Este artículo también está disponible en español.

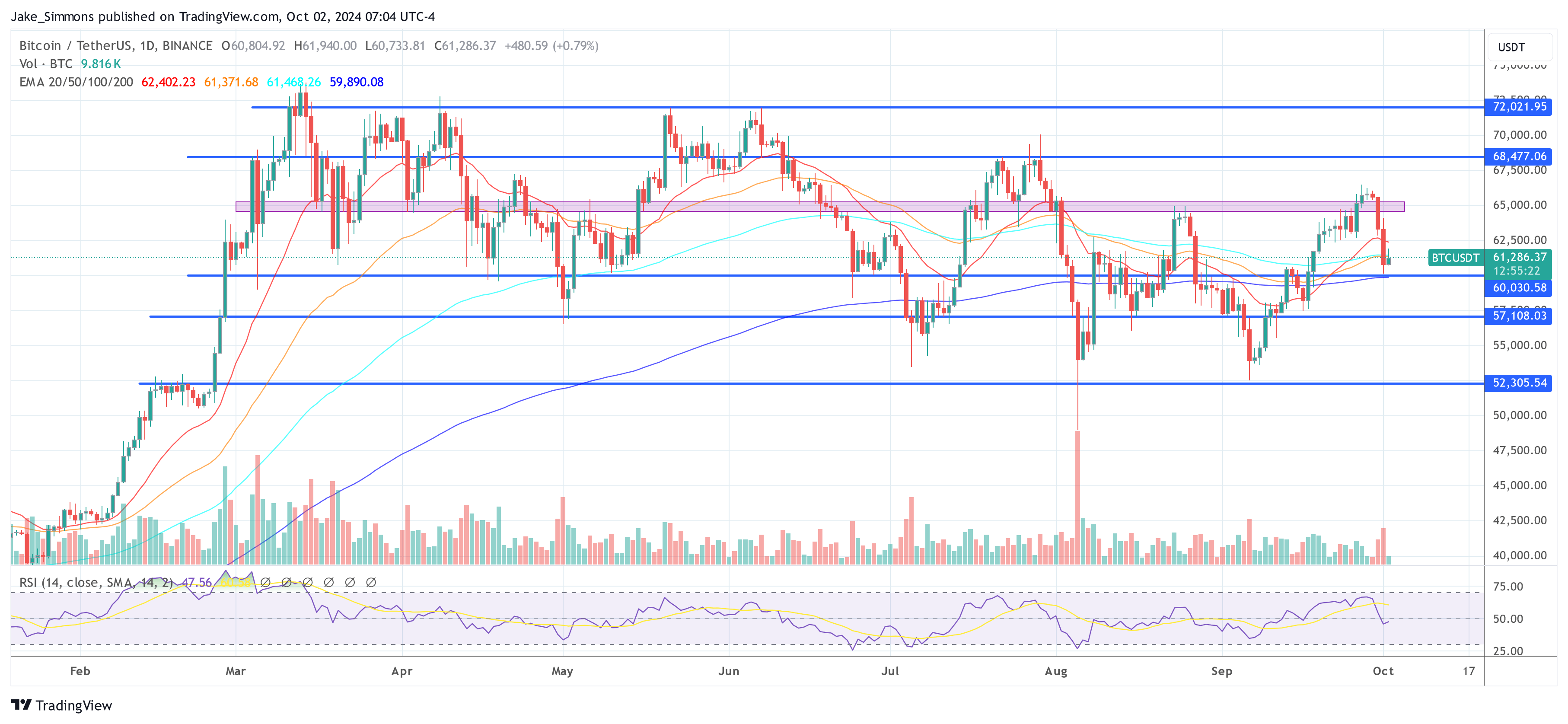

The Bitcoin value took a pointy dip to $60,164 on Tuesday following heightened geopolitical tensions within the Center East, with Iran launching missile assaults on Israel. The escalation rattled world markets, impacting each conventional and crypto belongings. Bitcoin was not immune with a notable -4% drop.

Market individuals, who had anticipated a powerful bullish development for the month dubbed “Uptober,” had been compelled to reassess as broader market sentiment turned risk-off. Nonetheless, the response to the geopolitical information could also be overblown, in accordance with a number of analysts.

Will Bitcoin Drop Additional?

Macro strategist Alex Krüger (@krugermacro) cautions on the sudden shift in market sentiment. By way of X, he writes, “It’s been weird observing everybody flip outright exuberant and calling for ‘Uptober‘. From doom to gloom, in a heartbeat […] Battle within the Center East however, that is an election 12 months within the US. Main uncertainty lies forward.”

Associated Studying

Krüger highlights the volatility sometimes seen in monetary markets throughout US election years, noting, “In election years, the month of October is accordingly probably the most risky, and equities traditionally show barely unfavorable returns.” He additionally added that speculative markets are inclined to react to uncertainties, and given the proximity of the elections and upcoming payroll information on Friday, additional volatility might be anticipated.

“After all if payrolls are available very sturdy this coming Friday, equities would rip, as we’re in a ‘excellent news is nice information’ regime. However the time to press & maintain is after the elections, presumably beginning on Election night time itself,” Krüger states.

Outstanding crypto analyst CRG (@MacroCRG) notes the potential for the Bitcoin value to recuperate regardless of the short-term market turbulence. “That could possibly be the quarterly low in boys. Markets like to put in highs/lows early on within the candle. Plus, geopolitical strikes have a excessive tendency of getting pale. We should see some turbulence relying on Israel’s response, however the market is probably going anticipating this.”

Identical to Krüger, he outlines that elevated liquidity out there may present help for Bitcoin, stating, “Liquidity will begin ramping up from now, which BTC ought to sniff out instantly.” Total, CRG stays bullish on Bitcoin’s long-term trajectory, asserting that regardless of the short-term uncertainties, “$100k BTC is coming.”

Associated Studying

Singapore-based buying and selling agency QCP Capital additionally offers its perspective on the battle’s influence. Of their newest investor word, the agency writes: “The Israeli-Iranian battle has intensified, with over 180 missiles launched by Iran. Regardless of this, the response in conventional monetary markets has been comparatively muted. The S&P closed only one% decrease, whereas crude oil (WTI) elevated by 2%.”

Nonetheless, the crypto market noticed a sharper decline, with Bitcoin going through heavier promoting strain. “BTC closed 4% decrease, with help holding across the $60k stage. An additional escalation within the battle may doubtlessly push BTC to the $55k mark,” QCP notes.

Regardless of the instant influence, QCP Capital’s report additionally stresses that the broader financial backdrop stays favorable for threat belongings within the medium time period. “Center East geopolitics will steal the limelight for now, however the shallow sell-off means that the market stays nicely bid for threat belongings. This minor setback shouldn’t distract from the larger image.”

Additionally they level to world financial insurance policies as a big issue. “The flush of liquidity from the PBoC and potential fiscal help will seemingly help asset costs in China, with bullish sentiment doubtlessly spilling over globally to help threat belongings, together with crypto. […] Property costs are anticipated to stay supported heading into 2025, as each the biggest (the Fed) and third largest (PBoC) central banks on the earth have began their slicing cycles in earnest,” QCP concludes.

At press time, BTC traded at $61,286.

Featured picture created with DALL.E, chart from TradingView.com