Japan sits on $14.9 trillion in family monetary property, but its mounted earnings market gives a number of the lowest returns within the developed world. The ten-year Japanese Authorities Bond yields simply ~1%, and company bonds usually battle to clear 2%. For many years, pension funds, insurers, and banks have been locked into low-return allocations just because there have been no compliant, acquainted alternate options.

Metaplanet’s Q2 earnings announcement goals straight at this hole. The corporate unveiled:

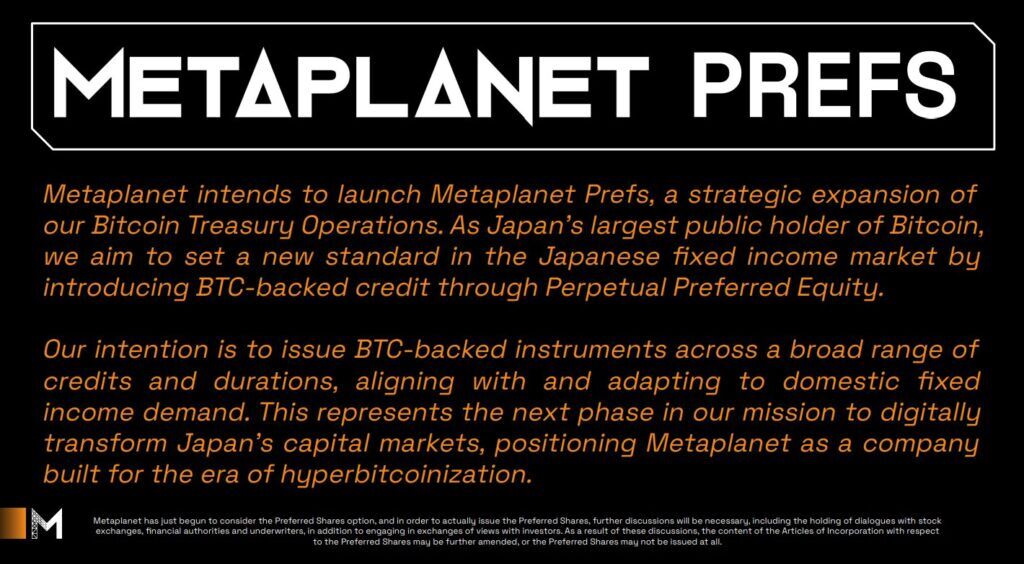

- “Metaplanet Prefs” — a program of Bitcoin-Backed Most well-liked Shares designed to scale its Bitcoin treasury operations.

- A plan to construct a Bitcoin-backed yield curve in Japan’s mounted earnings market.

In a market the place even “excessive yield” means low single digits, a well-structured Bitcoin-Backed Most well-liked Share providing 7–12% may command critical consideration—and critical capital.

Document Q2 Development Fuels Bitcoin-Backed Most well-liked Share Technique

Metaplanet’s Q2 wasn’t nearly asserting a brand new funding mannequin—it delivered one of many strongest quarters within the firm’s historical past. Each income and profitability surged, whereas property and internet property multiplied, underscoring the dimensions at which the corporate is now working.

Metaplanet Q2 Earnings Outcomes:

- Income: ¥1.239B ($8.4M) +41% QoQ

- Gross Revenue: ¥816M ($5.5M) +38% QoQ

- Extraordinary Revenue: ¥17.4B ($117.8M) vs. -¥6.9B

- Internet Revenue: ¥11.1B ($75.1M) vs. -¥5.0B

- Property: ¥238.2B ($1.61B) +333% QoQ

- Internet Property: ¥201.0B ($1.36B) +299% QoQ

This surge in monetary efficiency strengthens Metaplanet’s credibility with buyers and positions it to roll out Bitcoin-Backed Most well-liked Shares at scale, utilizing its momentum to seize a share of Japan’s huge however yield-starved mounted earnings market.

BTC-Backed Most well-liked Fairness: How ‘Metaplanet Prefs’ Will Work

Most well-liked fairness sits between debt and customary inventory in an organization’s capital construction. It gives dividend precedence, larger liquidation claims, and predictable payouts—usually with out voting dilution.

Metaplanet’s Bitcoin-Backed Most well-liked Shares are designed to:

- Ship materially larger yields than JGBs whereas retaining a well-recognized format for Japanese establishments.

