Each bitcoin worth bull market to this point has adopted a well-known sample of explosive upside adopted by sharp drawdowns, with every cycle delivering decrease proportion features than the final. This phenomenon, referred to as diminishing returns, has turn into one of the vital persistent narratives in Bitcoin. The query now’s whether or not this cycle will observe the identical trajectory or if the maturation of Bitcoin as an asset class might bend the sample.

Bitcoin Worth and Diminishing Returns

Thus far this cycle, we’ve witnessed roughly 630% BTC Development Since Cycle Low to the newest all-time excessive. That compares to greater than 2,000% within the earlier bull market. To match the final cycle’s magnitude, Bitcoin would wish to achieve round $327,000, a stretch that appears more and more unlikely.

Evolving Bitcoin Worth Dynamics

One cause for the much less explosive upside features could be seen within the Provide Adjusted Coin Days Destroyed (CDD) metric, which tracks the rate of older cash transferring on-chain. In previous cycles, such because the 2021 bull market, long-term holders tended to promote after Bitcoin had already appreciated ~4x from its native lows. Nevertheless, on this cycle, related ranges of profit-taking have occurred after simply 2x strikes. Extra not too long ago, spikes in CDD have been triggered by even smaller worth will increase of 30–50%. This displays a maturing investor base: long-term holders are extra prepared to understand features earlier, which dampens parabolic advances and smooths out the market construction.

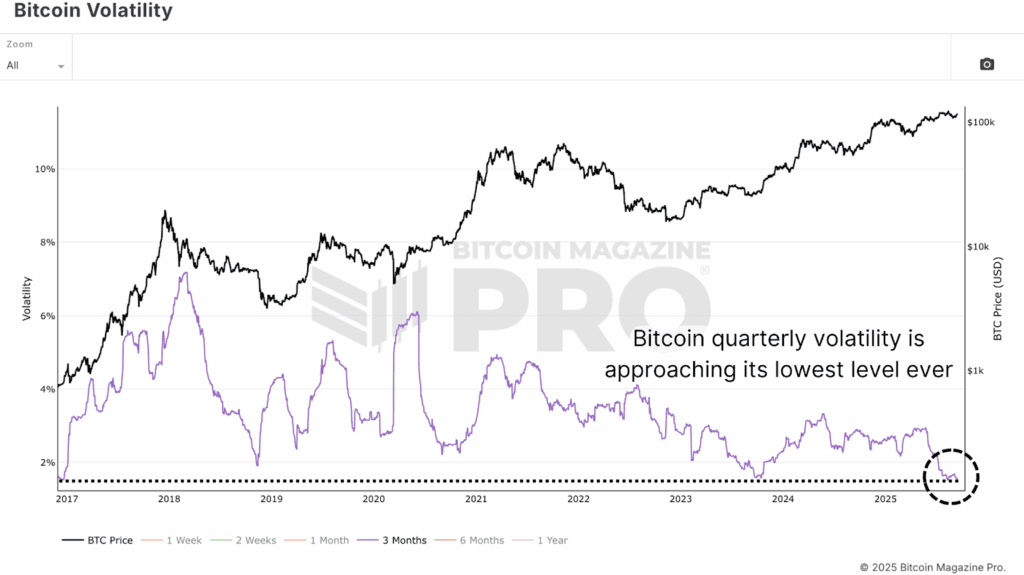

One other issue is Bitcoin Volatility. Bitcoin’s quarterly volatility has trended steadily decrease. Whereas this reduces the percentages of utmost blow-off tops, it additionally helps a more healthy long-term funding profile. Decrease volatility means the capital inflows required to maneuver worth develop bigger, but it surely additionally makes Bitcoin extra enticing to establishments searching for risk-adjusted publicity.

This reveals up within the Bitcoin Sharpe Ratio, the place Bitcoin at present scores greater than double that of the Dow Jones Industrial Common. In different phrases, Bitcoin nonetheless presents superior returns relative to its threat, even because the market stabilizes.

Bitcoin Worth and the Golden Ratio

From a technical perspective, The Golden Ratio Multiplier gives a framework for projecting diminishing returns. Every cycle high has aligned with progressively decrease Fibonacci multiples of the 350-day transferring common. In 2013, worth reached the 21x band. For the 2017 high, it reached the 5x band, and in 2021, the 3x band. This cycle, Bitcoin has up to now tagged the 2x and 1.6x bands, however a push again towards the 2x ranges stays potential.

Projecting these 1.6x and 2x ranges ahead, primarily based on their present trajectory, suggests a goal between $175,000 and $220,000 earlier than the top of the 12 months. After all, the information received’t play out precisely like this, as we’d see the 350DMA transfer extra exponentially to the upside as we closed in on these higher targets. The purpose is these ranges are ever-changing and continuously pointing in direction of increased targets because the bull cycle progresses.

Bitcoin Worth in a New Period

Diminishing returns don’t cut back Bitcoin’s attractiveness; if something, they improve it for establishments. Much less violent drawdowns, probably lengthening cycles, and stronger risk-adjusted efficiency all contribute to creating Bitcoin a extra investable asset. Nevertheless, whilst Bitcoin matures, its upside stays extraordinary in comparison with conventional markets. The times of two,000%+ cycles could also be behind us, however the period of Bitcoin as a mainstream, institutionally held asset is barely simply starting, and can probably nonetheless present unmatched returns within the coming years.

For deeper knowledge, charts, {and professional} insights into bitcoin worth traits, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Journal Professional on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding selections.