Whereas bitcoin (BTC) slid solely modestly, different main cryptocurrencies tumbled over the previous few days, sparking doubt of the sturdiness of the so-called altcoin season.

XRP (XRP), dogecoin (DOGE) and Solana's SOL (SOL) declined probably the most among the many prime 10 cryptos on Friday, slipping round 5% every over the previous 24 hours, CoinDesk information reveals. From the Wednesday highs, XRP and DOGE plunged round 18%, whereas SOL was down 12% over the identical stretch. The CoinDesk 80 Index, consisting of mid-cap tokens exterior of the CoinDesk 20, misplaced 10% from the weekly peak.

In the meantime, BTC was altering palms round $116,000, a bit greater than 3% decrease from its mid-week peak of $120,000. Ethereum's ether (ETH) was 4% under its weekly excessive, supported by regular accumulation by crypto treasury technique companies.

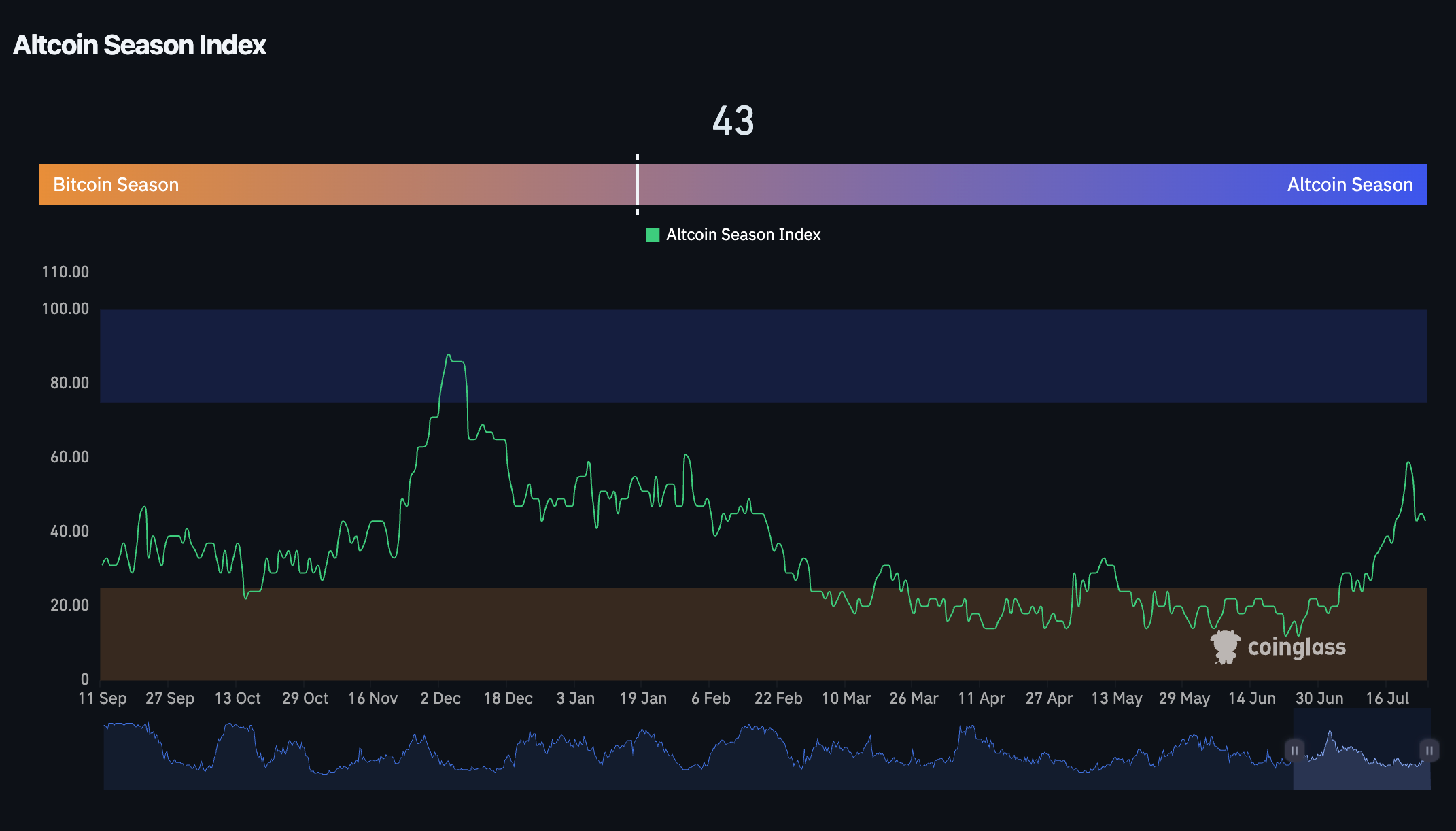

When altcoin season?