- Keep away from refinancing threat tied to debt maturities.

- Diversify funding sources for BTC accumulation past frequent fairness issuance.

The Precedent: Technique’s Multi-Class Stack

Technique (previously MicroStrategy) has already proven what’s attainable. The corporate constructed a stack of Bitcoin-backed most popular fairness courses, every geared toward a distinct a part of the yield curve and a particular investor profile:

- Low-volatility, income-focused courses for conservative patrons.

- Convertible preferreds combining mounted earnings with BTC upside.

- Greater-yield courses concentrating on risk-tolerant buyers.

By matching every issuance to market demand, Technique has raised billions and grown its Bitcoin holdings to greater than 500,000 BTC—with out relying solely on frequent fairness dilution.

Metaplanet is taking the identical multi-class idea right into a market the place most popular share issuance is uncommon, the investor base is yield-hungry, and Bitcoin-Backed Most well-liked Shares may see speedy adoption.

Japan’s Capital Market: A $14.9 Trillion Alternative

Japan’s mounted earnings market has confronted many years of near-zero yields, leaving trillions in capital with few compliant, income-producing choices. This shortage makes it uniquely primed for higher-yield devices like Bitcoin-Backed Most well-liked Shares.

Japan’s family monetary property break down as follows:

- $9.5 trillion in mounted earnings

- $6.8 trillion in equities

- $7.6 trillion in money and deposits

The listed most popular share market is simply $2.7 billion—lower than 0.02% of complete monetary property. But demand for steady, income-oriented merchandise is immense.

Right here’s the hole: a Bitcoin-Backed Most well-liked Share yielding 8% gives 8x the return of a 10-year JGB and 4x the return of most high-grade company bonds. In a regulatory-compliant, acquainted construction, that unfold may entice each home establishments and retail allocators on the lookout for yield with out leaving the mounted earnings universe.

Engineering a Bitcoin-Backed Yield Curve

Metaplanet plans to problem a number of courses of Bitcoin-Backed Most well-liked Shares, every constructed for a distinct investor section:

- Quick Period Variable Dividend Perpetuals pegged to short-term JGB spreads for conservative patrons.

- Medium Period Variable Dividend Perpetuals as a mid-range company credit score different.

- Senior Mounted Dividend Perpetuals (Class A) for stability-focused, long-duration portfolios.

- Mounted Dividend Convertibles (Class B) combining predictable earnings with BTC upside potential.

- Excessive Yield Mounted Dividend Perpetuals for buyers prepared to tackle extra threat in change for larger returns.

This isn’t only a product lineup—it’s the development of an investable BTC-backed yield curve. Technique constructed one within the U.S.; Metaplanet is doing the identical in Japan, however with the added tailwind of a market determined for yield.

Implications for Company Bitcoin Technique

Metaplanet’s strategy gives three clear takeaways for company strategists:

- Capital Effectivity: Bitcoin-Backed Most well-liked Shares channel yield-seeking capital into the treasury with out over-relying on frequent fairness. They supply everlasting capital with out the identical maturity constraints as debt.

- Market Match Issues: Technique succeeded within the U.S. with convertible debt and fairness raises as a result of these markets are deep and liquid. Japan’s capital construction norms are completely different, and Metaplanet is adapting the playbook to native investor habits—a vital step for adoption.

- Legitimization of Bitcoin as Collateral: Each issuance of Bitcoin-Backed Most well-liked Shares that finds a house in a regulated, yield-hungry portfolio chips away on the notion of Bitcoin as speculative-only. As soon as normalized in a single main economic system, replication in others turns into simpler.

The Greater Image: Bitcoin’s Mounted Revenue Period

Metaplanet’s Q2 bulletins can function a blueprint for the way Bitcoin could be built-in into nationwide capital markets.

By pairing a confirmed capital construction mannequin with one of the yield-constrained environments on the earth, Metaplanet is positioning Bitcoin as a respectable, income-generating collateral base for a sovereign-scale mounted earnings market.

In the event that they succeed, Japan’s first Bitcoin-Backed Most well-liked Share program received’t be the final. It may mark the start of Bitcoin’s mounted earnings period—and a case examine in how company Bitcoin methods evolve to suit the markets they enter.

Disclaimer: This content material was written on behalf of Bitcoin For Firms. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy or subscribe for securities.