The market intelligence platform IntoTheBlock has defined the explanation why Litecoin has been caught contained in the $90 to $130 vary lately.

Litecoin Trade Netflow Has Adopted An Fascinating Sample Not too long ago

In a brand new publish on X, the analytics agency IntoTheBlock has mentioned a few sample that the Litecoin Trade Netflow has proven throughout the current part of consolidation within the asset’s worth.

The “Trade Netflow” right here refers to an on-chain indicator that retains monitor of the web quantity of the cryptocurrency that’s getting into into or exiting the wallets related to all centralized exchanges.

When the worth of this metric is optimistic, it means the inflows for these platforms outweigh the outflows. Typically, one of many important the explanation why traders would deposit their cash into the custody of exchanges is for selling-related functions, so this type of pattern is usually a bearish signal for LTC’s worth.

Alternatively, the indicator being underneath zero suggests the holders are withdrawing a internet variety of tokens from the exchanges. Such a pattern is usually a signal that the traders are in a part of accumulation, which may naturally have a bullish affect on the asset.

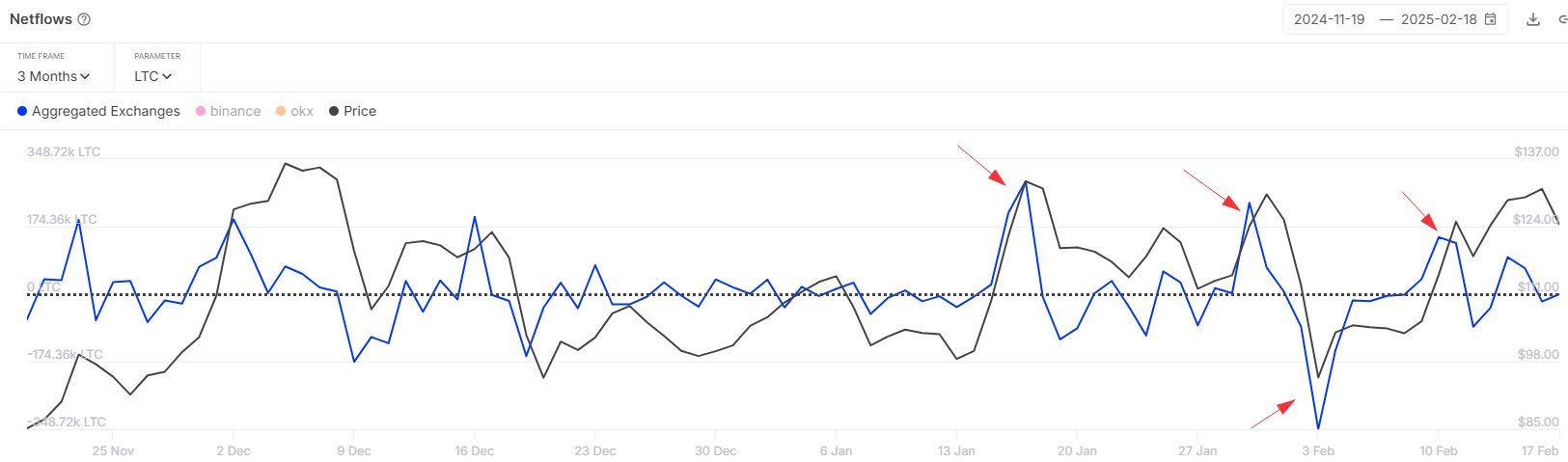

Now, right here is the chart shared by IntoTheBlock, which exhibits the pattern within the Litecoin Trade Netflow over the previous couple of months:

As is seen within the above graph, the LTC Trade Netflow has displayed an attention-grabbing sample over the past couple of months. It might appear that deposits have ramped up when the cryptocurrency has gone as much as retest the $130 higher degree of its current consolidation vary, whereas outflows have occurred throughout dips.

“Knowledge suggests Litecoin merchants are capitalizing on worth swings, ramping up withdrawals and deposits to promote on spikes and purchase on dips,” notes the analytics agency. “This sample has helped hold LTC buying and selling in a spread between 90 and 130 for about three months.”

Given this pattern, it’s attainable that the cryptocurrency would have hassle escaping out of this vary, so so long as the whales proceed to commerce on this method. Thus, the Trade Netflow might be saved a watch on, to verify when dealer conduct lastly shifts.

At current, Litecoin is buying and selling fairly close to the higher degree of the sideways channel, however the Trade Netflow remains to be at a impartial degree (that’s, the inflows are balancing out the outflows). It solely stays to be seen whether or not this can be a signal that the whales are switching issues up, or if it’s solely a short lived deviation.

LTC Worth

A lot of the cryptocurrency sector has discovered the previous day to be a crimson one, however Litecoin has proven divergence as its worth has jumped virtually 3%, reaching the $127 mark.