The sharp sell-off of the previous few days got here after weeks heavy capital rotation into smaller tokens, fueling talks of a full-blown altcoin season. That interval, generally dubbed alt season, happens when riskier, smaller tokens outperform bitcoin, the main crypto, for a sustained interval.

CoinGlass' Alcoin Season Index, which measures the altcoin market's outperformance versus BTC on a scale of 0 to 100, cooled off to 41 on Friday from Monday's 59, the strongest studying because the late January speculative frenzy round President Trump's inauguration.

Nonetheless, the entire altcoin market (besides stablecoins) noticed a speedy appreciation, practically doubling in worth since April, David Duong, head of analysis at Coinbase, stated in a Friday report.

For this week's pullback, merchants taking over extreme leverage on altcoin bets had been in charge, the report identified.

The Altcoin Open-Curiosity Dominance metric, which compares the quantity of {dollars} tied up in altcoin derivatives contracts to bitcoin's, soared to 1.6, a degree that has preceded earlier market shake-outs, the report famous. A lower within the ratio would recommend a wholesome leverage reset for the altcoin market, in any other case extra shakeouts are anticipated, Duong wrote.

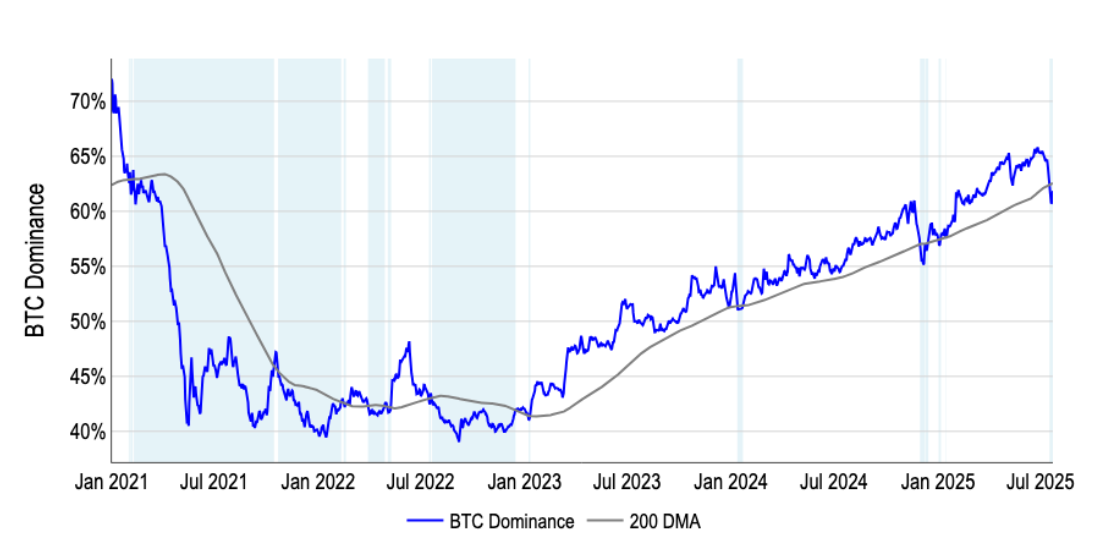

For an prolonged altcoin season, traders ought to control the Bitcoin Dominance, which measures BTC's share of the entire crypto market capitalization. The metric has damaged under the 200-day shifting common for the primary time since a quick interval in January 2025, the report famous.

“A sustained transfer beneath the 200-DMA may validate the 'alt season' narrative and have traditionally preceded multi-week stretches of altcoin outperformance (like in 2021),” Duong wrote.

Nonetheless, merchants is likely to be higher off ready for extra consecutive periods closing under the extent earlier than piling into altcoin bets for a extra “prudent positioning,” he added.