Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

CoinRoutes chief govt Dave Weisberger detonated a contemporary spherical of tension within the XRP market on Monday when he requested, on Scott Melker’s podcast, whether or not Ripple Labs may finance a takeover of Circle “for $10 to $20 billion” with out off-loading roughly $10 billion in XRP. “Who’s going to purchase the $10 billion value of XRP they would wish to promote out of their treasury?” Weisberger mentioned, warning {that a} sudden provide surge may overwhelm order books and “hammer the value.”

Is A XRP Promote-Off Conceivable?

Inside hours, pro-XRP lawyer Fred Rispoli fired again on X. “I like @daveweisberger1, however on this level he’s mcgloning so arduous,” he wrote, invoking Bloomberg strategist Mike McGlone’s fame for bearish hyperbole. “Simply primarily based on what I’m getting supplied for my Ripple shares on the secondary market, I don’t assume Ripple would even need to promote one XRP to purchase Circle.” Rispoli agreed that Ripple can’t elevate $10 billion in pure money, but insisted the corporate may “simply afford the acquisition for a mixture of money and debt” and a heavy equity-swap.

Associated Studying

When Weisberger replied that Circle’s board would seemingly demand arduous {dollars} until it accepted Ripple fairness or XRP “with out a haircut,” Rispoli dug in. “No solution to get $10B in money—and $10B is just too excessive anyway,” he wrote, citing late-2024 private-research valuations that positioned Ripple at $15 billion excluding its ~36 billion escrowed XRP. If Circle’s price ticket fell to $7–9 billion, he mentioned, Ripple may shut with “$1–3 billion money available, a heavy inventory alternate, and debt,” particularly with “all that GCC cash sloshing round crypto world proper now.” Rispoli conceded it might be “a attain” however “doable with out meaningfully promoting XRP.”

Weisberger acknowledged the mathematics—“That’s an affordable evaluation,” he wrote—but cautioned that any value on the higher finish of Rispoli’s vary “may very well be some short-term ache for us XRP holders.”

Ripple’s tender-offer buyback in January 2024 valued the corporate at $11.3 billion, disclosing greater than $1 billion in money and about $25 billion in digital belongings—largely XRP—on its books. The agency nonetheless controls roughly 52 billion XRP (about 40 % of provide), although 36 billion sit in timed escrow releases, limiting fast entry. At at this time’s $2.20 spot value, the spendable portion is value a bit of underneath $35 billion, however shifting even a fraction rapidly would collide with skinny venue depth—some extent Weisberger hammered residence.

Associated Studying

Ripple’s money pile additionally shrank after its $1.25 billion buy of prime dealer Hidden Highway in April, a deal settled with a mix of money, fairness and RLUSD stablecoins. That acquisition suggests the corporate prefers hybrid buildings, bolstering Rispoli’s declare that Treasury XRP needn’t flood the market.

Is Circle Even For Sale?

The controversy could also be tutorial. Circle, issuer of USDC, has repeatedly declared it “not on the market” whereas marching towards a New York Inventory Trade itemizing that now targets a $7.2 billion valuation. Ripple’s rumored strategy earlier this spring reportedly topped $5 billion, effectively under Weisberger’s stress case and inside Rispoli’s “doable” band, however Circle rebuffed the talks and up to date its S-1 two weeks later, enlarging the float quite than in search of a purchaser.

Strategically, Ripple already fields its personal dollar-token RLUSD, launched in January and positioned by president Monica Lengthy as “complementary to XRP, not a competitor.” Absorbing USDC’s issuer would immediately rocket Ripple in the direction of the scale of Tether.

Even underneath Rispoli’s optimistic construction, Ripple would possibly nonetheless must liquidate a number of hundred million {dollars}’ value of XRP for working capital and shutting prices. At present volumes, unloading simply 500 million XRP (≈ $1.1 billion) would equal half every week of worldwide turnover—sufficient to distort value until executed as personal blocks.

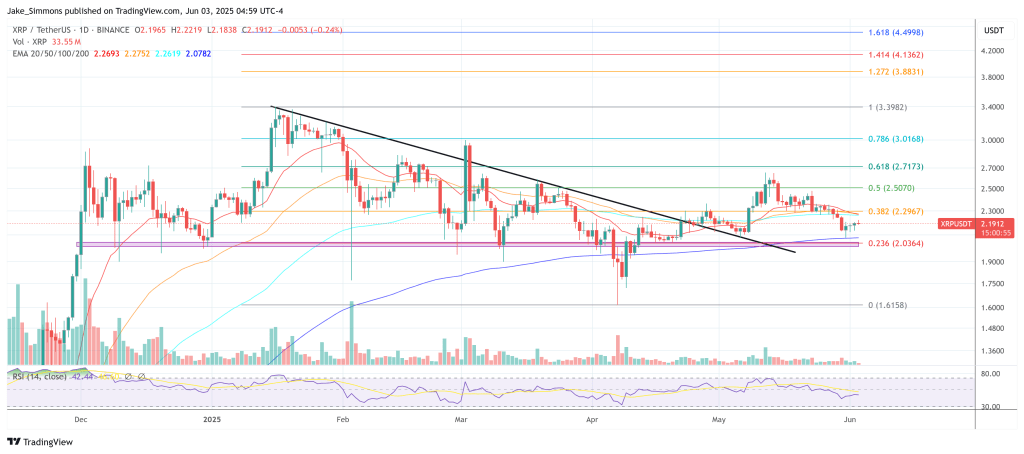

At press time, XRP traded at $2.19.

Featured picture created with DALL.E, chart from TradingView.com