As Bitcoin (BTC) continues to hover just under the $120,000 degree, miners have elevated transfers to Binance crypto alternate. In line with analysts, elevated BTC transfers to Binance might sign an upcoming value correction for the highest cryptocurrency.

Bitcoin Value Correction Upcoming?

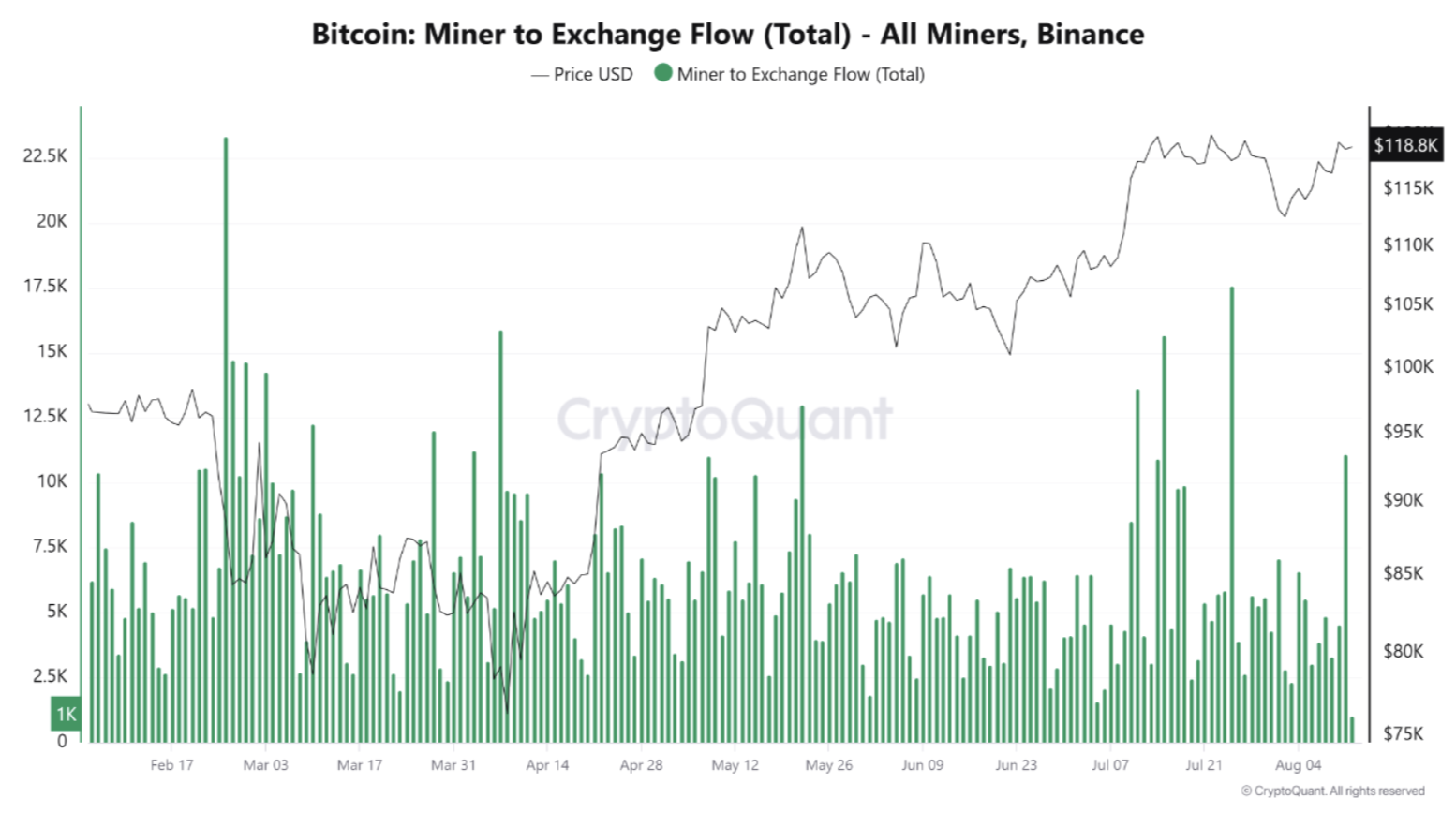

In line with a CryptoQuant Quicktake publish by contributor Arab Chain, there was a major spike in BTC transfers from miners to Binance crypto alternate in late July – proven within the type of double tops within the following chart.

These spikes have been adopted by a number of days of above-average flows to the alternate. Early August noticed one other surge, with transfers starting from a number of thousand BTC to greater than 10,000 BTC at their peak.

Associated Studying

This exercise means that miners are persevering with to distribute BTC to the alternate. The promoting comes because the asset’s value stays near its all-time excessive (ATH) of practically $120,000.

Arab Chain famous that in comparison with the April–June interval, the present miner exercise resembles “stockpiling or hedging conduct” reasonably than typical low-noise patterns. The analyst shared a number of behavioral indicators to assist this view.

As an illustration, sustained excessive inflows throughout elevated value ranges recommend that miners are profiting from the rally to safe liquidity, cowl operational prices, or handle post-halving treasury wants.

Nonetheless, such massive inflows are sometimes linked to short-term resistance. The market should have ample shopping for liquidity to soak up this provide and forestall it from triggering a pointy value decline.

The excessive frequency of peaks over the previous two weeks additionally signifies that this isn’t a one-off prevalence. As a substitute, it marks a part of heightened exercise amongst Binance miners, which will increase Bitcoin’s value sensitivity to any drop in demand.

In line with Arab Chain, if day by day flows stay above the latest weekly common – roughly 5,000 to 7,000 BTC per day – it could level to ongoing provide strain. Conversely, a fast drop again to decrease ranges would recommend that the distribution wave was short-term and has already been absorbed.

BTC Could Be Getting ready For A New ATH

Regardless of consolidating just below $120,000, latest on-chain information exhibits few indicators of the Bitcoin market overheating. As well as, the typical executed order measurement within the Bitcoin futures market has been steadily declining, indicating better retail participation within the rally.

Associated Studying

That mentioned, a good portion of short-term BTC holders have moved into revenue, which might set the stage for a sell-off. At press time, BTC trades at $118,970, down 0.6% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com