1. The Rise of the DAT: A Symptom of Shallow Understanding

As Bitcoin adoption by public firms accelerates, imitators are inevitable. The most recent pattern? DATs — “Digital Asset Treasuries” — which search to copy the success of Bitcoin treasury firms by allocating reserves to altcoins like Ethereum or Dogecoin.

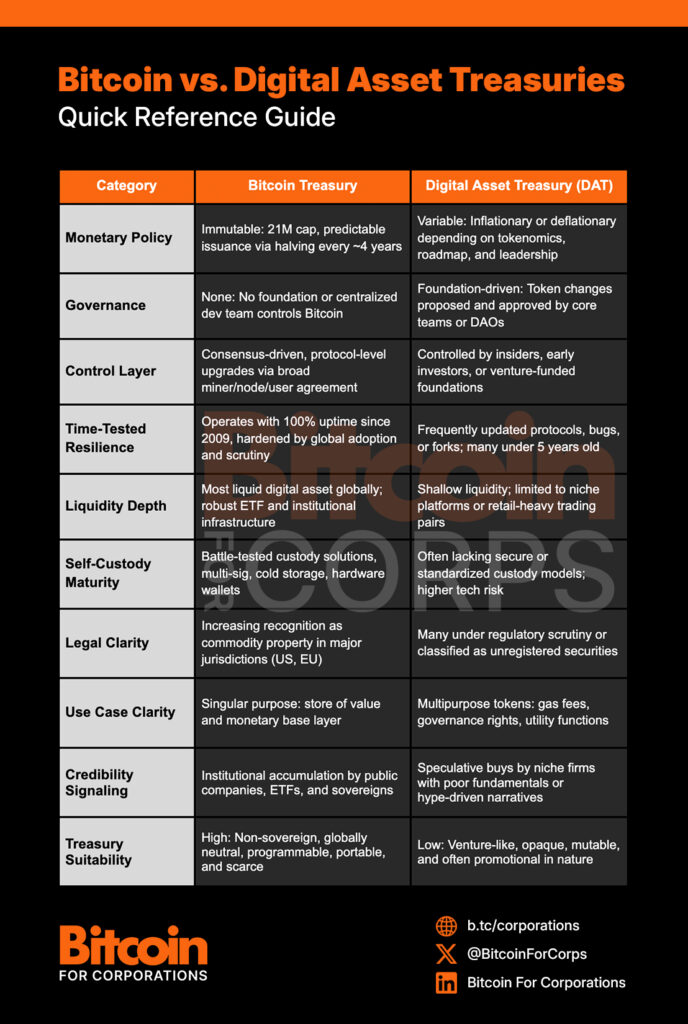

From the skin, the surface-level pitch might sound related: purchase a digital asset, transfer early, construct a treasury technique, situation fairness or dehttps://bitcoinmagazine.com/bitcoin-for-corporations/how-bitcoin-reduces-counterparty-risk-in-corporate-treasury-strategybt, and try to seize long-term upside and reflexive flows. However beneath the floor, the comparability collapses.

In latest months, a number of firms have made headlines for pivoting to DAT fashions:

- CleanCore Options plunged 60% after unveiling a $175M Dogecoin treasury plan.

- Bit Digital (BTBT) wound down its Bitcoin mining operations to turn out to be an Ethereum-only staking and treasury firm.

- Spirit Blockchain Capital and Dogecoin Money Inc. launched DOGE-centric treasury methods and misplaced over 70% YTD.

These strikes aren’t simply dangerous — they reveal a basic misunderstanding of what makes Bitcoin uniquely suited to function a treasury reserve asset.

2. Bitcoin Is Cash. Tokens Are Enterprise Bets.

Bitcoin shouldn’t be a tech platform or a product roadmap. It’s cash — purpose-built, impartial, leaderless, and maximally conservative in its evolution. Its guidelines are set in stone, its issuance schedule immutably locked, and its design fiercely resistant to alter.

