Ethereum is exhibiting renewed energy after a pointy rally of over 50% in lower than every week, pushing costs firmly above the $3,700 degree. The transfer alerts clear bullish management, with ETH reclaiming vital territory and holding regular close to current highs. The speedy worth enlargement has reignited optimism throughout the market, as merchants and analysts intently look ahead to continuation or indicators of exhaustion.

Associated Studying

Presently, Ethereum’s momentum means that bulls are making ready to problem the psychological $4,000 barrier. In accordance with key derivatives knowledge, this degree represents a vital strain level for bearish positions. If reached, huge brief positions may face liquidation, doubtlessly fueling much more upside via a cascade of pressured buybacks.

Market members are looking ahead to affirmation via quantity enlargement and follow-through shopping for strain. A decisive break above $3,800 may open the trail to $4,000 and past, whereas failure to take care of assist might set off a brief cooling-off interval. Both manner, Ethereum’s present setup means that vital volatility and alternative lie simply forward.

Large Brief Liquidation Looms As Ethereum Targets $4,000

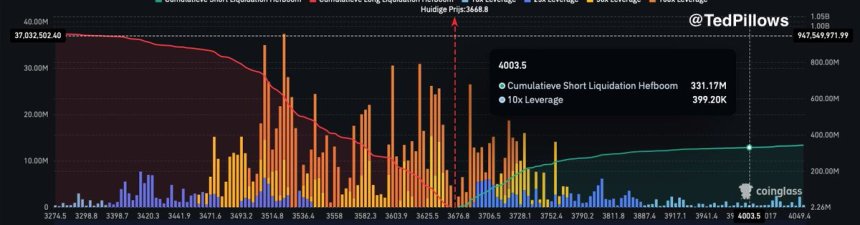

Ethereum’s current rally has put strain on short-sellers, and high analyst Ted Pillows has highlighted a vital degree that would set off a significant squeeze. In accordance with Pillows, roughly $331,170,000 value of brief positions will likely be liquidated if ETH reaches the $4,000 mark. This knowledge level reveals a extremely uneven setup the place a single upward thrust may set off a domino impact of pressured buybacks, fueling much more upside.

In crypto markets, when brief positions are liquidated, merchants are pressured to purchase again the asset to cowl their losses. This automated shopping for provides to the present demand and might quickly speed up the worth motion, main to what’s generally known as a brief squeeze. Given the focus of shorts at $4,000, a clear break above this degree may end in a sudden and aggressive worth spike, catching bears off guard and shifting momentum additional in favor of the bulls.

Past technical triggers, Ethereum can be benefiting from enhancing macro circumstances. Authorized readability within the US — via current laws just like the Readability and GENIUS Acts — is decreasing regulatory uncertainty for initiatives and traders alike. Mixed with rising ETF inflows and rising on-chain exercise, these elements counsel Ethereum might be getting into the early phases of a a lot bigger enlargement section. Because the $4,000 degree approaches, all eyes are actually on whether or not this key threshold will act as a catalyst for Ethereum’s subsequent main leg up.

Associated Studying

ETH Eyes Breakout As Momentum Builds

Ethereum (ETH) continues to point out spectacular energy, presently buying and selling round $3,817.49 after gaining 1.57% on the day. The chart displays a strong upward transfer, with ETH surging previous main resistance close to $2,850. The current breakout has been supported by robust quantity, confirming bullish conviction as Ethereum quickly approaches the psychological $4,000 mark.

The 50-day, 100-day, and 200-day transferring averages are all trending upward, additional validating the present uptrend. ETH is effectively above all key SMAs—particularly the 200-day SMA at $2,824.88—which now acts as strong macro assist. The subsequent check lies simply above present ranges on the $3,850–$4,000 zone, a traditionally vital resistance space. A breakout right here may spark a bigger transfer, doubtlessly resulting in new yearly highs.

Associated Studying

Nonetheless, merchants ought to stay cautious. After a 50%+ rally in only a few days, a interval of consolidation or a short pullback wouldn’t be uncommon. If Ethereum fails to interrupt and maintain above $4,000, we may see a retest of the $3,742 assist.

Featured picture from Dall-E, chart from TradingView