World financial tensions and commerce coverage uncertainties proceed to create volatility within the crypto market, with SOL navigating these challenges higher than many options.

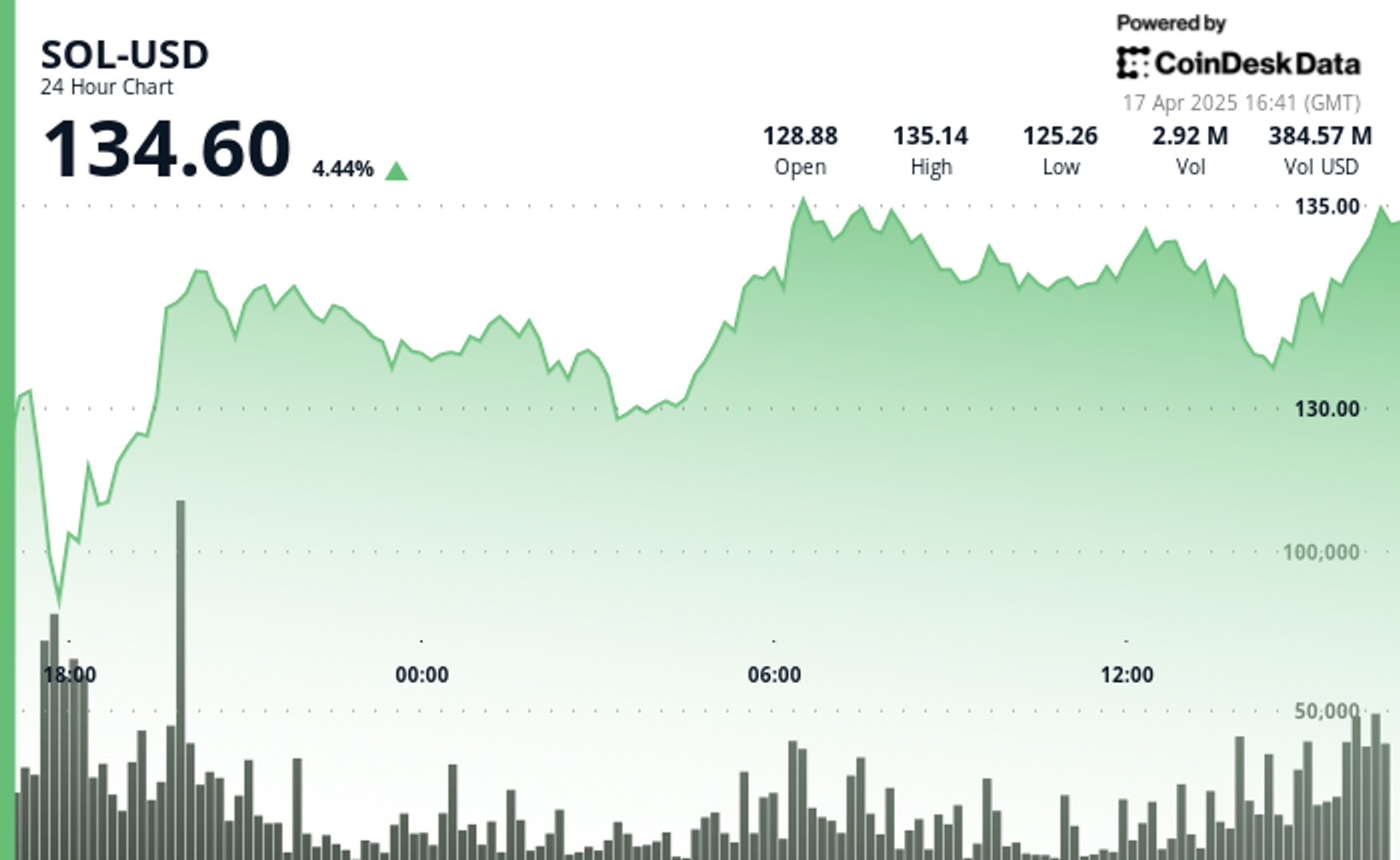

Solana token’s value rose greater than 4% on Thursday, whereas the broader market gauge, CoinDesk 20, rose about 3%.

The $125-$127 vary for SOL has emerged as a essential help zone that efficiently rejected a number of draw back makes an attempt, whereas the $133.50-$133.60 space represents vital resistance, based on CoinDesk Analysis’s technical evaluation mannequin.

Blockchain information exhibits over 32 million SOL (greater than 5% of the full provide) amassed on the $129.79 stage, establishing it as an important pivot level for future value motion.

Technical Evaluation Highlights

- SOL established a well-defined help zone between $125-127, which efficiently rejected a number of draw back makes an attempt.

- The worth demonstrates robust resiliency, recovering 4.5% from its April sixteenth low of $123.64 to $135.57, establishing a transparent uptrend.

- Canada launched the primary spot Solana ETFs in North America on April 16, issued by asset managers together with 3iQ, Objective, Evolve, and CI, boosting institutional curiosity.

- Solana has reclaimed the highest spot in DEX exercise, surpassing Ethereum after a 16% achieve over seven days, with complete worth locked (TVL) growing by 12% to $7.08 billion.

- Quantity evaluation exhibits significantly robust accumulation throughout the April sixteenth afternoon surge, with over 3 million models traded as the value broke by way of the $130 resistance stage.

- The Fibonacci retracement from the April 14th excessive ($136.01) to the April 16 low suggests the latest rally has reclaimed the essential 61.8% stage.

- Within the remaining 100 minutes of buying and selling, SOL skilled a big downward correction, plummeting from $134.11 to $130.81, representing a 2.5% decline.

- The sell-off intensified round 14:03-14:07, when quantity spiked dramatically to over 92,000 models throughout a single-minute candle.

- A robust resistance zone at $133.50-$133.60 rejected a number of restoration makes an attempt.

- A notable breakdown occurred on the $132.00 help stage, triggering cascading liquidations.

- Costs have now retraced past the 78.6% Fibonacci stage, suggesting potential continuation towards the $125-127 help zone if bearish momentum persists.

Disclaimer: This text was generated with AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage. This text might embody data from exterior sources, that are listed under when relevant.

Exterior References:

- “Solana’s Value Foundation Shifts Sharply: $129 Emerges as a Key Pivot Zone,” revealed April 16, 2025.

- NewsBTC, “Solana Retests Bearish Breakout Zone – $65 Goal Nonetheless In Play?” revealed April 17, 2025.

- Cointelegraph, “Why Is Solana Worth Up This Week?” revealed April 12, 2025.

- CryptoPotato, “Solana (SOL) Jumps by 7% Every day, Bitcoin (BTC) Eyes $85K Once more (Market Watch),” revealed April 17, 2025.

- Cointelegraph, “Solana Worth Is Up 36% From Its Crypto Market Crash Lows — Is $180 SOL the Subsequent Cease?” revealed April 16, 2025.