Altcoins like Ethereum or Dogecoin, against this, are higher understood as venture-stage software program initiatives masquerading as cash. They’re:

- Ruled by foundations or small teams of core builders

- Topic to frequent, generally radical, protocol modifications

- Actively managed to optimize for brand new characteristic adoption, not financial stability

- Intently tied to charismatic founders and basis capital constructions

From a capital stewardship perspective, that is the distinction between:

- Allocating reserves to a sovereign, apolitical financial instrument

- Speculating on the long-term success of a VC-style expertise platform

One is purpose-built for worth preservation. The opposite is a proxy for early-stage danger.

3. Time Horizon Inversion: Bitcoin Aligns, Altcoins Mismatch

A company treasury’s position is to not chase yield — it’s to protect and develop shareholder worth over lengthy durations. Public firms are rewarded for resilience, self-discipline, and clear capital frameworks that maintain up throughout cycles.

Bitcoin’s design aligns with this. Its properties reward conviction over time:

- Provide is fastened: 21 million, with issuance halving each 4 years

- Market entry is international and fixed: no trade hours or gatekeepers

- Liquidity deepens over time as adoption grows

- Volatility compresses over longer horizons

Altcoins invert this logic. They:

- Inflate provide by way of unlock schedules and protocol modifications

- Routinely shift consensus fashions (e.g. ETH’s transfer to proof-of-stake)

- Rely on speculative progress narratives to take care of curiosity

- Lack predictable issuance and improve paths

This mismatch creates pressure for treasuries. The longer you maintain a token, the extra governance, execution, and regulatory danger you accrue. It turns into more durable — not simpler — to defend the allocation.

Bitcoin, against this, turns into simpler to justify over time. It’s the one digital asset the place deeper holding reduces—not will increase—tail danger.

4. What May Go Incorrect: Dangers of Constructing on Altcoin Treasuries

For public firms, capital technique should prioritize sturdiness, auditability, and market belief. Allocating to altcoins introduces dangers which are antithetical to these objectives.

- Protocol Uncertainty: Tokens like Ethereum endure frequent technical upgrades that may introduce bugs, change economics, or expose validators to new types of slashing or MEV danger. Company treasuries require stability — not ongoing protocol experimentation.

- Governance and Seize Danger: Many altcoins are ruled by foundations or small groups. Key protocol selections could mirror the pursuits of insiders or early buyers, not long-term holders. Firms danger being uncovered to governance forks, roadmap pivots, or consensus drama.

- Regulatory Uncertainty: Bitcoin has been extensively acknowledged by U.S. regulators as a commodity. Most altcoins occupy a murkier authorized territory — and lots of are actively underneath investigation or pending litigation. A sudden classification as a safety might set off compelled divestment, authorized penalties, or reputational harm.

- Custody and Infrastructure Limitations: Whereas Bitcoin advantages from mature institutional custody options, many altcoins don’t. Staking contracts, wrapped tokens, and DeFi-based custodial layers add good contract danger and cut back auditability. This weakens the steadiness sheet relatively than strengthening it.

- Narrative Fragility: When value appreciation slows or reverses, the underlying thesis of an altcoin treasury usually collapses. With out financial fundamentals to fall again on, the “strategic” story devolves right into a speculative one — and boards, auditors, and shareholders start asking onerous questions.

Constructing a company treasury on prime of tokens with malleable guidelines, weak settlement assurances, and governance opacity shouldn’t be daring — it’s reckless. Bitcoin is the exception not simply because it got here first, however as a result of its structure is the one one constructed to final.

5. Bitcoin Is the Bedrock

Public firms that undertake Bitcoin don’t make a wager on crypto. They’re upgrading the inspiration of their capital construction with an asset that’s:

- Non-sovereign: Proof against political interference or financial debasement

- Finite: Capped at 21 million, with no centralized authority to inflate provide

- Verifiable: Each unit auditable, each transaction immutable

- Accessible: Liquid and tradable in each main jurisdiction

- Battle-tested: Working flawlessly for over 15 years with no bailouts or downtime

Bitcoin’s uniqueness isn’t ideological — it’s structural. And that construction is what allows it to function a contemporary steadiness sheet anchor in a time of forex volatility, debt saturation, and institutional mistrust.

Disclaimer: This content material was written on behalf of Bitcoin For Firms. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to amass, buy or subscribe for securities.