After hitting the $100,000 milestone, Bitcoin suffered a sudden value crash on Friday leading to an estimated value lack of 7%. Throughout this decline, the asset’s perpetual funding charges within the by-product markets took successful. Nevertheless, merchants could but retain sufficient leverage to strongly affect value volatility.

Bitcoin Quick-Time period Outlook Unsure Due To Heightened Leverage

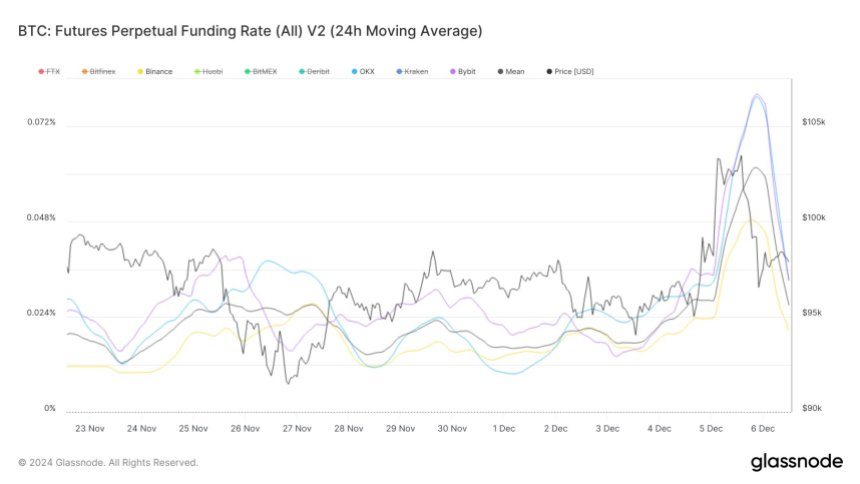

In an X publish on December 6, blockchain analytics agency Glassnode expressed that Bitcoin’s perpetual funding fee could maintain vital implications for the asset’s short-term value.

For context, perpetual funding charges are periodic funds made between merchants within the perpetual futures market to make sure the contract value aligns with the spot value of Bitcoin. Constructive funding charges point out that lengthy positions are paying shorts, which is bullish whereas detrimental funding charges signify the vice versa.

In line with Glassnode, BTC’s perpetual funding charges initially confirmed indicators of stabilization on its weekly body amidst speculative demand. Nevertheless, the asset’s surge to $100,000 on Thursday pushed by elevated market leverage noticed these funding charges rise by 3.6x their weekly common.

Notably, Bitcoin’s perpetual funding fee hit a peak of 0.062, representing its highest worth since April. Importantly, the analytics group at Glassnode notes that this fee spike suggests vital affect by the by-product market on Bitcoin’s ascent above $100,000.

Nevertheless, Bitcoin’s flash value resulted in a serious decline in its funding charges barely above 0.024. Regardless of this fall, Glassnode states these charges are nonetheless comparatively excessive in comparison with earlier this week, indicating the Bitcoin market nonetheless accommodates a big stage of leveraged positions.

This residual leverage out there signifies a robust potential for elevated value volatility. Subsequently, Bitcoin’s value motion within the coming days seems unclear as a reversal on both facet might set off a big stage of liquidation, inducing a cascading impact.

STH Value Foundation Factors To $112,000 Value Goal

In different information, famend analyst Ali Martinez has posted a Bitcoin value prediction based mostly on the asset’s short-term holder (STH) value foundation i.e. the common value at which those that sometimes acquired BTC over the past 155 days. It signifies a break-even stage for these buyers.

In line with Martinez, the STH habits signifies that Bitcoin would attain a neighborhood prime or $112,926 value based mostly on a +1 normal deviation that adjusts the extent of STH value foundation upward to account for value volatility and behavioral developments.

At press time, Bitcoin trades at $100,137 after its restoration from Friday’s crash confronted a rejection at $102,000. In the meantime, the asset’s buying and selling quantity is down by 42.46% and valued at $89.12 billion.