3k being key demand.” In derivatives, CoinGlass liquidation heatmaps for Binance’s BTC/USDT pair over one week and one month present dense liquidation bands layered above the $114k cap and clustered under across the $120k area, whereas no vital ranges are seen to the draw back.

With a macro-heavy week forward— ISM prints, JOLTS, the Fed’s Beige E book, jobless claims, ADP, ISM Providers, and Friday’s Nonfarm Payrolls—Ostium lays out conditional tactical setups. For longs, they like proof of exhaustion into assist: trendline resistance revered, “immediately’s low” taken out by way of a liquidation wick into the June-open/200-day cluster, and bullish divergence forming there earlier than bidding for a transfer again to the weekly open and the $112k retest. For shorts, they like a pointy early-week squeeze into $112k “with development exhaustion… having not taken out immediately’s low round $107k,” fading the pop again into weekly lows with threat lowered if it unfolds forward of NFP.

Associated Studying

Ostium additionally surveys positioning, pointing to snapshots throughout Velo and CoinGlass, three-month annualized foundation, and the combination between Bitcoin and altcoin open curiosity, in addition to one-week and one-month liquidation maps. Whereas it refrains from headline claims on these dashboards, the observe’s technical ranges line up with essentially the most concentrated liquidation density seen within the hooked up heatmaps, the place stacked curiosity stays perched close to the $112k pivot overhead and layered by way of the $105k–$101k demand shelf.

DXY As Tailwind For The BTC Value

The report extends past Bitcoin. The greenback backdrop, in Ostium’s framework, stays a tailwind for BTC into year-end. With DXY round 97.2, the agency says the present sequence rhymes with previous cyclical drawdowns and expects “DXY to interrupt under 96 and push in direction of a minimum of 94.6, however extra doubtless 93,” the place a bottoming formation may emerge above the 200-month transferring common. The secular DXY bull case will not be dismissed; somewhat, Ostium situates the current leg as the ultimate cyclical downswing earlier than a higher-low and multi-year restoration, contingent on coverage outcomes. A decisive month-to-month reclaim of 100 would invalidate the near-term bearish DXY view.

Throughout belongings, the through-line of Ostium’s September map is readability on thresholds. For Bitcoin, a weekly lack of $98,000 could be the primary structural break of the cycle; a each day reclaim of $112,000 would strongly argue the native low is in; and a month-to-month maintain above $105,000 with an in depth again over $115,000 would tee up recent highs into October.

At press time, BTC traded at $110,610.

Featured picture created with DALL.E, chart from TradingView.com