Information Background

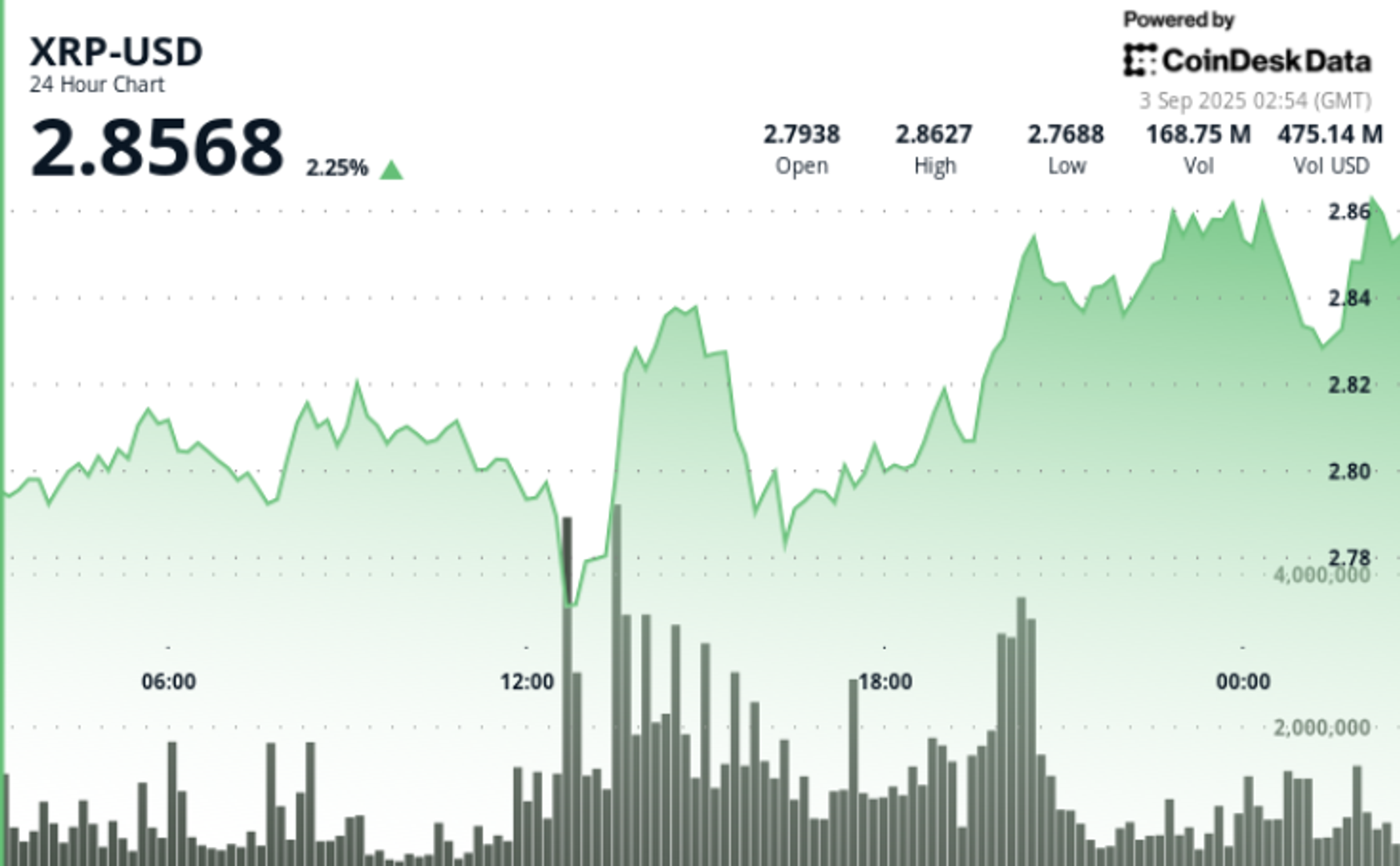

- XRP traded in a risky 23-hour session from Sept. 2 at 03:00 to Sept. 3 at 02:00, transferring between $2.76 and $2.86.

- Geopolitical and financial coverage uncertainty proceed to drive volatility throughout crypto markets. Fed rate-cut expectations stay in flux after inflation knowledge releases, including to liquidity stress.

- Whale accumulation of

340M XRP ($960M) over the previous two weeks suggests establishments are positioning on weak spot regardless of broader promoting since July. - Analysts stay break up: some flag draw back dangers towards $2.50 if $2.76 breaks, whereas others cite long-term breakout setups with targets above $4.00 if $3.30 resistance clears.

Value Motion

- XRP opened close to $2.79 and closed round $2.82, up 2% on the session.

- Intraday low at $2.76 (12:00 GMT) was rapidly defended with quantity spikes above 180M, nicely above the 24h common of 78M.

- Value then superior to $2.86 through the 13:00–14:00 restoration, establishing resistance.

- Closing hour noticed one other push from $2.83 to $2.86 with 3M+ tokens per minute traded, confirming institutional participation.

Technical Evaluation

- Assist: $2.76–$2.78 defended on heavy quantity. Subsequent draw back guardrails sit at $2.70 and $2.50.

- Resistance: $2.86 near-term cap; $3.00 and $3.30 stay key breakout ranges.

- Momentum: RSI regular in mid-50s, exhibiting neutral-to-bullish bias.

- MACD: Histogram converging towards bullish crossover, supportive of accumulation thesis.

- Patterns: Symmetrical triangle beneath $3.00 stays intact. Greater lows level to rising strain for a breakout if $2.86 is cleared.

What Merchants Are Watching

- Can $2.76 proceed to carry beneath repeat checks, or does a breakdown open $2.50 threat?

- A sustained shut above $2.86, then $3.00, as alerts for momentum continuation.

- Whale and ETF-related flows: October deadlines for spot ETF rulings may act as a catalyst.

- Whether or not quantity stays elevated or fades again towards averages, figuring out power of the breakout setup.