Este artículo también está disponible en español.

In accordance with veteran dealer Peter Brandt, Ethereum may need simply seen its future trying brighter. Identified for his technical forecasts, Brandt feels the altcoin is on the verge of a bullish turnaround.

He’s recognized an inverted Head and Shoulders formation on the every day chart of Ethereum. This is among the most traditional purchase indicators in technical evaluation. If ETH can maintain above that neckline at $2,745, we may very well be taking a look at a breakout.

Essentially the most fascinating chart developments I see proper now

See thread

#1$ETH closing value chart inverted H&S sample

I’m flat in ETH pic.twitter.com/OCG0GcTdxF— Peter Brandt (@PeterLBrandt) October 21, 2024

Associated Studying

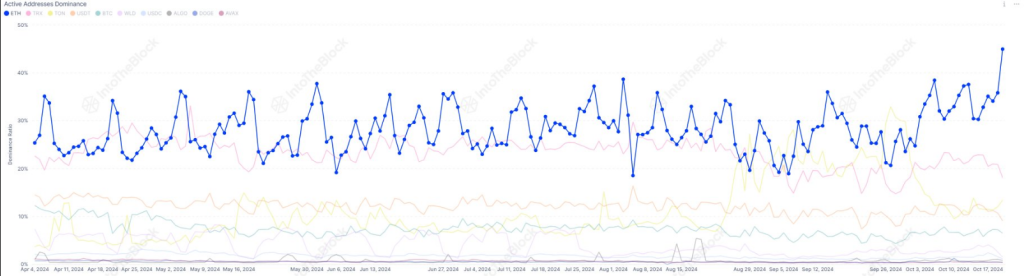

However the pleasure doesn’t cease there. Knowledge from IntoTheBlock exhibits that Ethereum’s community is stronger than ever, boasting over 5 million energetic addresses throughout its mainnet and Layer 2 networks.

Although market temper continues to be combined, this statistic confirms Ethereum’s significance within the crypto ecosystem. Though some buyers see Ethereum’s long-term future enhancing, others are apprehensive by the short-term hazards.

There at the moment are over 5 million energetic $ETH addresses throughout the Ethereum mainnet and main L2 networks, outpacing some other Layer 1 asset by a major margin. pic.twitter.com/W6JaauNvhV

— IntoTheBlock (@intotheblock) October 21, 2024

A Lengthy-Time period Play

Ethereum positively had its ups and downs. From a price ticket as little as $10 to almost $4,900 prior to now, it’s very apparent that ETH has made fairly a number of early believers. And whereas taking such wild rides might be stuffed with gut-wrenching moments, Ethereum by no means failed to make sure that its core energy lies within the facilitation of sensible contracts and decentralized purposes within the blockchain house.

Nonetheless, Ethereum’s price foundation for a lot of buyers has risen because the market has matured. This has made short-term positive aspects extra elusive, main some merchants to method the market cautiously. However for these with a long-term view, Ethereum’s bold roadmap and historical past of overcoming challenges proceed to make it a sexy possibility.

Ethereum: The Subsequent Path

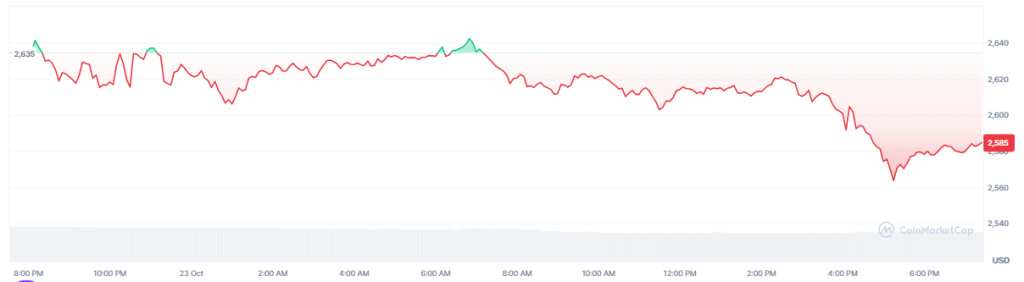

Ethereum’s current pricing conduct has one in every of extra fascinating technical facets: its interplay with the Level of Management (POC). Usually thought-about as a major assist or resistance, this stage may very well be essential in deciding Ethereum’s subsequent course.

As ETH’s value hovers close to this level, it suggests a doable shopping for alternative for these taking a look at the long run. If the POC holds, Ethereum might construct a strong basis for future progress. However a break beneath this stage may sign bother forward, so buyers ought to keep cautious.

Associated Studying

Will The Bullish Reversal Maintain?

Brandt’s bullish prognosis offers ETH followers optimism. If Ethereum maintains over $2,745 and the inverted Head and Shoulders sample persists, it’d climb considerably.

But, as all the time, it’s important to contemplate different market components—broader developments, technical indicators, and market sentiment all play a job in shaping the way forward for Ethereum.

Whereas Ethereum has its challenges, the potential for a bullish breakout is difficult to disregard. Whether or not you’re in it for the lengthy recreation or watching intently for short-term positive aspects, Ethereum’s subsequent transfer may very well be a major one.

Featured picture from AFP/Finance Magnates, chart from TradingView