Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin is going through an important take a look at because it struggles to interrupt above key resistance ranges whereas holding simply above essential assist. The market stays caught in a decent vary, reflecting rising indecisiveness amongst merchants and traders. Uncertainty has grow to be the brand new regular, with macro circumstances and political developments persevering with to cloud sentiment.

Associated Studying

US President Donald Trump has added additional volatility to the combo, unsettling monetary markets with unpredictable insurance policies and newly imposed tariffs. His erratic conduct has solely intensified the delicate temper, pushing threat belongings like Bitcoin into deeper consolidation.

Regardless of transient rallies, Bitcoin has as soon as once more failed to interrupt above descending resistance, in response to crypto analyst Carl Runefelt. This rejection, paired with declining buying and selling quantity, is an indication that consumers could also be dropping power. Runefelt warns that if quantity continues to dry up and BTC stays caught beneath key ranges, the bearish goal of $78,600 stays a robust chance.

Whereas bulls are defending assist zones for now, the shortage of momentum is elevating pink flags. Except Bitcoin can reclaim increased floor quickly, the chances of a deeper correction will proceed to develop — making the approaching days essential for figuring out the market’s subsequent route.

Bitcoin Down 25% from January ATH As Bears Tighten Grip

Bitcoin is now down 25% from its January all-time excessive, and bulls are struggling to regain management. After repeated makes an attempt to reverse the development, BTC continues to carry above the $81,000 degree — a key assist zone — however has didn’t reclaim the $86,000 mark, which is important to verify any critical restoration. The shortcoming to push increased has weakened market confidence, and bulls now discover themselves in a tough place.

Macroeconomic uncertainty and fears surrounding escalating commerce wars, particularly beneath U.S. President Donald Trump’s unpredictable insurance policies, have added to market volatility. These components proceed to favor the bears, and the stress on high-risk belongings like Bitcoin stays intense. With broader monetary markets beneath stress, bullish sentiment within the crypto area is fading rapidly.

Panic is starting to set in for some traders as promoting stress reveals no signal of slowing. Nonetheless, there’s nonetheless a sliver of optimism amongst market watchers who consider {that a} bounce might comply with as soon as key resistance ranges are reclaimed.

Runefelt lately shared insights pointing to BTC’s failure to interrupt above descending resistance — a bearish signal. He additionally famous that buying and selling quantity continues to say no, an indication that market participation is scaling down. This lack of quantity usually precedes massive strikes, and on this case, the bearish goal of $78,600 stays firmly on the desk if bulls fail to reclaim momentum.

For now, the market stays on edge. Bitcoin’s means to carry above $81K and try a transfer previous $86K will probably be essential in figuring out whether or not a restoration is feasible — or if the subsequent leg down is about to start.

Associated Studying

Technical Particulars: Key Ranges To Maintain

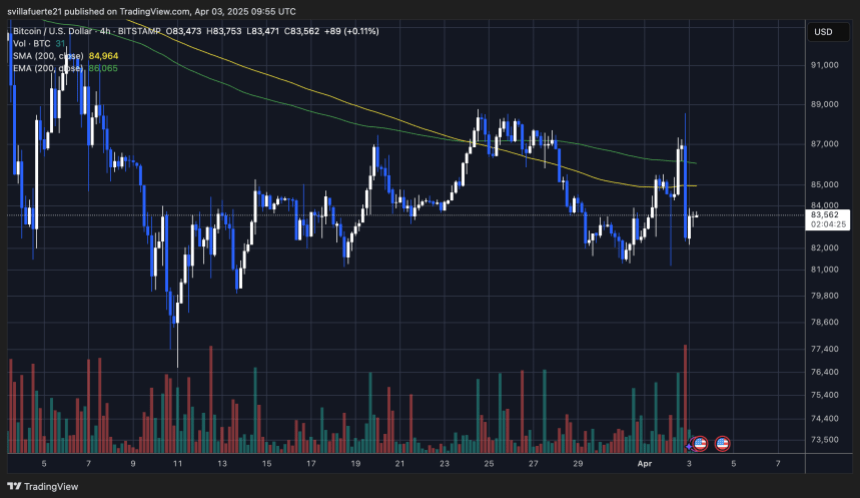

Bitcoin is at present buying and selling at $83,500 after a number of days of uneven, unstable worth motion that has left merchants unsure in regards to the market’s subsequent route. The current swings between key ranges have highlighted the indecision amongst each bulls and bears, with neither facet in a position to take full management. For bulls, the quick problem is to reclaim the $85,000 degree, which aligns with the 4-hour 200-day transferring common (MA). A profitable transfer above this mark can be an encouraging sign of short-term power.

Past that, the subsequent key degree is $86,000, which is the place the 4-hour exponential transferring common (EMA) sits. Reclaiming this zone would assist shift momentum again in favor of the bulls and doubtlessly set the stage for a restoration try towards $90,000.

Associated Studying

Nonetheless, probably the most essential degree within the quick time period is assist at $81,000. This worth zone has acted as a robust flooring in current weeks, and dropping it might probably set off additional draw back stress. As macro uncertainty and market-wide volatility proceed, bulls should defend this assist whereas working to reclaim the MAs above. The approaching periods will probably be essential in defining whether or not Bitcoin can get better—or slide deeper into correction territory.

Featured picture from Dall-E, chart from TradingView