The value of Bitcoin is sort of 45% away from its all-time excessive of $126,080, reflecting a worsening market local weather over the previous few months. One of many indicators that confirmed the emergence of the bear market was the breach of the 365-day transferring common to the draw back late final 12 months. Utilizing this metric, a distinguished crypto researcher has come ahead with an analysis that exhibits how the present Bitcoin bear market compares to the previous ones.

BTC Worth Is 30% Under 365-Day Shifting Common

In a brand new put up on the social media platform X, CryptoQuant’s head of analysis, Julio Moreno, revealed that the present bear market efficiency compares to those seen in Bitcoin’s latest historical past. The indicator in focus on this evaluation is the 365-day easy transferring common (SMA) on the BTC value chart.

Moreno outlined the beginning of the bear market because the second when the value of Bitcoin crossed under the 365-day SMA. In keeping with the on-chain knowledgeable, the premier cryptocurrency is down by 30% to date within the present part, making it one of many worst bear seasons in latest occasions.

Supply: @jjcmoreno on X

As noticed within the chart above, the Bitcoin value is deeper than it’s typically seen at this stage of the bear market. Through the 2014 bear market, the flagship cryptocurrency was barely down by 20% at this present stage of the season.

The identical may very well be stated for the 2018 bear season, which was extra across the 20% market at this stage. Nonetheless, the value of Bitcoin might need succumbed to larger strain throughout the 2022 season, because the market chief was down from its 365-day transferring common by practically 60% at this stage of the cycle.

This development is very attention-grabbing, contemplating that Bitcoin is believed to have matured as an asset class. Nonetheless, the world’s largest cryptocurrency nonetheless seems to witness unbelievable ranges of volatility initially of the bear market.

Whereas it’s unclear when the Bitcoin value will attain a backside, sure circumstances should be met for a turnaround to happen. One among these circumstances is the obvious demand metric, which has continued to worsen over the previous few weeks. As seen within the outflow numbers of the US-based Bitcoin ETFs, capital constraints have been a serious subject for the premier cryptocurrency.

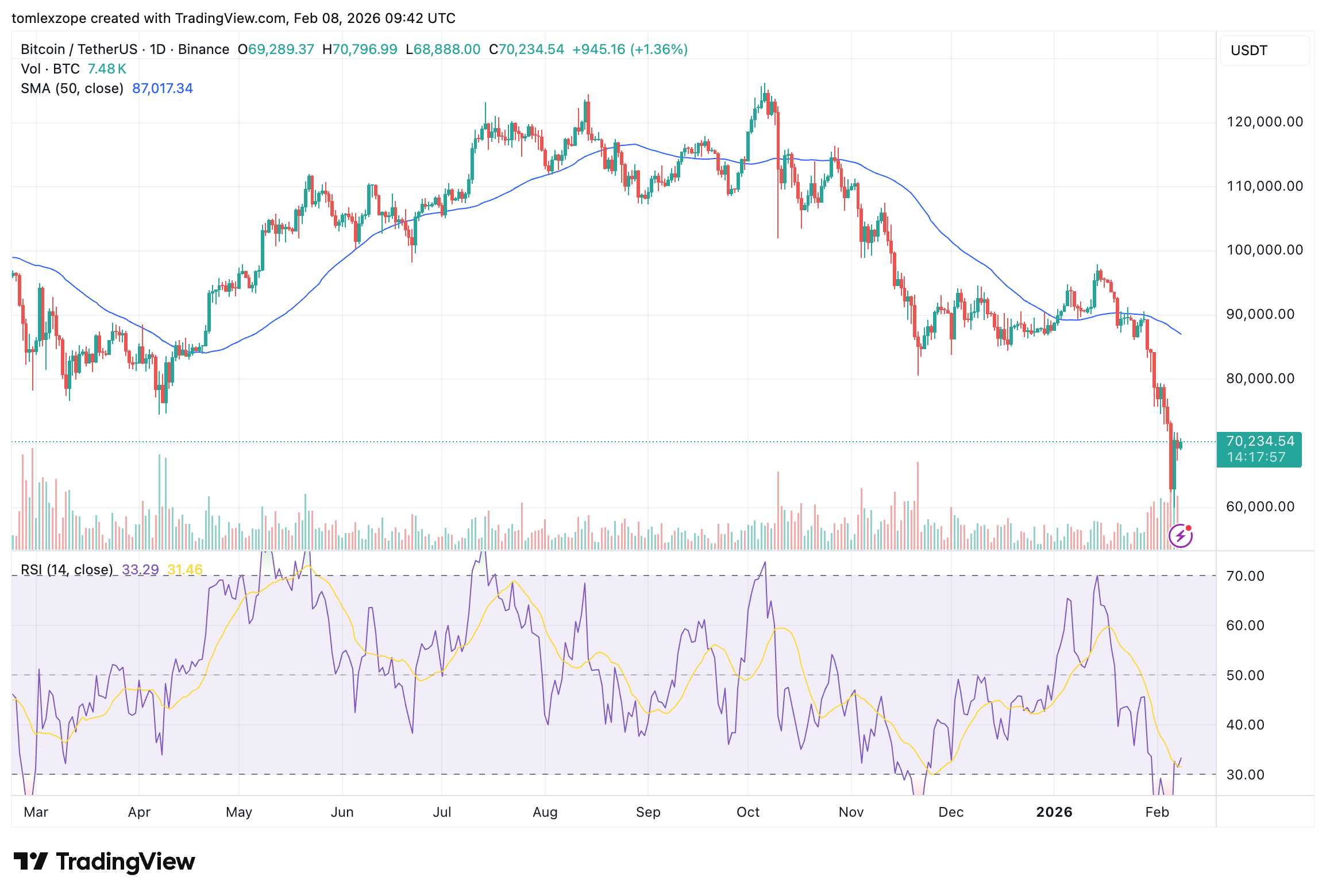

Bitcoin Worth At A Look

As of this writing, the value of BTC stands at round $70,500, reflecting an over 2% bounce prior to now 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.