The U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETF) registered file outflows Thursday and the CME futures premium dropped into single digits in an indication of weakening short-term demand.

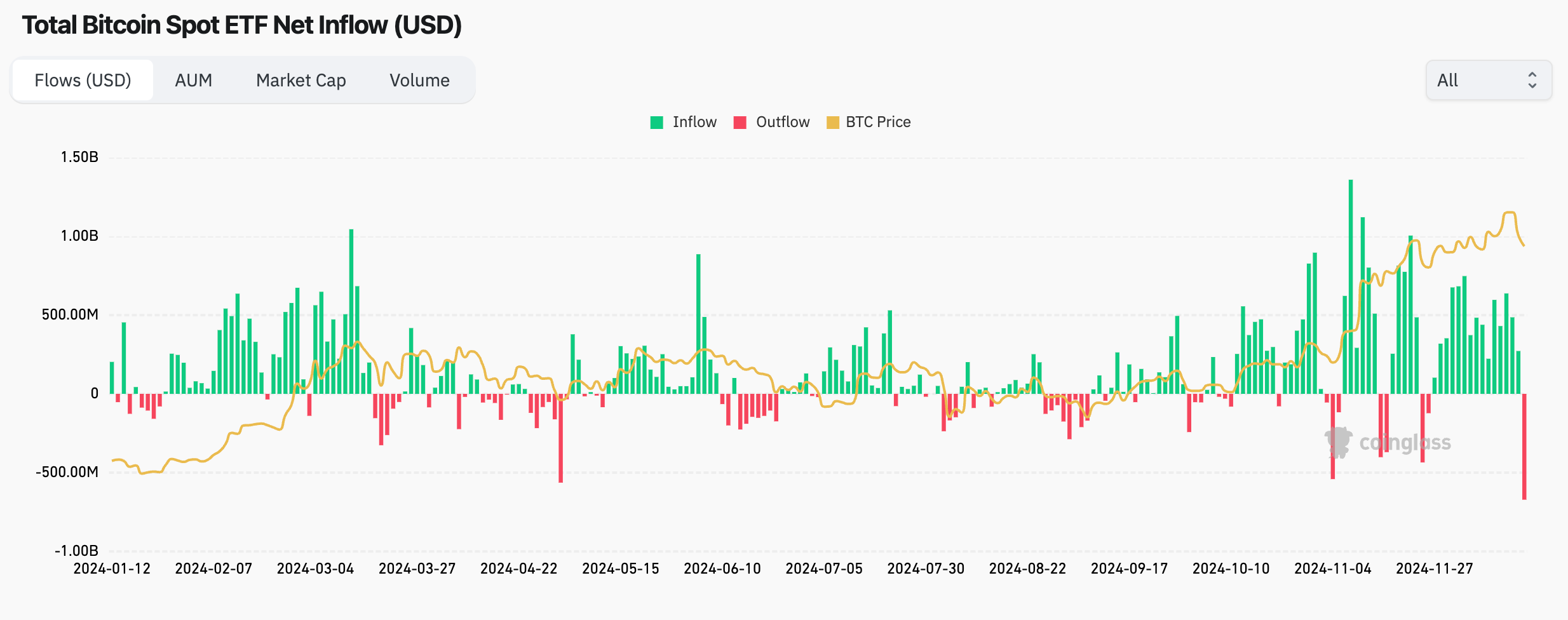

Traders ended a 15-day streak of inflows by withdrawing a web $671.9 million from the 11 ETFs, the most important single-day tally since their inception on Jan. 11, in line with knowledge from Coinglass and Farside Traders.

Constancy’s FBTC and Grayscale’s GBTC led the outflows, dropping $208.5 million and $188.6 million, respectively. Different funds registered outflows, too, and BlackRock’s IBIT scored its first zero in a number of weeks.

Bitcoin prolonged its post-Fed losses Thursday, falling to $96,000, down practically 10% from the file excessive of $108,268 seen early this week.

The bearish sentiment was mirrored within the derivatives market, the place the annualized premium within the CME’s regulated one-month bitcoin futures fell to 9.83%, the bottom in over a month, in line with knowledge supply Amberdata.

A decline within the premium means cash-and-carry arbitrage bets involving a protracted place within the ETF and a brief place within the CME futures yield lower than they did earlier. As such, the ETFs might proceed to see weak demand within the short-term.

Ether ETFs additionally registered a web outflow, $60.5 million. That is the primary since Nov. 21. Ether has dropped 20% since ranges above $4,100 earlier than Wednesday’s Fed choice.