XRP is buying and selling round $1.87 and has slipped beneath the $2 mark after a current slide. In line with market trackers, the token is down about 30% within the fourth quarter of 2025, but some analysts say the present weak spot could also be half of a bigger build-up that has preceded sturdy rallies earlier than.

Buyers and commentators are watching value motion carefully as debate grows over whether or not the token is organising for a pointy rebound or extra weak spot.

Associated Studying

Historic Accumulation Patterns

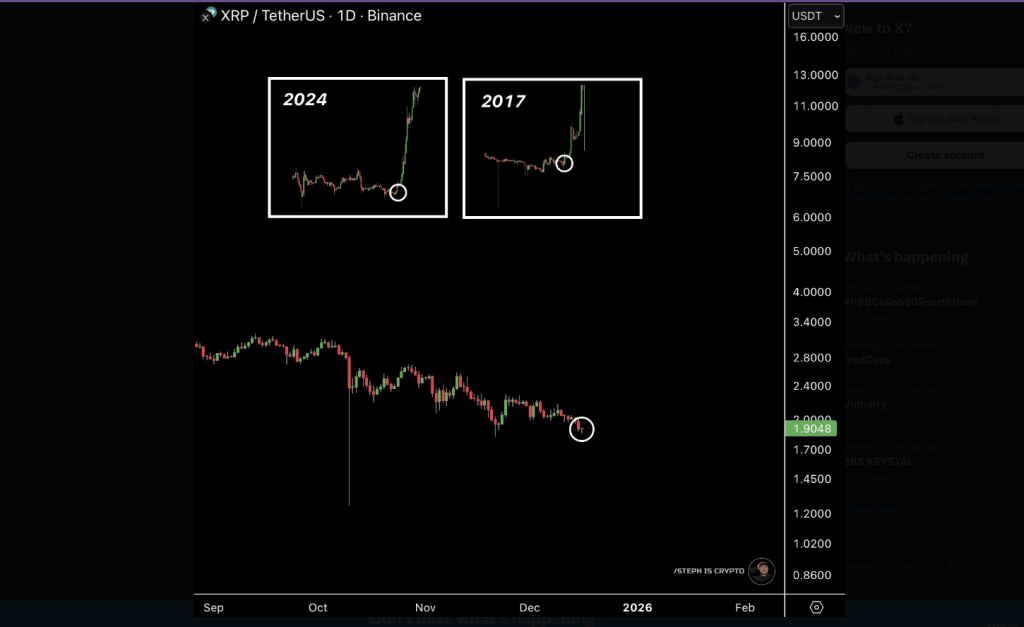

Primarily based on reviews from chart watchers, XRP has proven what some name repeatable accumulation phases in previous cycles. One run of consolidation unfolded from early 2015 via early 2017.

Throughout that span a steep drop took XRP from $0.00885 to $0.005, and later it rallied onerous, climbing to about $3.30 by January 2018.

A second cycle ran from mid-2023 into late 2024, the place an August to November slide noticed costs fall from $0.62 to $0.50, earlier than a fast push as much as roughly $3.4 in January 2025. Analysts level to those previous strikes as a sample that might present clues about what occurs subsequent.

Current Downtrend And Help Ranges

Studies present that since October 2025, XRP has fallen from about $2.8 to the present value close to $1.84. Technical commentators have highlighted that the $1.8–$2 band, which acted as resistance earlier, could now be appearing as help after current buying and selling.

One analyst framed the current setup as an ABC reset, a short-term corrective construction that typically precedes renewed upward motion. Nonetheless, merchants are cut up; some see a base forming, whereas others view the decline as proof of continued promoting strain.

Probably the most hated $XRP rally is about to begin! pic.twitter.com/HTwbTIwxZ2

— STEPH IS CRYPTO (@Steph_iscrypto) December 16, 2025

Market Voices And Doable Catalysts

In line with neighborhood commentators, authorized and market actions may affect XRP’s subsequent leg. The potential finish of a long-running SEC case, the arrival of XRP-focused ETFs, and pending laws generally known as the Readability Act had been all cited as objects which may change investor sentiment.

One market watcher went as far as to say this might develop into the “most hated” rally, a phrase meant to explain a sudden surge that comes whereas many stay uncertain and annoyed.

Utility Versus Value

A number of observers have urged a concentrate on real-world use. In line with Aljarrah, the token’s worth comes from sensible utility and improved liquidity, which permits bigger transfers with fewer tokens and makes the fee rails extra environment friendly.

Individuals obsess over value, however XRP’s worth is in its utility. A better value strengthens liquidity, effectivity, and adoption. Let the tech and management do the work, short-term noise doesn’t matter.

— Black Swan Capitalist (@VersanAljarrah) December 21, 2025

Associated Studying

Value strikes matter, he mentioned, however not as hypothesis—moderately as an element that may broaden adoption by enhancing liquidity and community operate.

Merchants ought to word that previous patterns don’t assure future outcomes. Whereas the buildup thesis rests on historic parallels and technical charts, the market stays delicate to information and flows.

Promoting now may imply lacking features if a rally follows, some warn; others say persistence and cautious sizing stay important. For buyers, the approaching weeks could inform whether or not the present droop is the tip of a retracement or the beginning of one other climb.

Featured picture from LumerB/Getty Photos, chart from TradingView